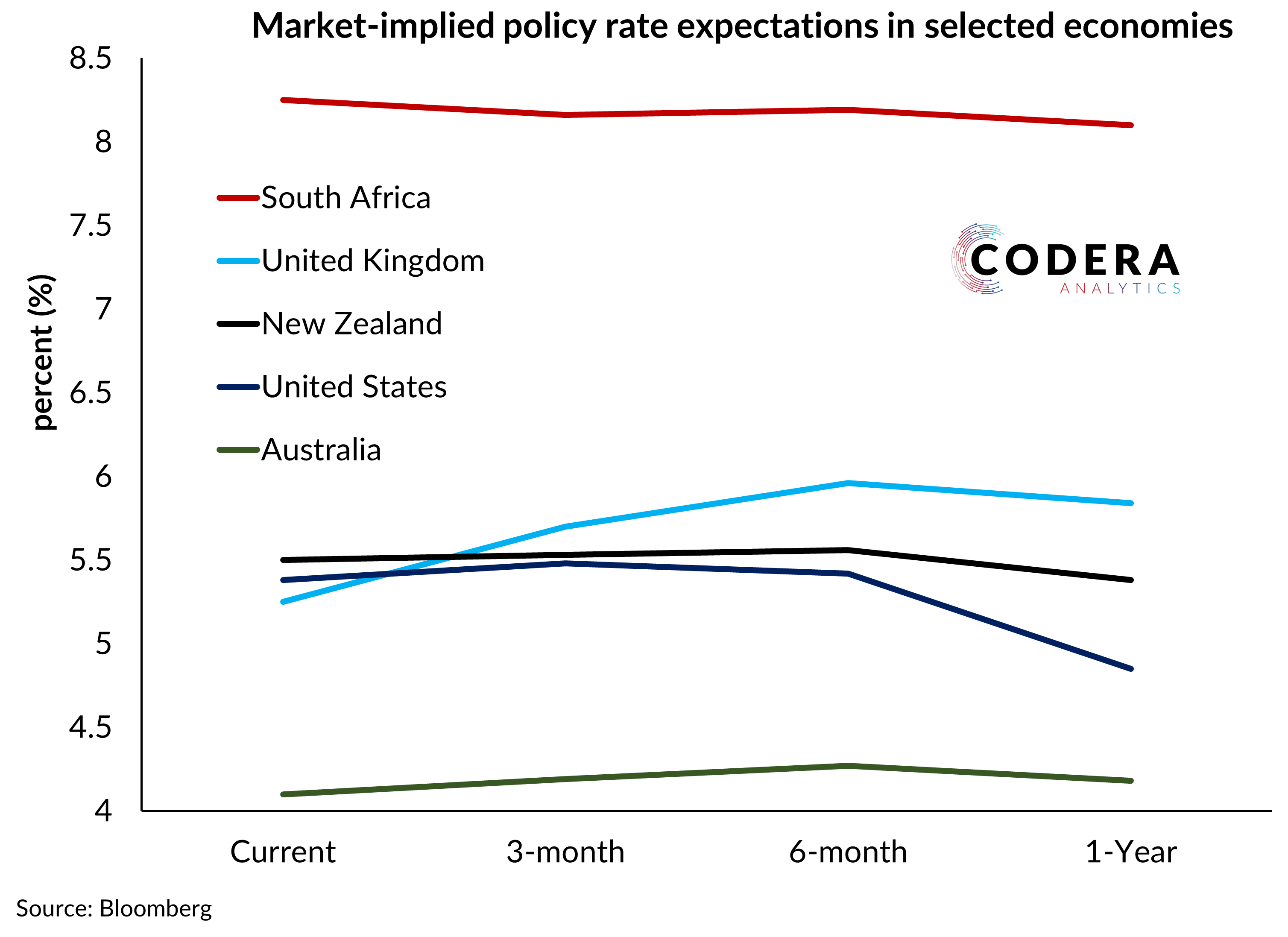

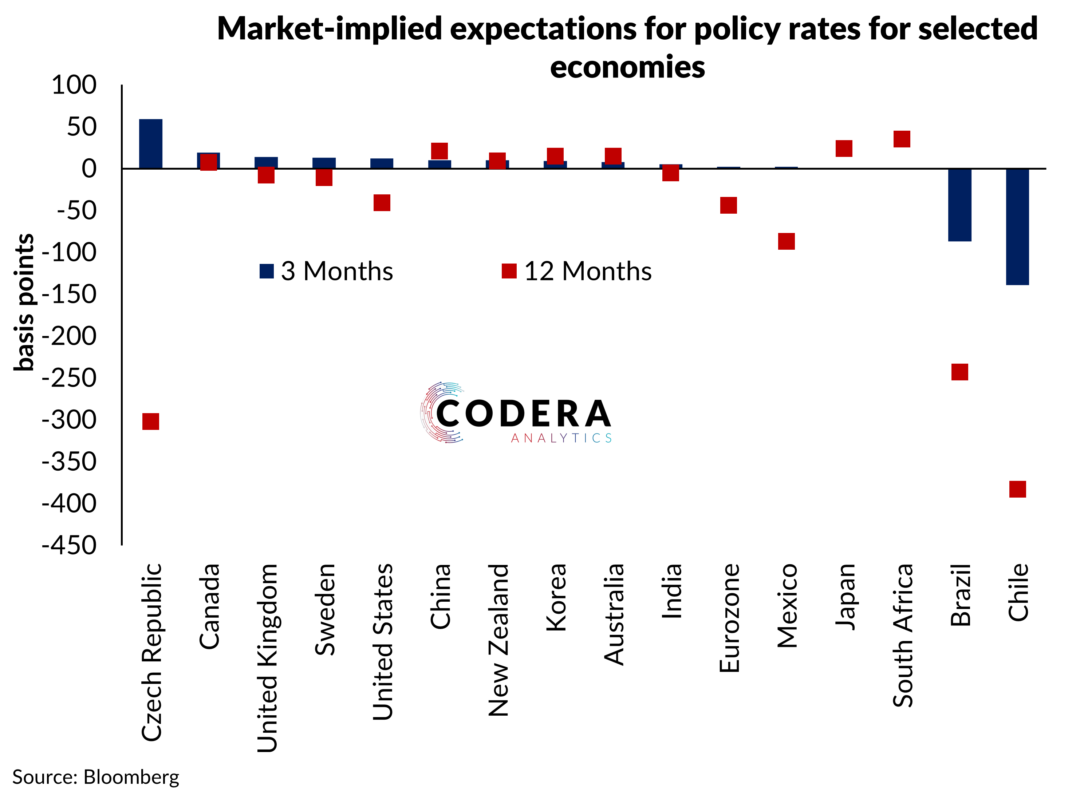

The market is pricing in a possibility that the SARB could cut the policy rate before the end of the year, in line with the SARB’s published forecast that implies an end of year policy rate of 8.03% (compared to 8.25% currently). There has been a retracement of expectations of the terminal policy rate in this tightening policy cycle over recent months, though market pricing has been quite volatile over the course of the year (see here and here). Market pricing implies further tightening is likely in the UK and that the Fed could tighten further short-term but begin to ease within the next 12 months, while the market-implied profiles for the policy rates in Australia and New Zealand are much flatter for a year-ahead horizon.