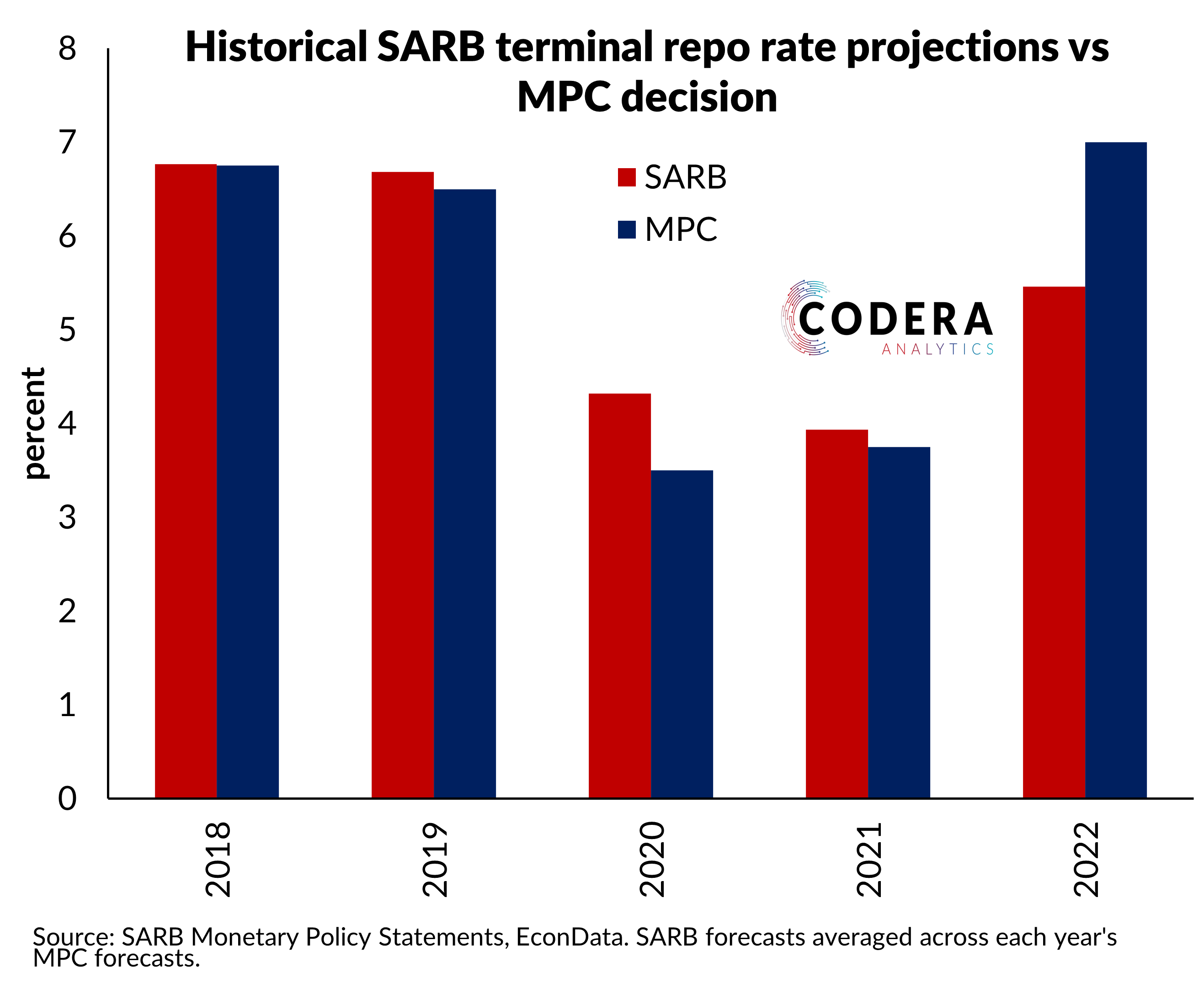

The SARB stands out among major central banks for publishing forecasts that are not consistent with monetary policy decisions. The most recent Monetary Policy Committee (MPC) decision was to raise the policy rate to 7%, while the SARB’s accompanying economic forecasts were based on an end-of-year rate of 6.3%. This means the inflation forecasts published by SARB are conditioned on a looser policy stance than the Bank has implemented.

Best practice among major central banks that use models to communicate forecasts is to publish forecasts that are conditioned on the currently decided policy stance or at least to publish scenarios that explain any deviations in monetary policy decisions from their published forecasts. Most banks that do publish forecasts that are not consistent with their policy decisions explicitly label such forecasts as ‘staff forecasts’ to clarify that they are based on different assumptions and judgements about the outlook for the economy.

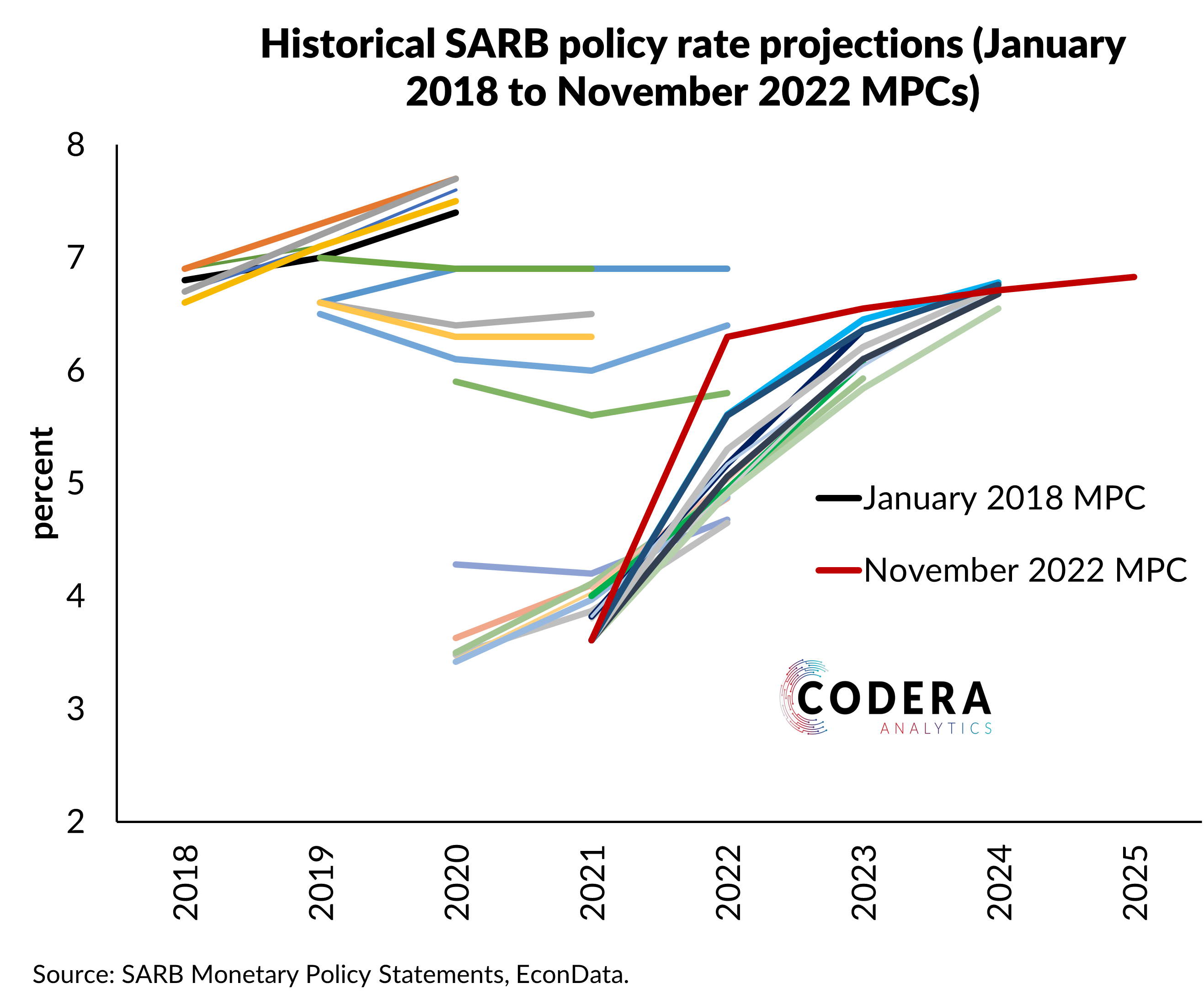

The first chart shows that SARB’s policy rate forecasts have been revised substantially over the last year. The second shows that the MPC front-loaded cuts in 2020 with the onset of the COVID-pandemic and then front-loaded hikes in 2022 relative to what the Bank’s published forecasts suggested would be required to meet their inflation target.

The implication of publishing forecasts that are not based on the actual decisions made by the MPC is that it creates uncertainty around the reaction function of the SARB (i.e. how the Bank will react to specific economic shocks) and makes it difficult for market participants to anticipate how interest rates might change over time. Commentators and analysts also have a hard time interrogating the reasonableness of SARB projections since the SARB does not communicate the economic narrative underlying monetary policy decisions through the lens of its main forecasting model.