Updated output gap and potential growth estimates for SA

Simple statistical filters for estimating the output gap (a measure of economic slack) suggest that it remains in positive territory. Our filters suggest that potential growth remains below 1%. The most recently published SARB assumptions (from the March 2024 MPC) have potential growth at 0.1% for 2023 and 1% in 2024 … Read more

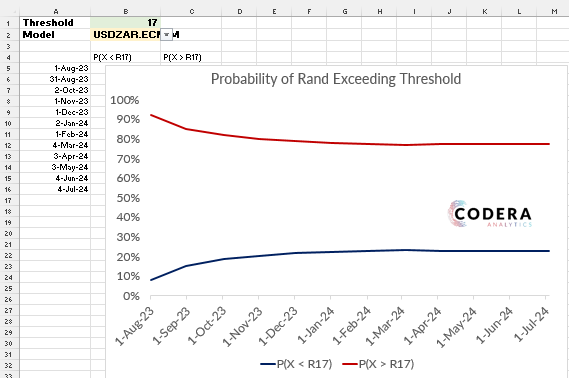

ZAR misalignment based on a Bayesian Threshold VECM

This post assesses whether the rand has been misaligned relative to its economic fundamentals compared to the dollar. Since the drivers of exchange rate movements tend to change over time, it is useful to use a framework that allows the relationship between the rand and its key macroeconomic fundamentals to change at specific points in time. In this post, I … Read more

Data Availability Across Countries

How does the volume of data available in different economies compare? In this post, we summarise the number of data series available from the World Bank for different countries as a proxy for macroeconomic and social data availability. Using the World Bank API, we calculate that there are 16800 indicators in total across countries available from the World Bank. To … Read more

What drives the rand?

A challenge forecasters face is interpreting the drivers of model-based forecasts. In an exchange rate context, this can be particularly challenging given the volatility of currencies and the fact that currencies reflect changes in economic and financial fundamentals, as well as sentiment and expectations about the future. Fundamentals, sentiment and expectations are unobserved, so there is always uncertainty around whether

Read more

Some reflections on SARB’s supercore and persistent inflation measures

The South African Reserve Bank (SARB) published its latest Monetary Policy Review (MPR) yesterday. As usual, it provides a bunch of interesting analysis about the current business cycle. It was nice to see SARB provide alternative measures of underlying inflation (‘supercore’ and ‘PCCI’), as we have calling for since 2022. These measures are meant to capture demand-driven inflation. As previously … Read more

Labour market insights from the QLFS

Unemployment is higher among women than men in South Africa. Men have a higher participation and absorption rate. EconData makes it easy to download data from official publications like the Quarterly Labour Force Survey and automate workflows that use such data.

Read more

What drives South African bank ROE?

Today’s post looks at the drivers of South African banking sector return on equity (ROE). The model weights up individual models of banking sector ROE using a Bayesian model averaging approach that assigns weights to models based on their their ability to explain ROE. In this illustration, we consider a large number of potential explanatory factors, including credit impairments, the … Read more

Using options prices to measure rand risk

In today’s post, I back out market expectations of future USDZAR movements using options prices. The first chart shows that the distribution of the USDZAR’s options-implied densities is more more peaked at shorter maturities (i.e. 1 month ahead) and the confidence intervals widens as one looks at longer horizons (i.e. 12 months ahead). Over longer periods ahead, less of the … Read more

Term premia in SA, AU, NZ and CAN

South Africa’s 10 year government bond rate is more than 700 basis points higher than the Canada, Australia or New Zealand. We estimate that the term premium embedded in South African government 10-year bond rates can explain almost half of the spreads, with the term premium more than 300 basis points higher in South Africa than in the these countries. Read more

How does SA’s data ecosystem stack up internationally?

Here I repost my article published in the Business Day: How does South Africa’s data ecosystem stack up internationally? Data matter. Reliable and timely data are crucial for decision making. Data drives innovation and is an important source of value. In the public sector, data helps drive better development outcomes through evidence-based policies, and improved transparency and accountability. Estimates from … Read more

Estimating the costs of holding foreign reserves in SA

The Reserve Bank is responsible for managing South Africa’s foreign reserves. Among other things, South Africa invests in liquid foreign reserves to provide resources for dealing with external shocks. As the amount of reserves South Africa holds has risen over time, so has the implied holding cost of our reserves. Since our inflation tends to be higher than in our … Read more

Bid-Cover ratios for National Treasury of South Africa instruments

Bid-cover ratios provide a measure of the extent of demand for sovereign money market instruments and debt issuances. Floating rate notes have had higher weighted bid cover ratios than other Treasury issuances since their introductions in late 2022. Since 2010, weighted bid cover ratios have been highest for fixed rate bonds and lowest on average for inflation linkers. Read more