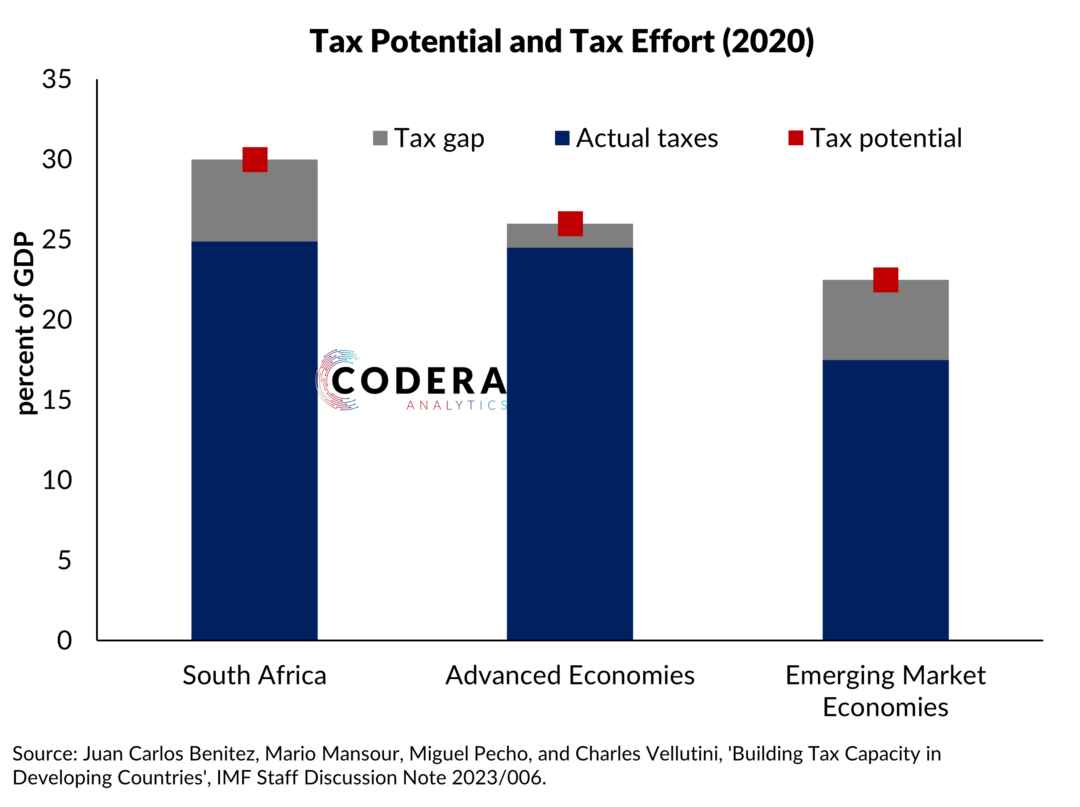

South Africa’s tax burden has been steadily rising, driven by an increase in the personal income tax burden. We showed in an earlier post that the Laffer curve is kicking in, with higher taxes not raising as much increased revenues. A reduction in the statutory corporate tax rate over the last two decades has seen the average tax rate paid by companies decline over time (see here for a distributional assessment), though the real value of company tax receipts have held up. The value added tax (VAT) rate was raised to 15% in 2018/19 and receipts have held up, both in real terms and relative to GDP.

As pressure on public finances grows, the increasing reliance on these taxes raises concerns about the impact on households, businesses, and economic growth.

Compiled by Sinead Morrow