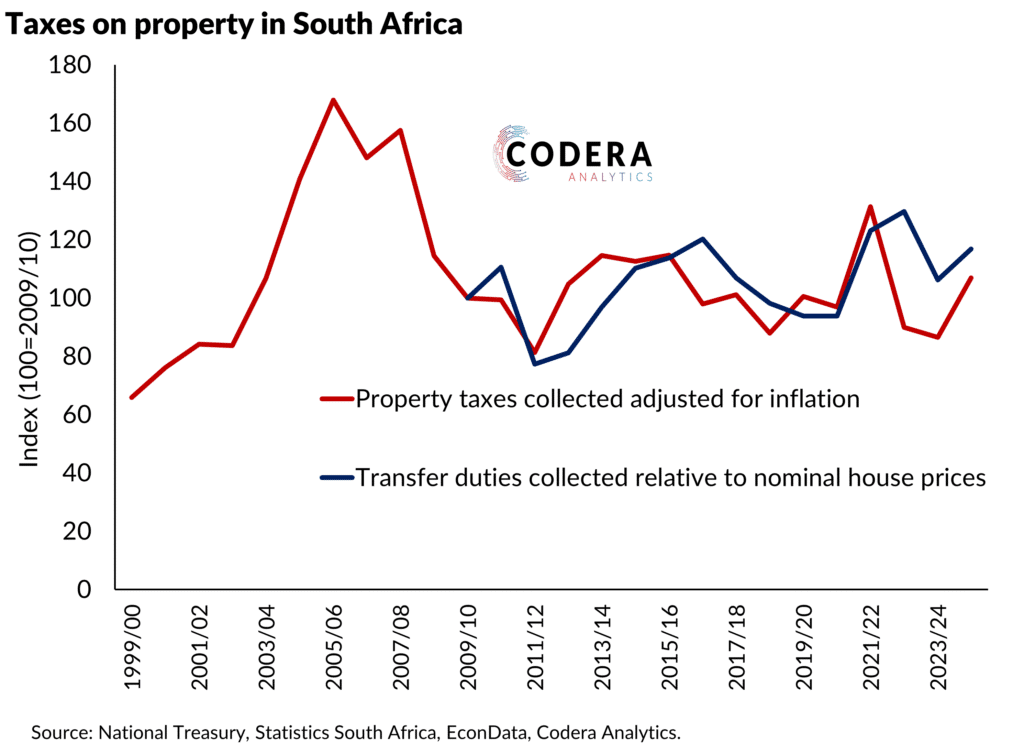

Today’s post shows that taxes on property and transfer duties have not grown much relative to consumer prices or house prices since the global finance crisis of 2008/09. This illustrates the importance of asset price growth for this part of the tax base. Given South Africa’s high property taxes, it also illustrates how the high level of informality in South Africa’s property sector—characterised by unregistered developments, informal dwellings, and unclear ownership—significantly hampers property tax collection, as municipalities struggle to identify taxable properties and enforce compliance.