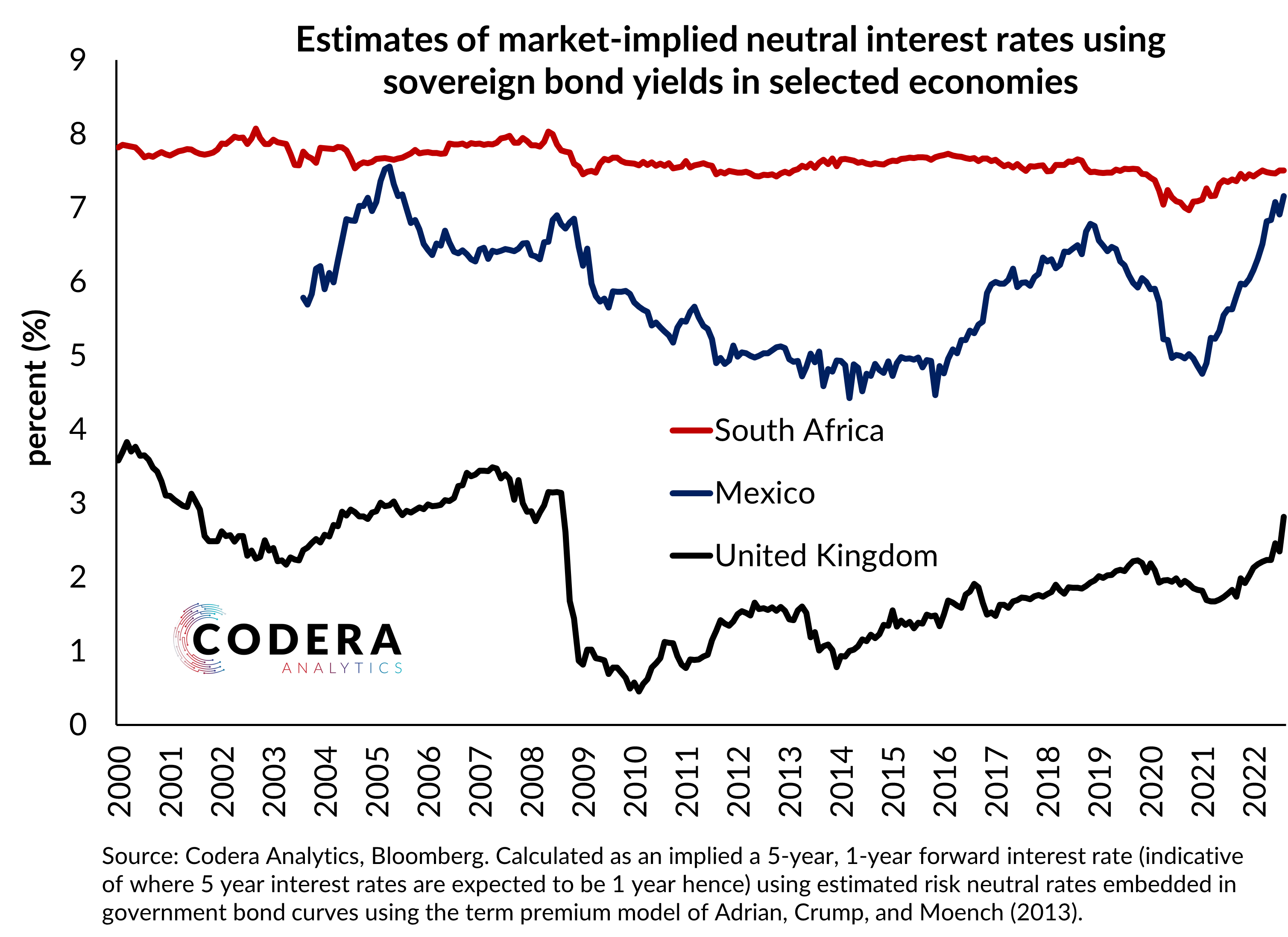

Our market-implied estimate of the neutral interest rate in South Africa defied the global downward drift in global equilibrium interest rates over the last two decades. Apart from being more stable, South Africa’s estimate has also been much higher than in many emerging markets (here we compare to Mexico) or advanced economies (here we plot our estimate for United Kingdom). There are many possible explanations for South Africa’s high long term sovereign interest rates. In future posts we will examine the global and domestic factors that affect interest rate expectations and term premia in SA.