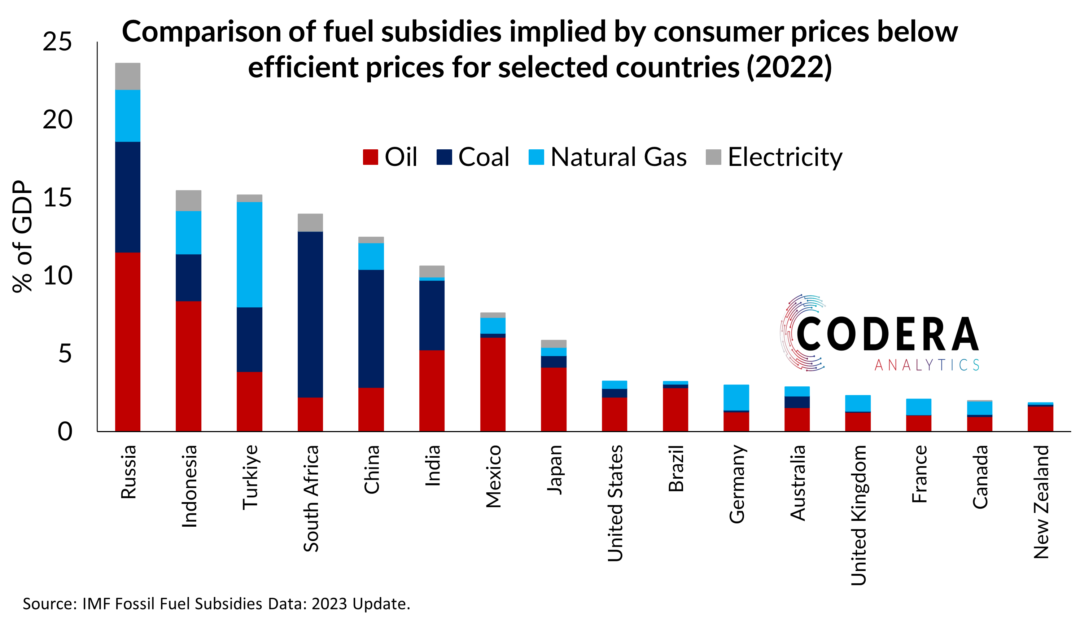

Tax expenditures by governments are generally not well understood by the public and can be quite expensive. Tax expenditures include things like tax incentives for firms, tax deductibility for saving by households, or tax relief on certain consumer goods. Data from the Global Tax Expenditures Database show that the Netherlands and Russia have the largest ratios of revenue forgone to GDP (at almost 15%). For South Africa, the figure is almost 5% of GDP (around 20% of revenue).