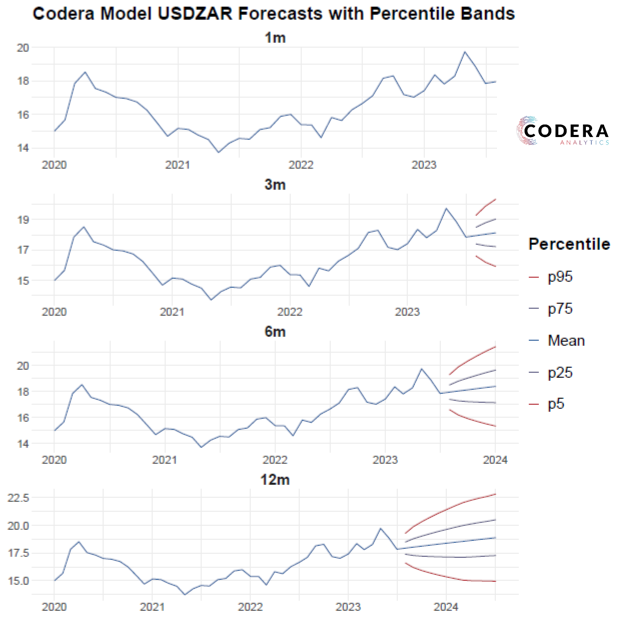

Many asset prices resemble random walk processes, where the direction and size of changes are near random so that predicting price changes is difficult. There is a large literature that documents the difficulty involved in beating a naïve random walk exchange rate forecast with more sophisticated models. However, understanding the statistical properties of exchange rates can help one build models that can produce more accurate forecasts. Our FX model suite beats random walk specifications at both short- and long horisons. The chart below presents smoothed projections for illustrative purposes at horisons between 1- and 12 months-ahead, along with percentile estimates that describe the uncertainty range around each forecast. The projections suggest that the rand may be expected to depreciate slightly over the next year. But the expected trend for the USDZAR is flatter than has been observed since 2020. Codera will be launching an FX forecasting service, contact us if you are interested in subscribing.