In today’s blog post, I repost last week’s Business Day article in which I provide suggestions for improvements to the SARB’s monetary policy communication.

Time central banks stop pretending they know the future

Central bankers like to present their economic forecasts as if they are weather reports. But unlike meteorologists, central banks can influence the things they predict, and therefore as the systemic impacts of their predictions. Instead of saying, ‘it looks like a 50% chance of rain’, they should be describing how their plans will change if it does rain and what impact that would have.

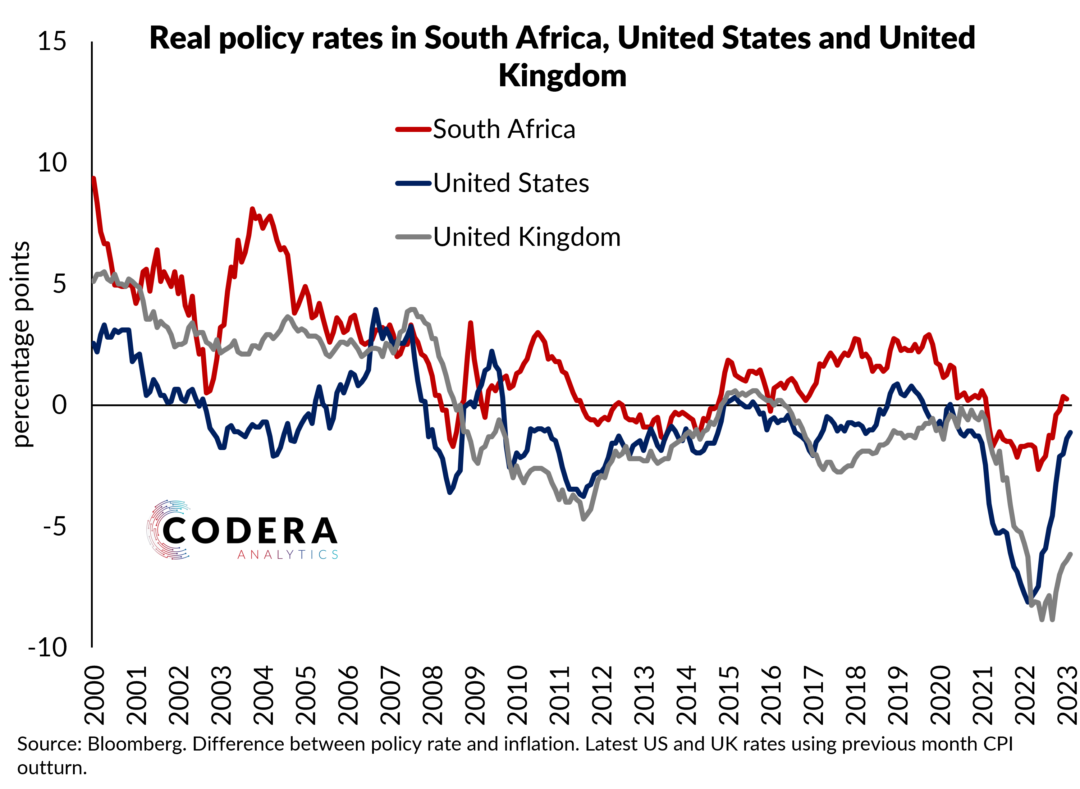

Since major central banks started tightening monetary policy, communication around their assessments and intensions have become increasingly hazy. Like the Federal Reserve of the United States, the South Africa Reserve Bank (SARB) Monetary Policy Committee (MPC) has recently emphasised ‘data dependency’ as the underlying principle of their policymaking. Since the SARB does not communicate its policy strategy through the lens of its policy model, ‘data dependency’ amounts to an excuse not to provide guidance about how it might set policy in the future.

Most leading inflation targeting central banks publish a ‘baseline’ projection that is meant to capture their assessment of the most likely set of economic and financial outcomes and their expected path for policy. Best practice among inflation targeters is to guide market expectations by communicating the central bank’s policy target and how policy is likely to be set in future to ensure achievement of its target.

But the future is unknowable, and shocks might require a change in policy stance from what has previously been communicated. The challenge central banks face is therefore how to communicate the contingencies upon which policy guidance is based to avoid inevitable forecast errors from damaging their credibility.

Alan Greenspan, former chairman of the United States Federal Reserve, promoted the importance of a risk management approach to monetary policy. He argued that policymakers should not only continuously assess the sources of risk and uncertainty around the economic outlook, but explicitly quantify these and the potential costs and implications when possible.

In line with Greenspan’s view, the Better Policy Project has been promoting a shift to scenario-based monetary policy decision-making instead of focusing on a baseline forecast and risks around that forecast. By focusing more on how the central bank would react to different combinations of shocks, communication should be focused on the policy strategy, as opposed to how plausible aspects of the baseline projections are.

Their approach involves providing a plausible ‘hawkish’ scenario (i.e. a tight policy stance with policy rate higher than market expectations) and a plausible ‘dovish’ scenario (i.e. a looser policy stance with policy rate lower than market expectations) each time a forecast is published. They propose that central banks provide additional scenarios that describe tail risks around sliding towards ‘dark corners‘ of monetary policy where normal economic relationships begin to break down. Examples of such scenarios might be specific combinations of outcomes that lead to undesirable outcomes, such as persistently high or low inflation, or using scenarios to demonstrate the policy implications of uncertainty around parameter uncertainties in their models (such as how strongly inflation responds to interest rate changes). Providing such scenarios would help central banks communicate how they would operationalise policy based on risk minimisation on a least regrets basis.

Another advantage of such an approach is that it would reduce the need for policymakers to achieve consensus around the appropriate monetary policy stance. This has been a key challenge for the SARB over recent years, with voting information revealing disagreement in the judgements of MPC members about the appropriate policy stance.

The MPCs of some central banks (notably the Bank of England) collectively ‘own’ policy projections and use forecasts to communicate the MPC’s assessment of the appropriate policy stance. This convention forces MPC members to be explicit about their assumptions and how they would react to specific types of economic outcomes.

In contrast, the SARB’s MPC does not communicate its policy stance through its projections. In fact, SARB MPC decisions have, at times, even diverged from their published policy rate projections. In early 2023, for example, the MPC tightened policy even though their projections implied that policy easing would be consistent with achieving the inflation target. The SARB MPC regularly confuses the market about what its monetary policy strategy implies for the path of interest rates by acting differently from its published projections.

The danger of not having a formal framework governing policy strategy is that it tilts decision-making towards discretion, weaking the credibility of the framework. This is why policy models are an indispensable part of monetary policy making. They require explicit assessment of the underlying conditions of the economy and quantification of the drivers of projections. Uncertainty around these judgements means that forecasts are not very useful unless central banks communicate their assumptions and use models to ensure a systematic approach to policy strategy.

The SARB could better guide expectations if it used its policy model to communicate its economic narrative. Providing multiple scenarios would enable individual MPC members to clearly communicate their risk assessments and policy preferences. Making model-based scenarios available would also help to promote a culture of internal debate in the SARB, and anchor discussion with analysts on pertinent strategic questions instead of speculation about the Bank’s next move.

Dr Daan Steenkamp

Daan is CEO of Codera Analytics and a research fellow with the Economics Department at Stellenbosch University.