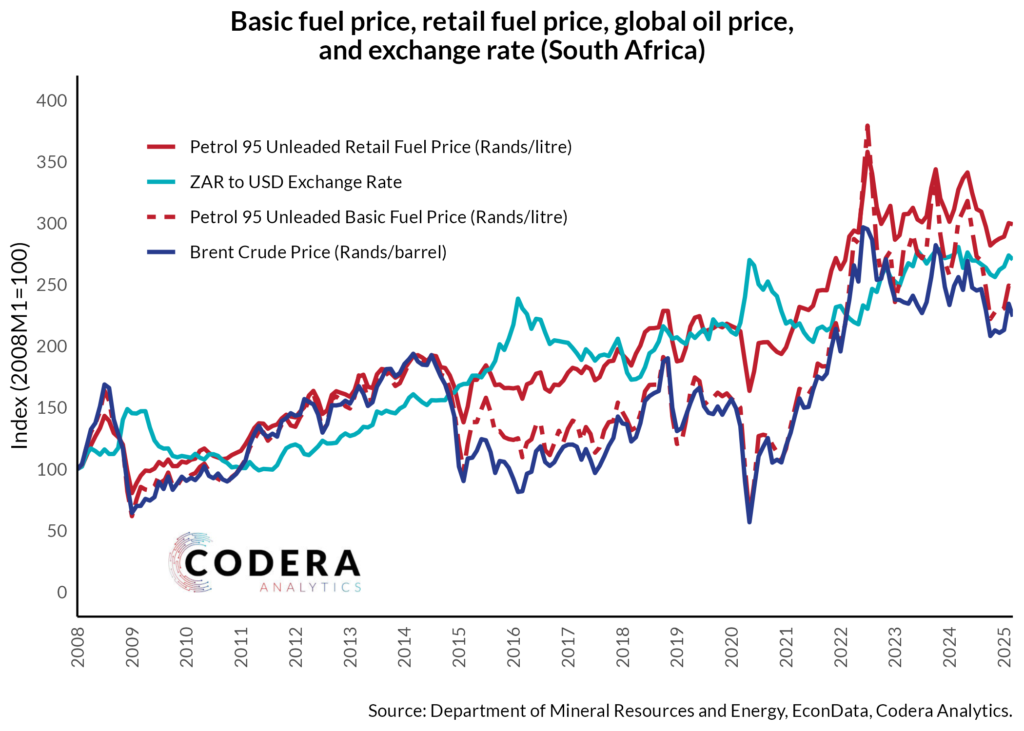

Today’s post by Jan-Hendrik Pretorius shows that persistent exchange rate depreciation has played a key role in the continuous rise in domestic currency fuel prices. Yesterday’s post however showed that that there is a meaningful wedge between the retail petrol price and the globally determined portion of its price, reflecting the much larger cumulative increase in domestic taxes (the road accident fund levy), transport costs and margins.

Note that basic fuel price data from the Central Energy Fund are available in EconData. Contact us at info@codera.co.za if you are interested in subscribing to subscriber-only datasets.