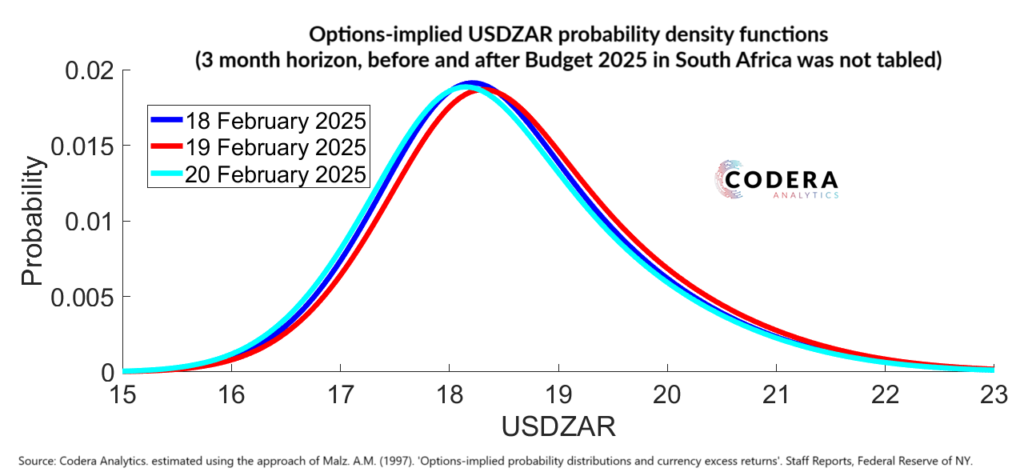

The options market can help us understand how events affect currency expectations and uncertainty. In today’s post, we look back and estimate how market expectations of the future value of the USDZAR shifted around the time of the unprecedented postponement of the 2025 South African Budget Review.

We show that the market briefly thought that the rand could stay weaker given the postponement, but the market changed its mind the next day.

Options-implied USDZAR expectations shifted meaningfully to the right by market close on the day of the postponed Budget Review (19 February). There was also a slight fattening of the right tail of the distribution, suggesting that market participants expected that value of the ZAR was more likely to remain above its mean over the coming months than to fall to values below it. However, the following day, the mean of the options-implied USDZAR distribution shifted leftwards again, indicative of a lower implied point estimate of the future value of the ZAR over the next 3 months.

Footnote: Estimated using the approach of Malz, A. M. (1997). Option-implied probability distributions and currency excess returns. Staff reports, Federal Reserve Bank of New York. See this paper for more detail of the methodology used, and this paper by Michelle Lewis for more discussion on using option pricing to gauge market expectations.