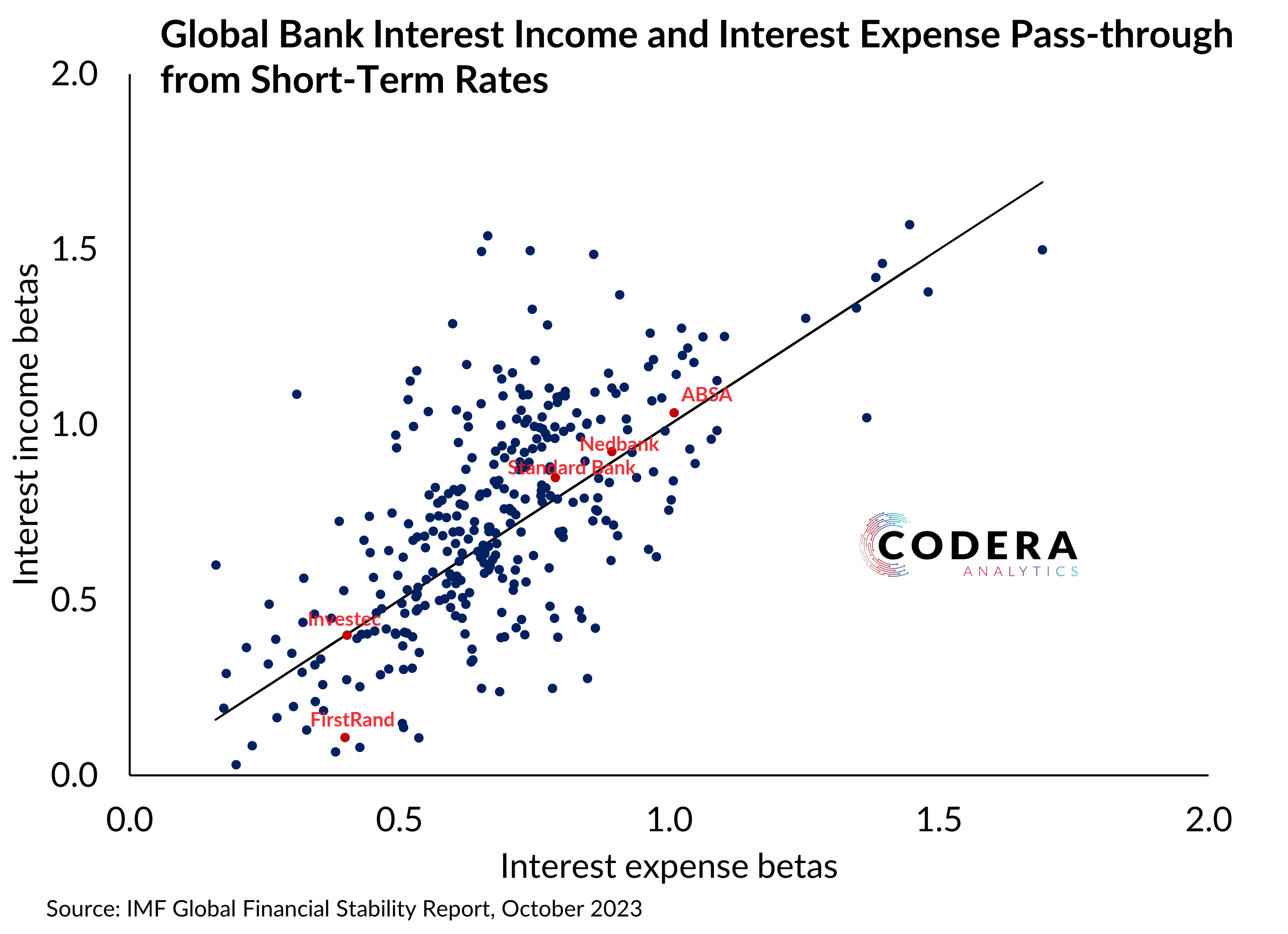

South Africa’s largest banks are highly profitable by global standards. The most profitable banks have interest income that rises from higher policy rates and slower-than-expected repricing of deposits (and therefore lower relative funding costs, see here for evidence of the stickiness of deposit rates). In the chart below, ‘betas’ measure the sensitivity of bank interest income and expenses to changes in interest rates for large banks in different countries. The most profitable banks are those with higher ‘income betas’ relative to ‘expense betas’ (i.e. banks above the 45 degree line), so that their net income rises with policy rate increases. The estimates show that among South Africa’s five largest banks, all except FirstRand have higher interest income betas than expense betas, with Standard bank having the highest positive differential. These differences may be one reason for the low aggregate correlation between the yield curve and bank net interest margins in South Africa. The sensitivity of bank balance sheets to market conditions also have a range of possible monetary policy and financial stability implications.

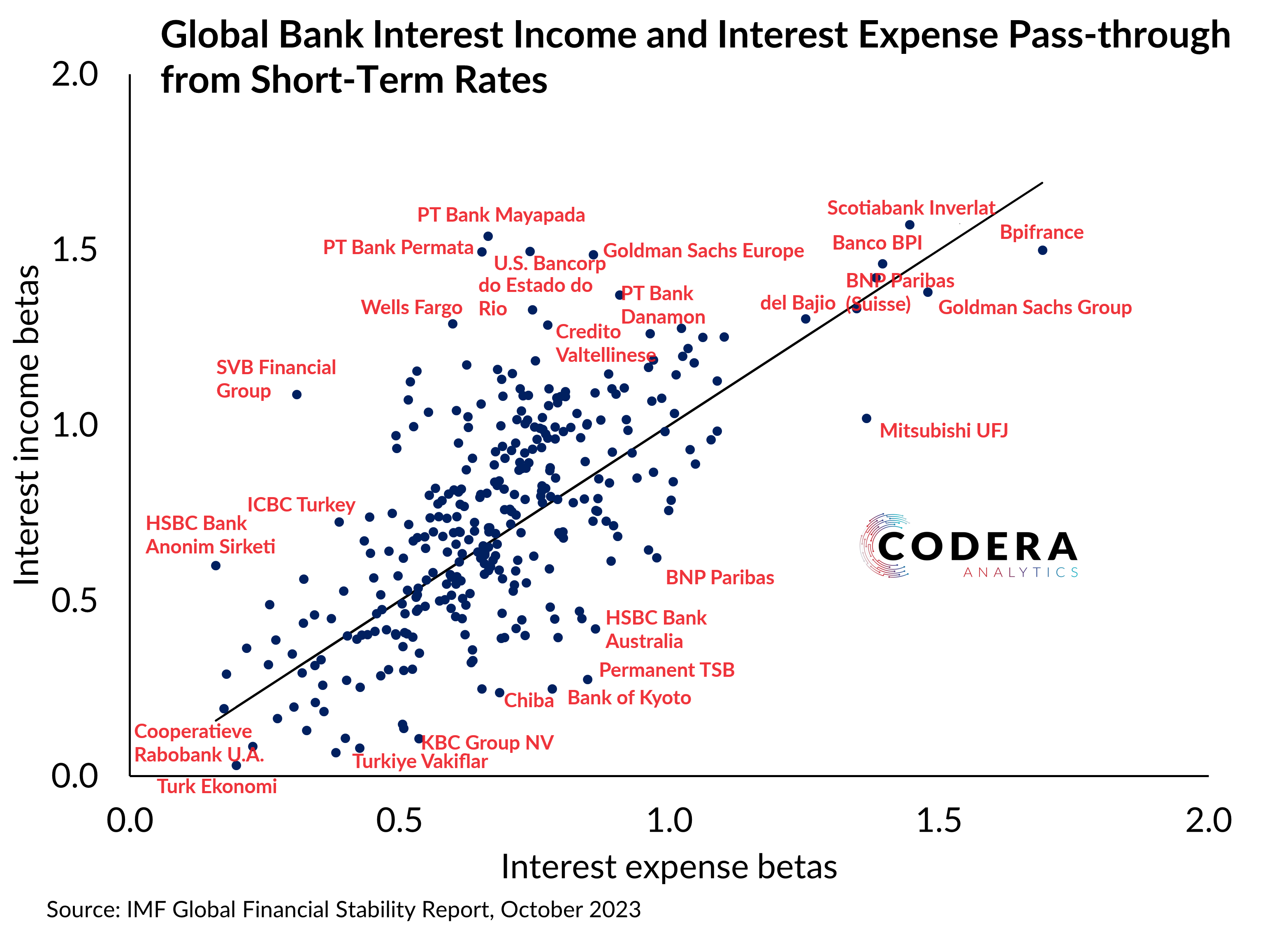

Among global banks, Indonesia’s Mayapada and Permata and the US’ SVB, U.S. Bancorp and Wells Fargo had the highest differential between their estimated interest income and expense betas. Germany’s Goldman Sachs Bank Europe ranks sixth, followed by the US MUFG Americas Holdings Corporation, Portugal’s Grupo Credito Agricola, Brazil’s Banco do Estado do Rio Grande do Sul and the US’ Cullen/Frost Bankers. The banks with the lowest differentials are Ireland’s Permanent TSB, Japan’s Bank of Kyoto and Chiba Bank, Australia’s HSBC Bank Australia and Belgium’s KBC Group.

Footnote

The IMF estimates are based on the long-term pass-through of permanently higher short-term rates to bank-level interest income and expenses 2-years on. An income beta of 0.5, for example, implies borrowing interest rates increase by 50 basis points when short-term rates rise by 100 basis points.