SARB yesterday released modelling results describing its macroeconomic assumptions presenting the path to a lower inflation target in South Africa. The MPC also presented a forecast scenario for an inflation target of 3% instead of 4.5% that has rates for 2025 50 basis points lower and long term rates 150 basis points lower.

We have been calling for such analysis to be published to help motivate a shift to a lower target. Codera released a paper in February (with an update after the CPI weights were updated) to help advance the debate about South Africa’s inflation target. We presented the paper at the recent ERSA conference, and our slides are available here. In the paper we argued that:

- high structural inflation and backward-looking inflation expectations in South Africa mean that promising a lower target could backfire without government and stakeholder buy-in.

- without structural reforms, inflation in parts of the economy where prices are flexible (e.g. the tradeable sector) would need to undershoot whatever a new target might be.

- without co-ordination and reforms, this could imply higher costs for the private sector.

- that we need a team-SA approach to a lower target:

- Clear SARB communication of the approach to the transition and co-ordination with stakeholders

- Social compact between government, SARB, SOEs, relevant regulators, and labour unions

- Government commitment to structural reform

- Supportive fiscal policy

How does the SARB’s analysis stack up? Such analysis plays an important role in guiding expectations around monetary policy, and if SARB can achieve buy-in from other stakeholders, support low-cost transition to a lower policy target.

The credibility of SARB’s analysis hinges on whether its assumptions around how quickly inflation expectations would re-anchor to a lower target are realistic. We have suggested that inflation expectations are more backward-looking than SARB assumes. If SARB is mistaken with this assumption, nominal interest rates would need to remain higher than under a 4.5% target, not lower as SARB assumes.

It is also worth mentioning that the paper’s estimates are conditioned on an optimistic outlook for fiscal policy, with a debt service cost projection that moves in the opposite direction to those from Budget 3.0.

This is to say that SARB’s estimates reflect what a best case scenario for the transition would look like, not the most likely transition path.

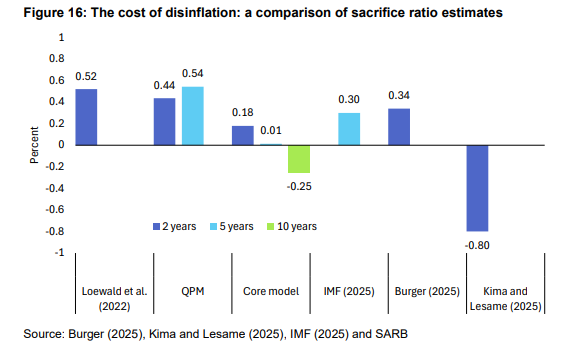

As SARB’s analysis acknowledges, there are as many estimates of the sacrifice ratio (that captures the extent to which lower inflation requires the sacrifice of output) as there are economists that have estimated it. SARB’s estimate range between zero to 0.5% of GDP. We argue that there is enormous uncertainty around that judgement.

Analysts will closely track how inflation expectations, price and wage setting dynamics and fiscal policy evolve to assess whether SARB’s assumptions are reasonable and therefore the adjustment path it has laid out is likely to bear out.