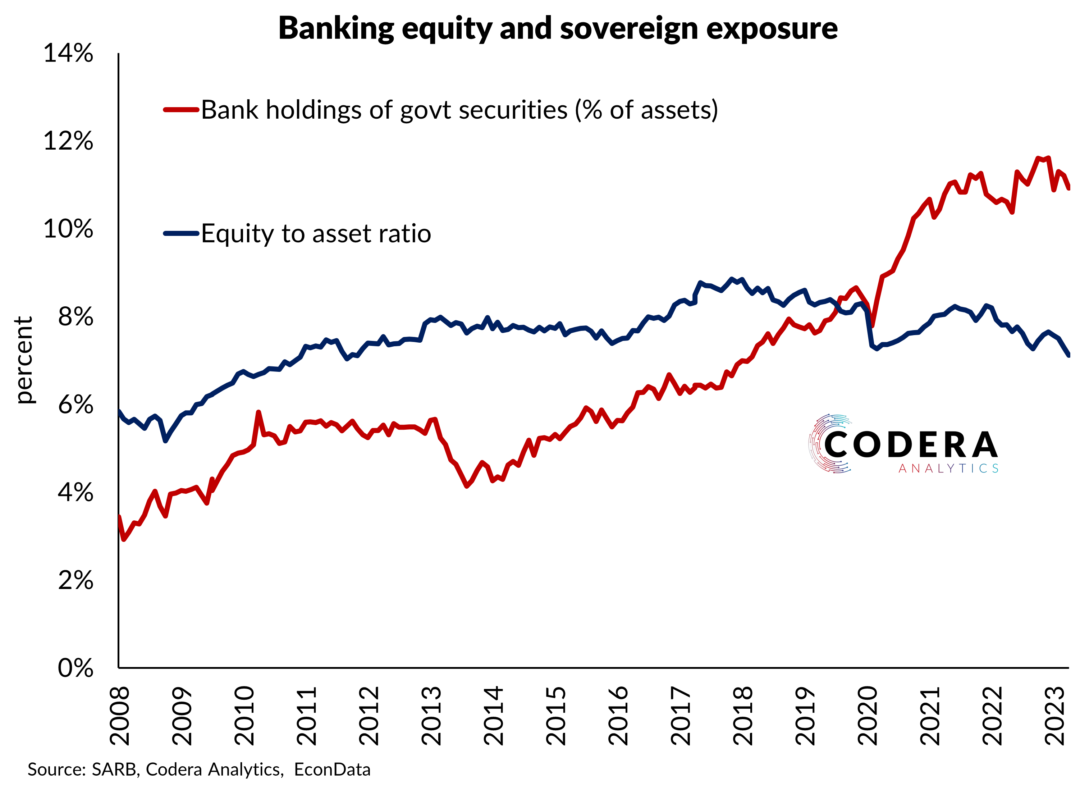

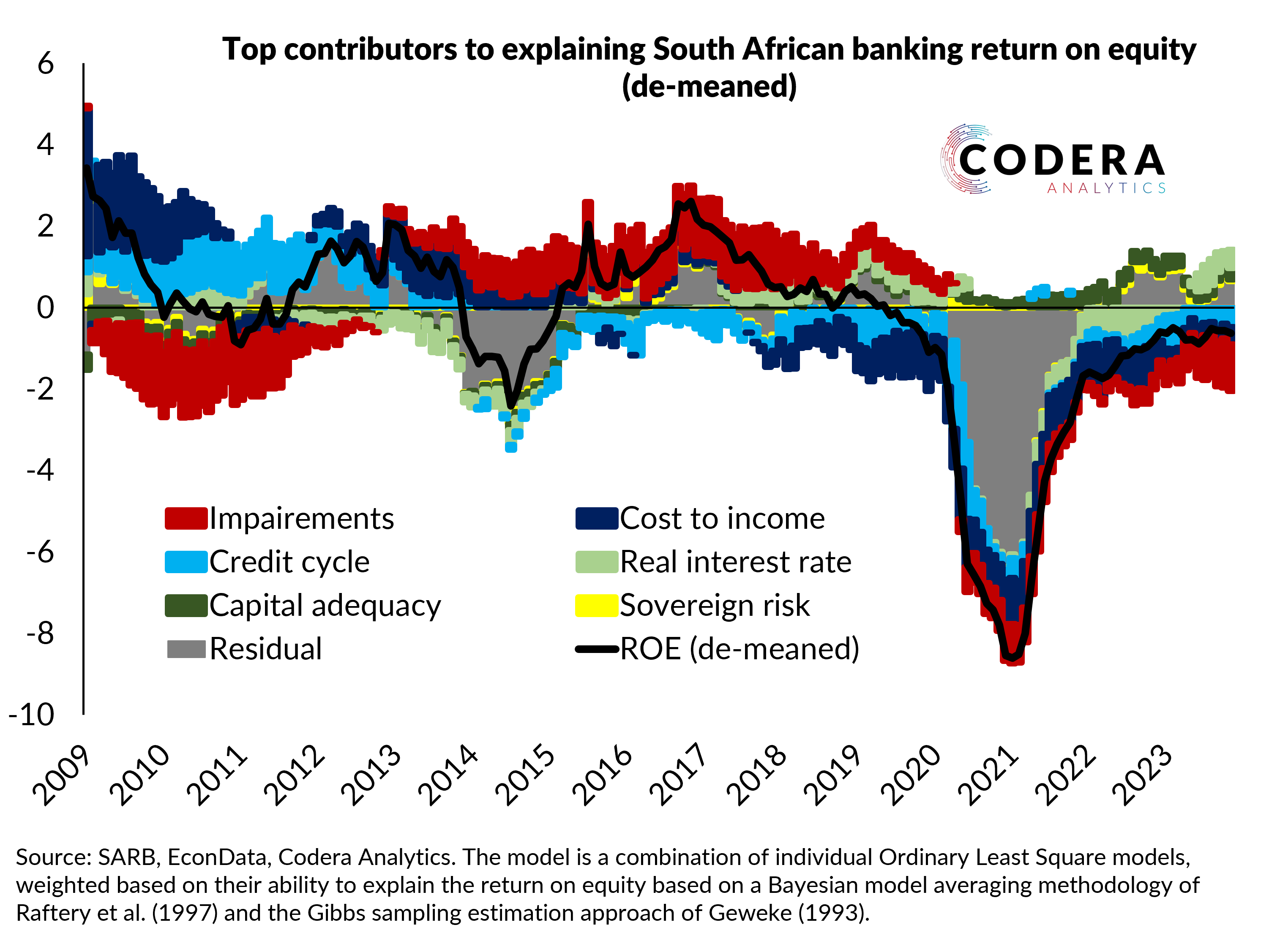

Today’s post looks at the drivers of South African banking sector return on equity (ROE). The model weights up individual models of banking sector ROE using a Bayesian model averaging approach that assigns weights to models based on their their ability to explain ROE. In this illustration, we consider a large number of potential explanatory factors, including credit impairments, the domestic short term real interest rate as a measure of the monetary policy cycle, banks’ cost-to-income ratio to capture relative cost pressures, South African sovereign risk to capture the impact on banks’ holdings of government securities and the level of risk in the economy, the ratio of bank lending to interpolated GDP as a measure of the credit cycle, the aggregate sector’s capital adequacy ratio as a measure of capital levels, net interest margin and funding spreads (proxied using the difference between implied lending and deposit rates). The model suggests that impairments is the top explanatory variable for South African banking ROE, followed by cost-to-income and the credit cycle. ROE is currently below its long term average level. This can be explained by elevated impairments and costs and and the weakness of the current credit cycle that are estimated to be weighing on banking ROE. On the other hand, ROE is being buoyed by capital adequacy and elevated real interest rates. One can also see that there is still a large unexplained component (‘residual’) for some periods: the variables considered do not fully explain the large COVID-19 decline in banking ROE. It is likely, for example, that banks took provisions ahead of expected credit losses that may not have arisen to the extent expected and for which data are not easily available for this example.

Footnote

For caveats around the framework used see this earlier post.

Codera’s banking dashboard makes it easy for analysts to access and analyse hundreds of different measures of banks’ financial position, that in turn indicate bank performance and broader financial stability risk. Get in touch if you would like to subscribe to our banking dashboard.