In today’s post, I back out market expectations of future USDZAR movements using options prices. The first chart shows that the distribution of the USDZAR’s options-implied densities is more more peaked at shorter maturities (i.e. 1 month ahead) and the confidence intervals widens as one looks at longer horizons (i.e. 12 months ahead). Over longer periods ahead, less of the distribution’s probability mass is near the current level of the exchange rate as the market is pricing in a larger probability that the currency could appreciate or depreciate.

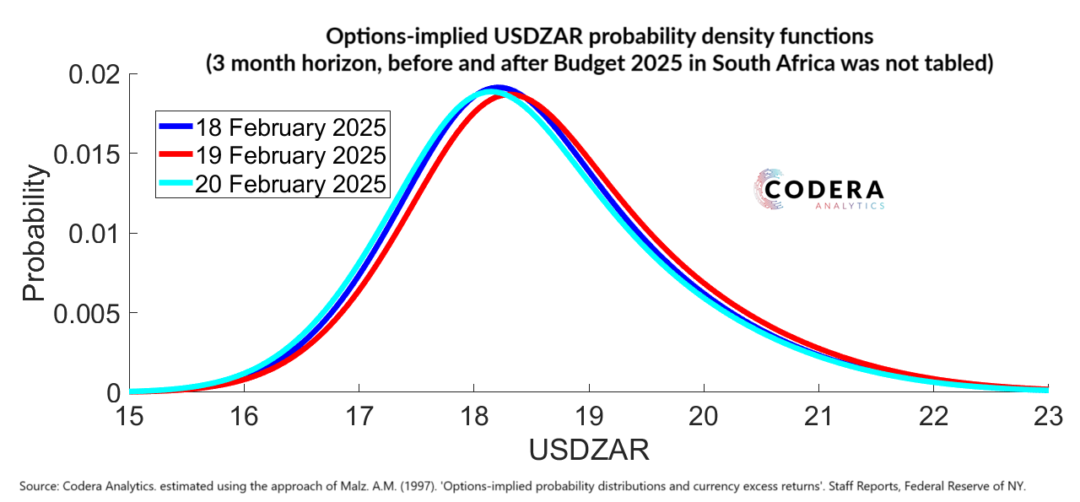

As we have shown in previous posts, these distributions can also be used to assess the probability of large shifts in the exchange rate or for measuring the uncertainty about the outlook for the USDZAR. What is interesting about the USDZAR’s option-implied moments is that the distribution has long tails, particularly in the right tail, indicative of positive skewness, or that depreciation has always been more likely than appreciation.

If we look over time, we see that the mean of the probability distribution has shifted through time, with a rightward shift showing that the USDZAR has been on a depreciating trend since 2019. The density of the distribution has also become less peaked over recent years as uncertainty around the mean expected value of USDZAR increased and the probability mass in the right tail has increased (indicative of a greater risk of large depreciations).

Footnote

For more details on the approach used read our paper, where we show that option-implied rand variance can improve forecast accuracy when predicting the USDZAR. This paper by Michelle Lewis also provides more discussion on using option pricing to gauge market expectations.