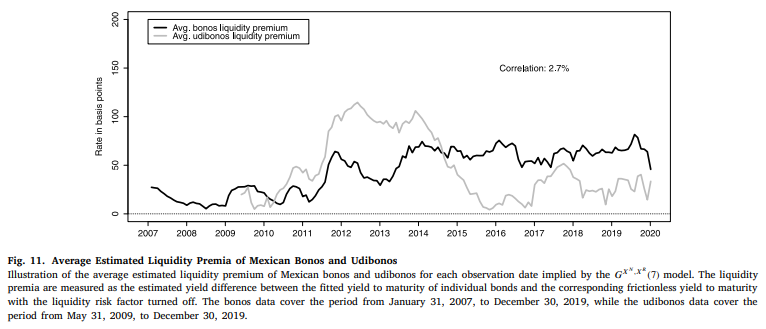

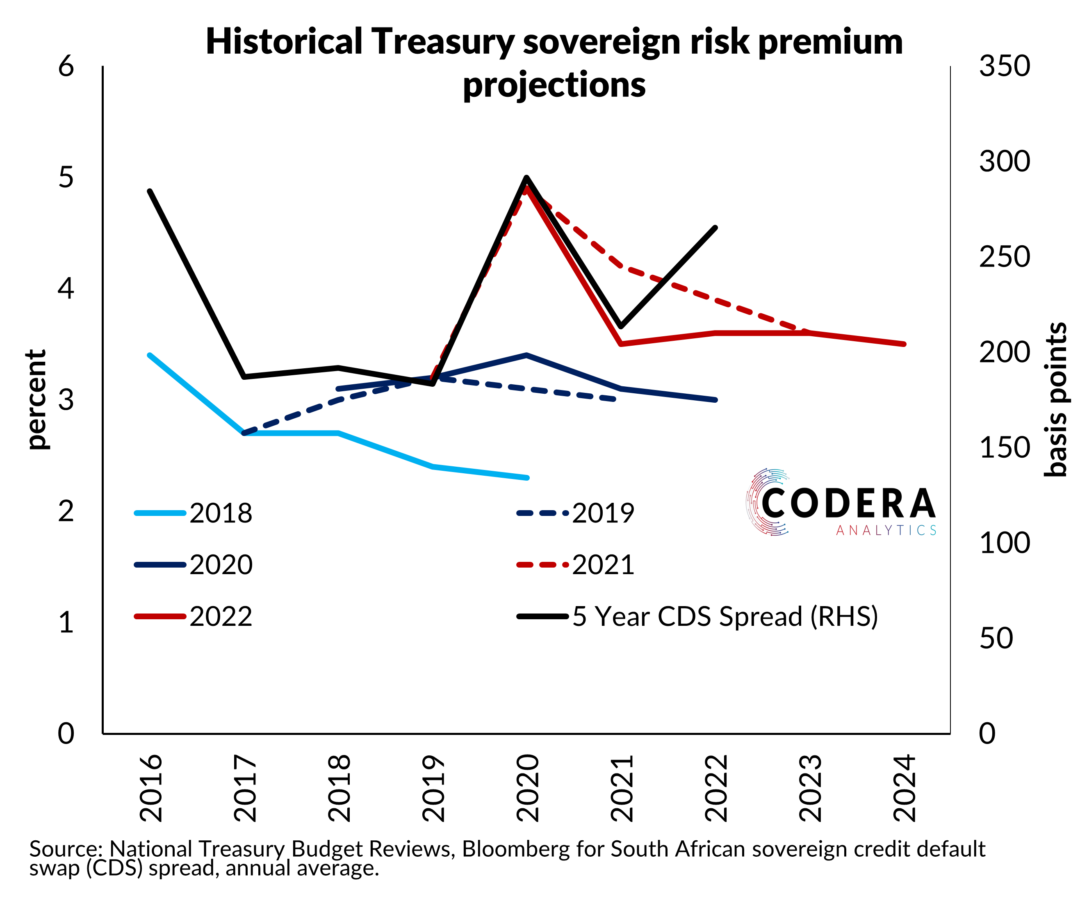

Many market analysts use breakeven inflation (calculated as the difference between nominal and real yield on bonds with the same maturity) to measure market-implied inflation expectations (see estimates for South Africa here). The problem with breakeven inflation as a measure of inflation expectations is that it could be contaminated by liquidity risk premia. In a paper recently published in the Journal of International Economics, Remy Beauregard, Jens Christensen, Eric Fischer and Simon Zhu use a dynamic term structure model to quantify liquidity premia in nominal and inflation-linked bonds and more reliably estimate inflation expectations in a Mexican context. The paper shows how this enables assessment of how well anchored inflation expectations are. Jens and I are working on a paper in which we build on this approach, adding adjustments for changes in the credit risk embedded in government bonds, applied to the South African bond market.