The IMF recently published a selected issues report on South Africa that includes analysis of the macroeconomic effects of a potential change in South Africa’s inflation target.

It finds:

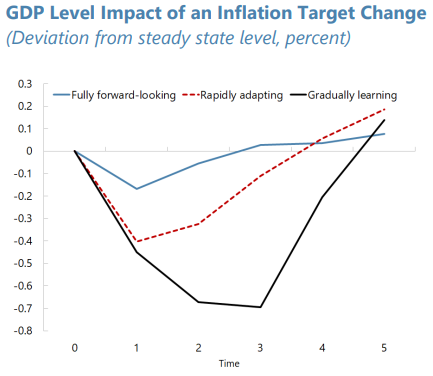

- moderate short term disinflation costs: a sacrifice ratio of 0.6 (output loss per percent inflation decline). See here for our discussion of uncertainties around sacrifice ratio estimates.

- if the SARB’s plans to reduce the target are credible, these costs are much lower. As we have shown, inflation-expectations in South Africa are backward-looking, which means that if takes time for firms and households to believe that SARB will be able to permanently reduce inflation (our expectation), then the sacrifice ratio would be 1.2 instead.

- if fiscal and monetary policy are coordinated such that there is fiscal consolidation that brings down public debt it would reduce the sacrifice ratio overall. The IMF acknowledge that fiscal consolidation would be difficult and add to the short-term output costs of disinflating.

- Achieving a lower target over the long term would reduce borrowing costs in the economy and ultimately support long run growth. However, if inflation expectations only gradually adjust towards a lower target (again our base case) then economic growth remains lower that otherwise for almost 5 years.

Overall, the IMF’s message is in line with our earlier paper on Gaps in the South African Inflation Targeting Debate: that clear communication of any plans to revise the target and buy in from government will be key to successfully lowering the target. But achieving buy in is not a given – as we argued (here and here) – we have not seen evidence of this yet and if anything, there is a risk that the fiscal stance and government policy will counteract SARB’s plans. This would see raise borrowing costs rise and impose very large adjustment costs on the private sector.

Like our paper, the IMF emphasise that the SARB must ‘ensure transparent and consistent communication with the public and markets to guide expectations’. For those interested, we go into a lot more detail about what practical steps the SARB should take to ensure a successful target reform process.