In today’s blog post, I repost my Business Day article in which I argue that Ben Bernanke’s recent review of the Bank of England’s forecasting process prompts questions about how the Reserve Bank’s process stacks up to international best practice.

Perhaps it’s time for Reserve Bank to review its modelling and forecasting

The South African Reserve Bank (SARB), like other central banks, were caught by surprise by the post-COVID-19 pandemic inflation spike. Around the world, this has seen calls for changes to the way central banks forecast and communicate their policy plans.

Best practice among central banks is to periodically review their assessments of economic conditions and policy settings in order to learn from their inevitable forecasting mistakes. Former US Federal Reserve chair Ben Bernanke’s recent review of the Bank of England’s forecasting process is a good example of this practice.

His review called for a revamp of the Bank of England’s economic modelling and changes to how it analyses forecast errors and communicates its policy path. Bernanke also proposed that apart from a forecast based on the market path for interest rates, the Bank of England publish scenarios based on alternative assumptions about future economic or financial conditions.

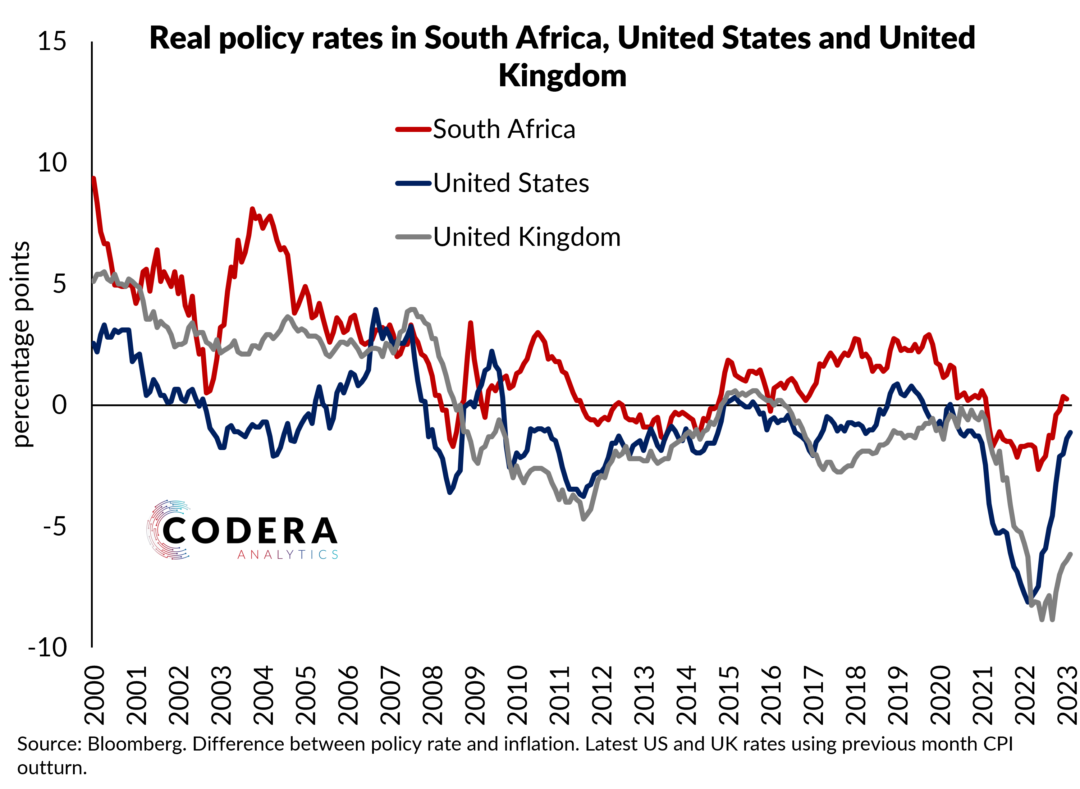

It is worth comparing how SARB’s approach stacks up against Bernanke’s critique of practice at the Bank of England. The major strength of the SARB’s current approach is that it publishes a forecast consistent with the achievement of its inflation target over the medium term. The major weakness in its approach relates to its policy communication.

The SARB’s monetary policy committee (MPC) does not communicate its policy stance through its projections, instead giving its model ‘one vote in the decision making process’ as the Governor likes to say. This has meant that SARB’s MPC decisions have sometimes diverged from their published policy rate projections.

This confuses the market about SARB’s likely future policy path since SARB does not fully communicate how its economic assumptions map to the projections from its model. Publishing additional scenarios, as Bernanke proposes, would help SARB communicate its risk assessments and policy preferences more fully, promoting a risk management approach to monetary policy.

How has SARB been thinking about its recent forecast errors? SARB’s approach has been to assess the size of forecast errors in components of its forecasts (such as food inflation projections) and comparing its forecast errors to the median among market analysts.

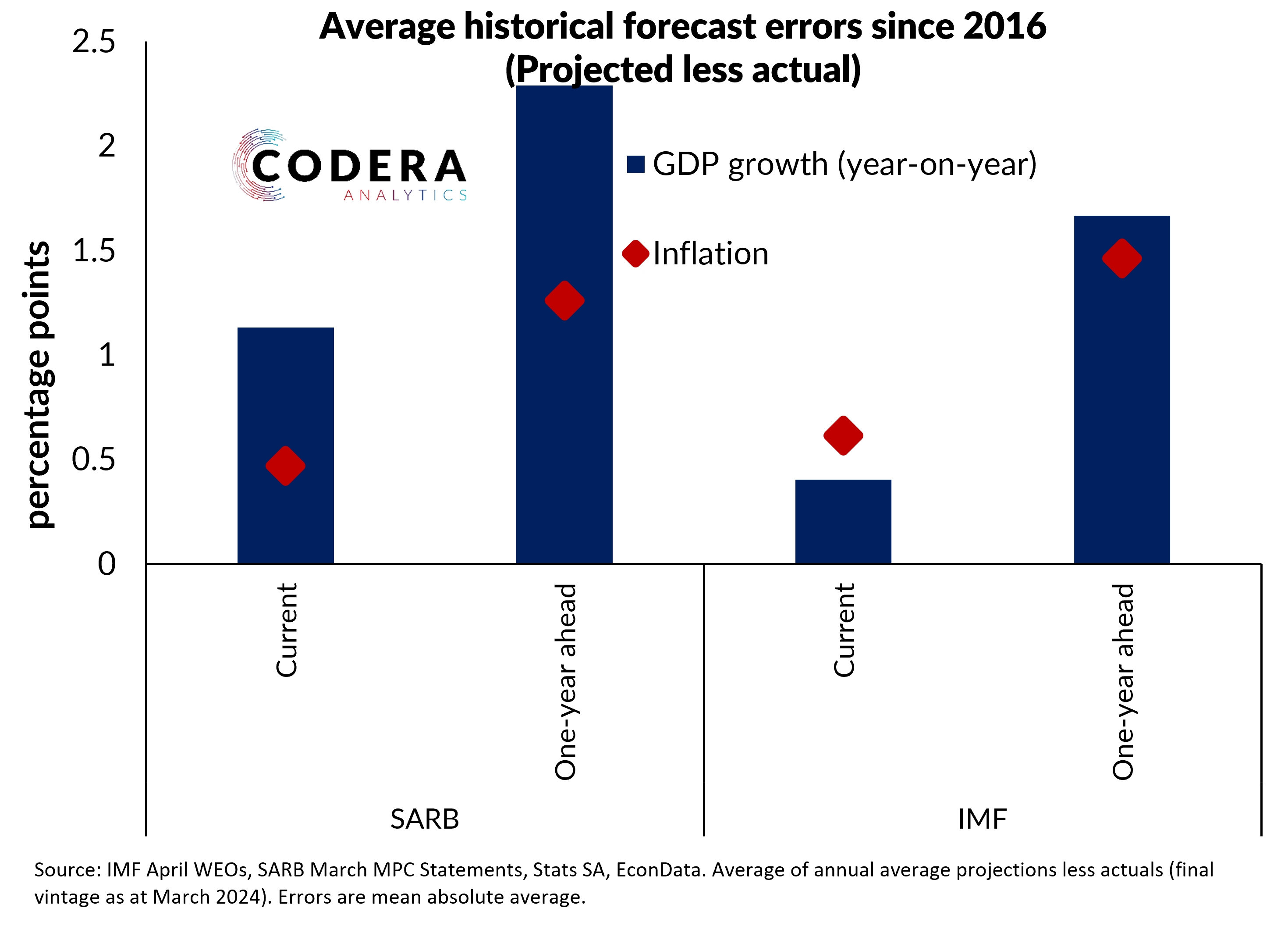

This is inadequate for several reasons. Firstly, it unfairly favours the SARB, which has an advantage from early access to data. There is also a wide dispersion in the accuracy of analysts forecasts in South Africa. If, instead, one compares to the International Monetary Fund’s (IMF) projections, SARB’s performance is less impressive. In fact, its current year GDP and inflation forecasts have been less accurate than the IMF’s since the South SARB began publishing projections in 2016, while its inflation projections have only been marginally more accurate.

An important potential source of forecast errors is data revisions and changing statistical properties of macroeconomic data. We showed in a South African Journal of Economics article that statistical models have outperformed SARB’s official projections at ‘nowcasting’ GDP because such models have been better at understanding what data revisions and seasonal variations imply for forecasts. SARB does not publish this kind of analysis in its Monetary Policy Reviews.

The biggest issue with the way SARB thinks about its forecast errors is that it does not use its policy model to interpret which mistaken assumptions contributed to inaccurate projections. As I have argued previously in this newspaper, the main reason SARB under-predicted post-pandemic inflation was that it underestimated the role of supply shocks that subsequently pushed up prices. Even though SARB has applied very large revisions to its estimates of potential growth and economic slack, we cannot judge whether it has internalised lessons from the pandemic since it does not use its policy model to shed light on how economic shocks and revisions to its assumptions contributed to deviations in inflation from the target.

This means market analysts cannot interpret which aspects of SARB’s economic narrative it has gotten wrong and therefore which of its judgements it will need to revise. Apart from providing more guidance about its monetary policy decisions, communicating forecast error analysis using a model ensures a systematic approach to learning about the sources of the central bank’s forecast errors and reduces the chance of future policy missteps.

The Bernanke review also raises questions about resource allocation at the Bank of England, implying that too many researchers work on non-core issues. Since the central bank is funded from the public purse, the appropriate role of the central bank and its resource allocation are ultimately questions a country’s society must debate through parliamentary processes. The Bank of England is enormously influential in driving economic research globally, as demonstrated by its high research ranking, even if it has got recent inflation projections wrong.

The SARB, despite its large budget relative to advanced economy central banks, ranks near the bottom amongst major banks for the influence of of its research. One might argue that policy research should be considered a luxury good in a country with many competing needs. But having researchers on staff is important for internal policy debate and to ensure that advances in modelling are adopted. Not using its model for policy analysis also implies a lack of formal engagement with conjunctural economic challenges such as the persistent deviation in inflation from the inflation target.

Is the SARB’s policy model and associated forecasting process fit for purpose? Even though SARB has published code for an earlier version of its model, this question cannot be answered with any degree of confidence without more detail around its judgements over time and a comprehensive understanding of the process governing its modelling and forecasting process that serve the MPC.

Another important consideration is whether there are governance and accountability arrangements that ensure that the central bank maintains its forecasting and policy assessment credibility. In other jurisdictions, central bank boards and parliamentary committees formally interrogate the central bank’s analytical performance on a regular basis. Perhaps it is time for a review of SARB’s modelling and forecasting?

Dr Steenkamp is CEO of Codera Analytics and a research fellow with the Economics Department at Stellenbosch University.