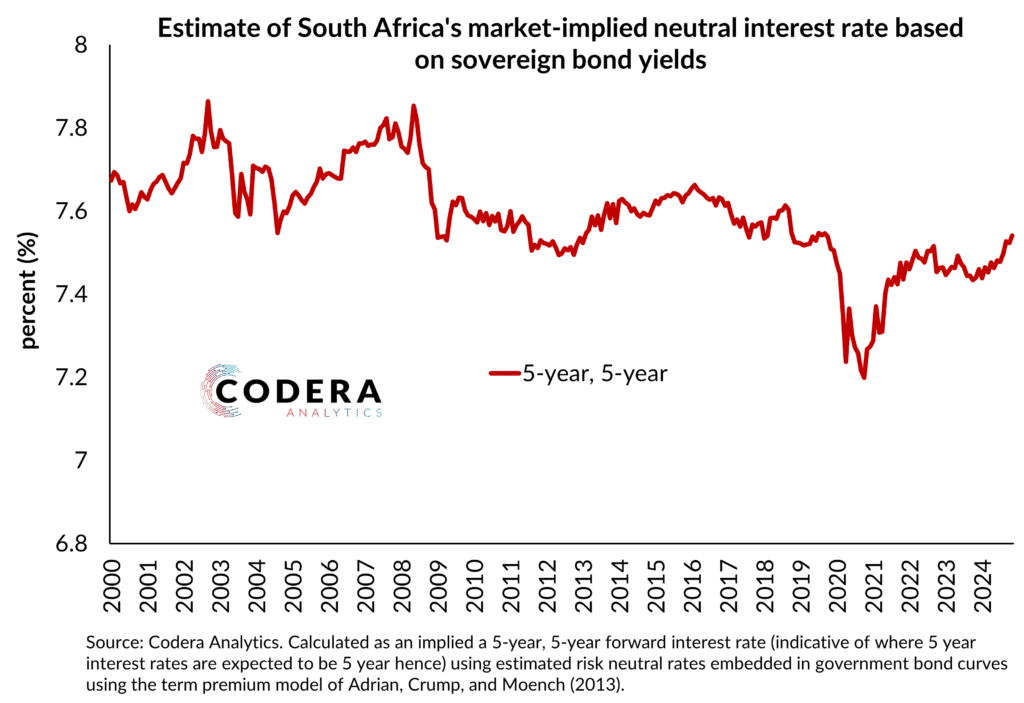

In today’s post, we estimate the bond market-implied neutral rate for South Africa. Using information from the entire yield curve, we calculate long-term expectations of future interest rates: the expected 5-year government bond rate, five years into the future, adjusted for an estimated term premium.

Our estimates suggest that market pricing has long implied that South Africa’s neutral rate might be higher than SARB and many private sector economists have been assuming. Our updated estimate is around 7.5% nominal – implying 3% real (compared to SARB’s assumption of 2.66%).