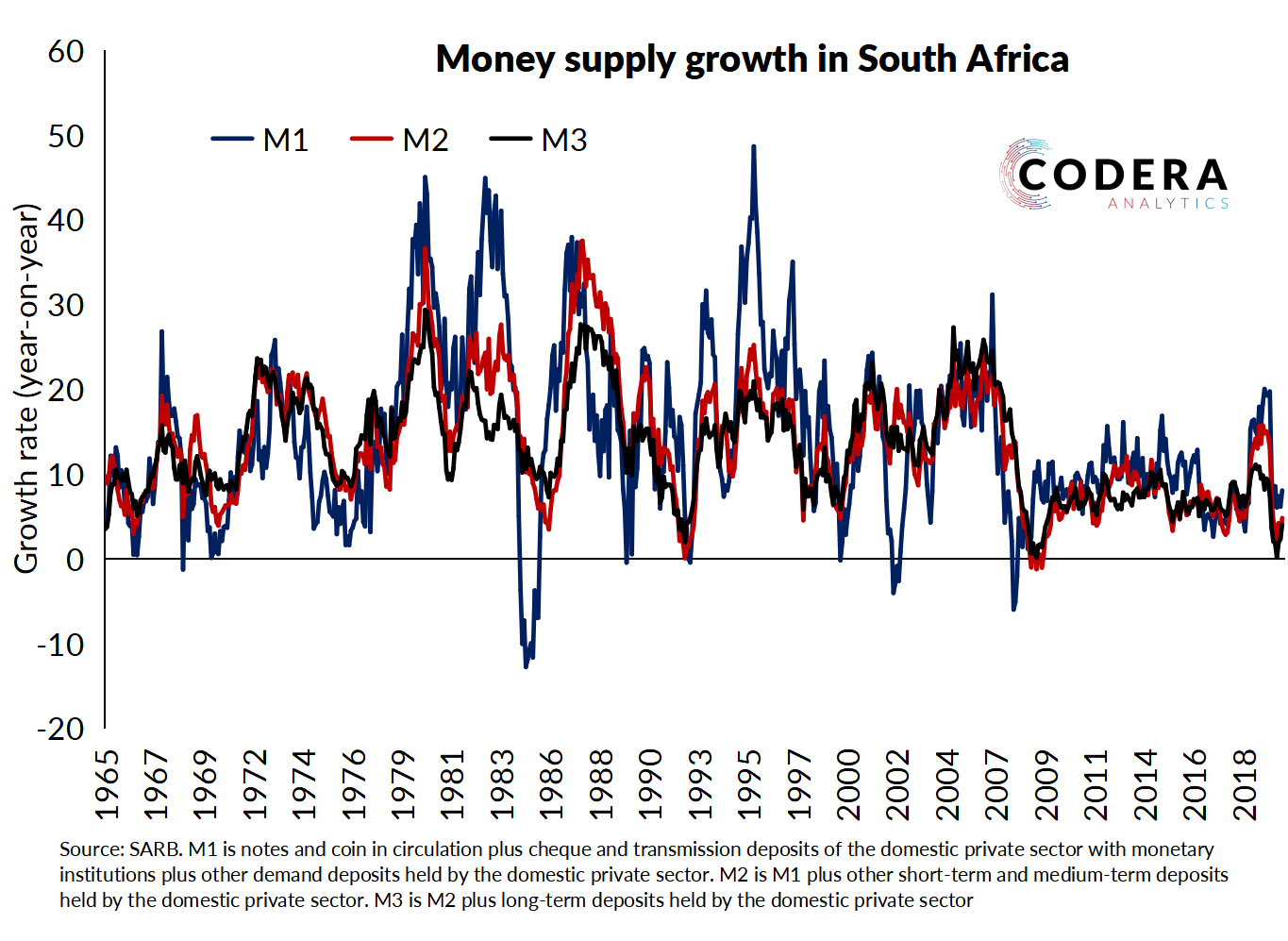

Low interest rates and quantitative easing in major advanced economies has led to debate about whether rapid money growth would lead to higher inflation. But in South Africa, money supply growth has recently been much lower than has been the case historically. It is therefore difficult to argue that faster money supply is driving inflationary pressure at the moment.

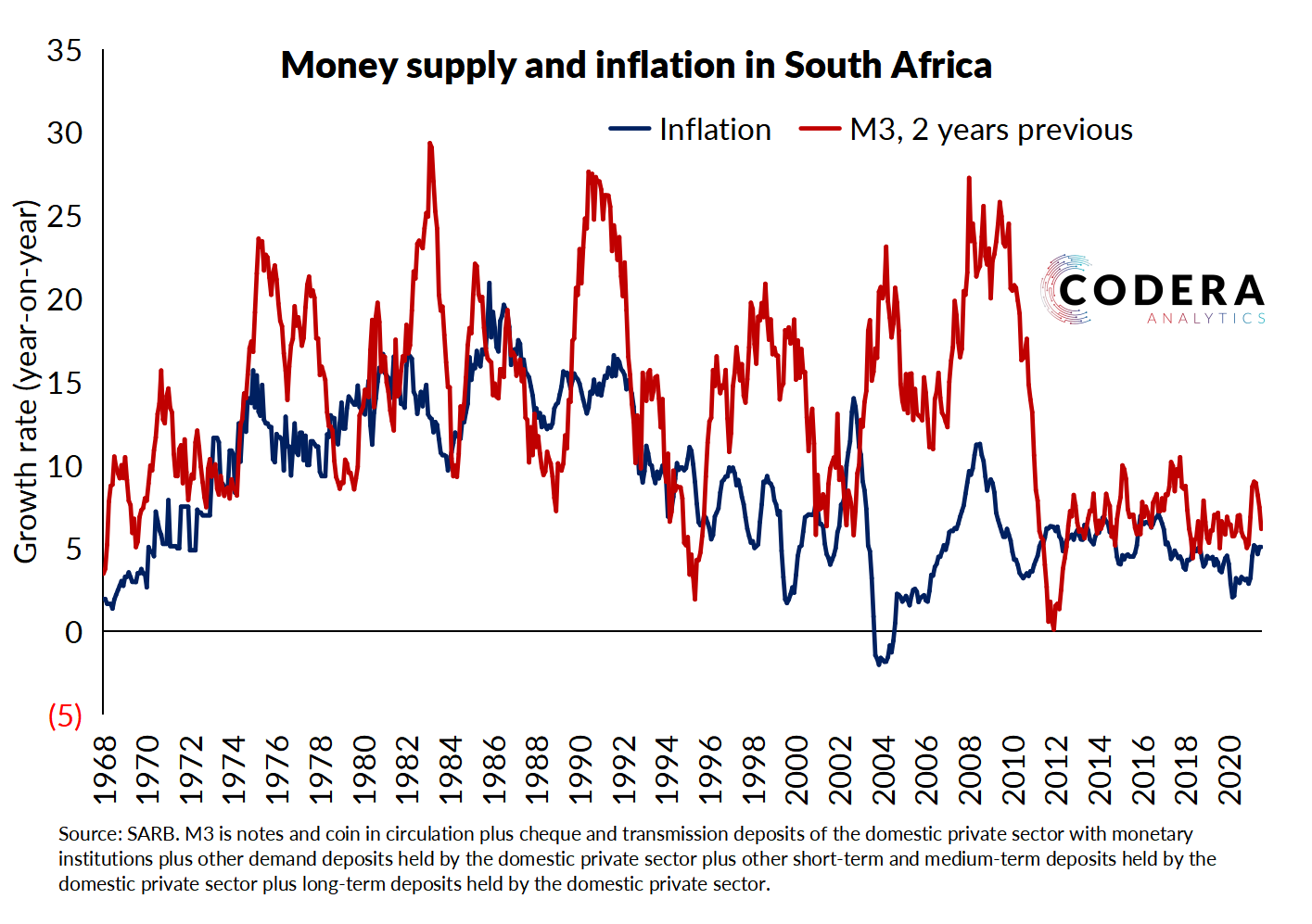

Like many other central banks around the world, the South African Reserve Bank targeted monetary growth (in their case for broad money, ‘M3’) based on the expectation that inflation was largely a monetary phenomenon. The charts below show that while there was a positive relationship between money supply and inflation in the 1970s, that disappeared when the central bank began targeting money supply growth.

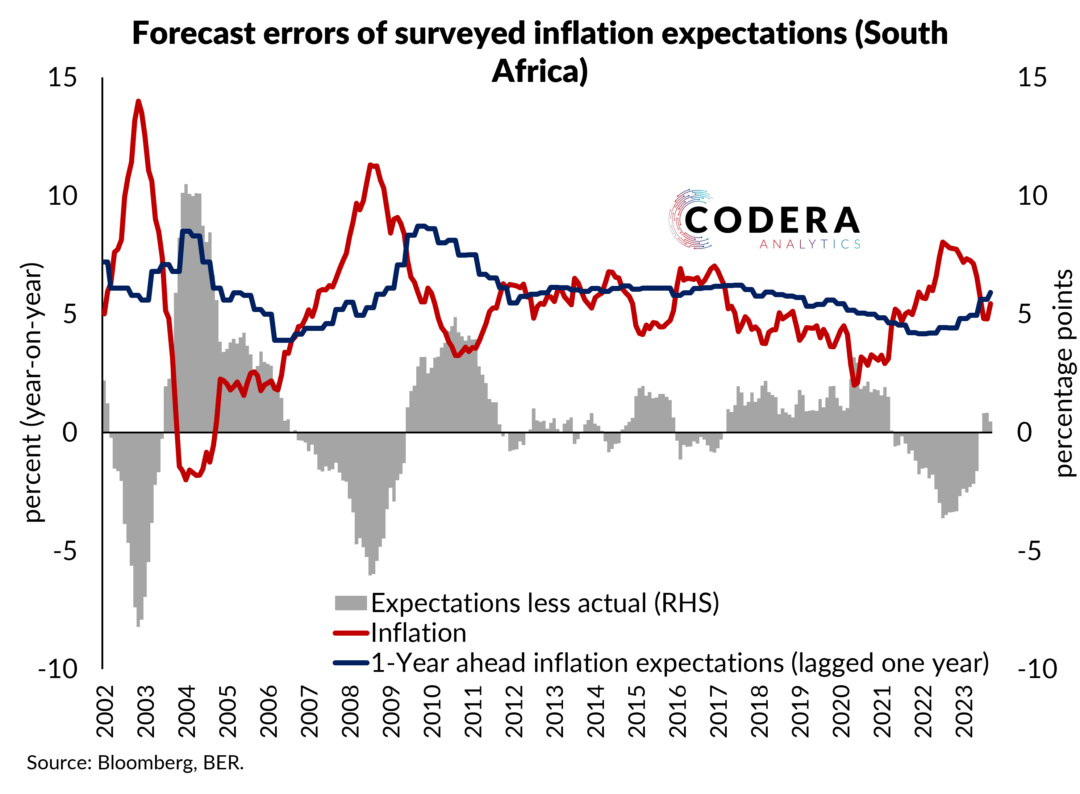

This reflected changes in the financial system and declining money velocity. The latter implies that money has increasingly been held idle instead of being spent. One explanation for lower money velocity is that money supply growth has been driven by precautionary demand for cash. Inflation expectations have gradually declined, while market uncertainty has periodically spiked.

This reflected changes in the financial system and declining money velocity. The latter implies that money has increasingly been held idle instead of being spent. One explanation for lower money velocity is that money supply growth has been driven by precautionary demand for cash. Inflation expectations have gradually declined, while market uncertainty has periodically spiked.

Under an inflation targeting approach to monetary policy, a central bank targets the price of money, not its quantity. As a result, price pressures do not depend directly on money supply, but on real factors (such as demand for credit). In South Africa’s case, credit growth has been anemic for much of the post-global financial crisis period, and there has not been a strong link between money supply and inflation.