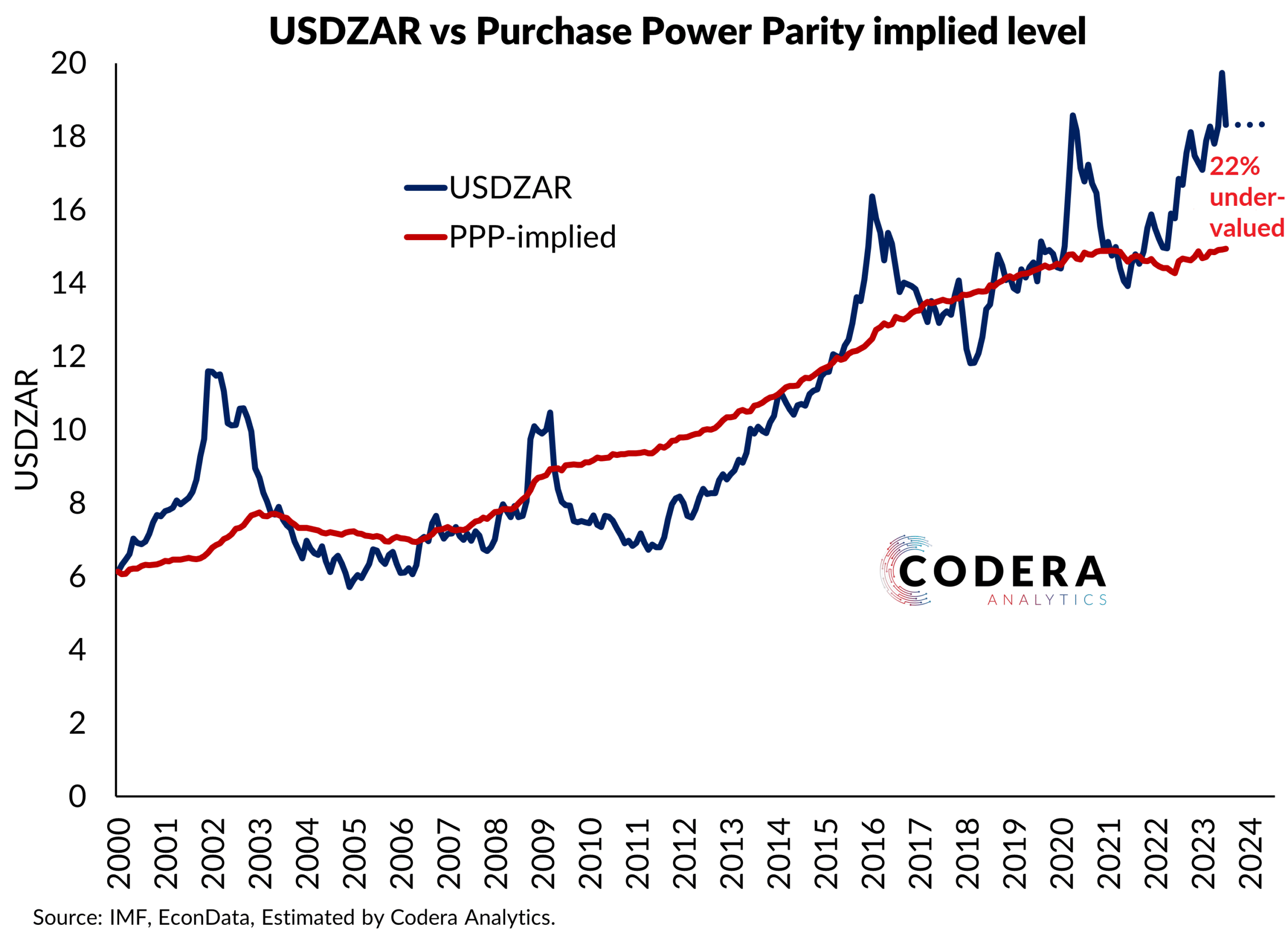

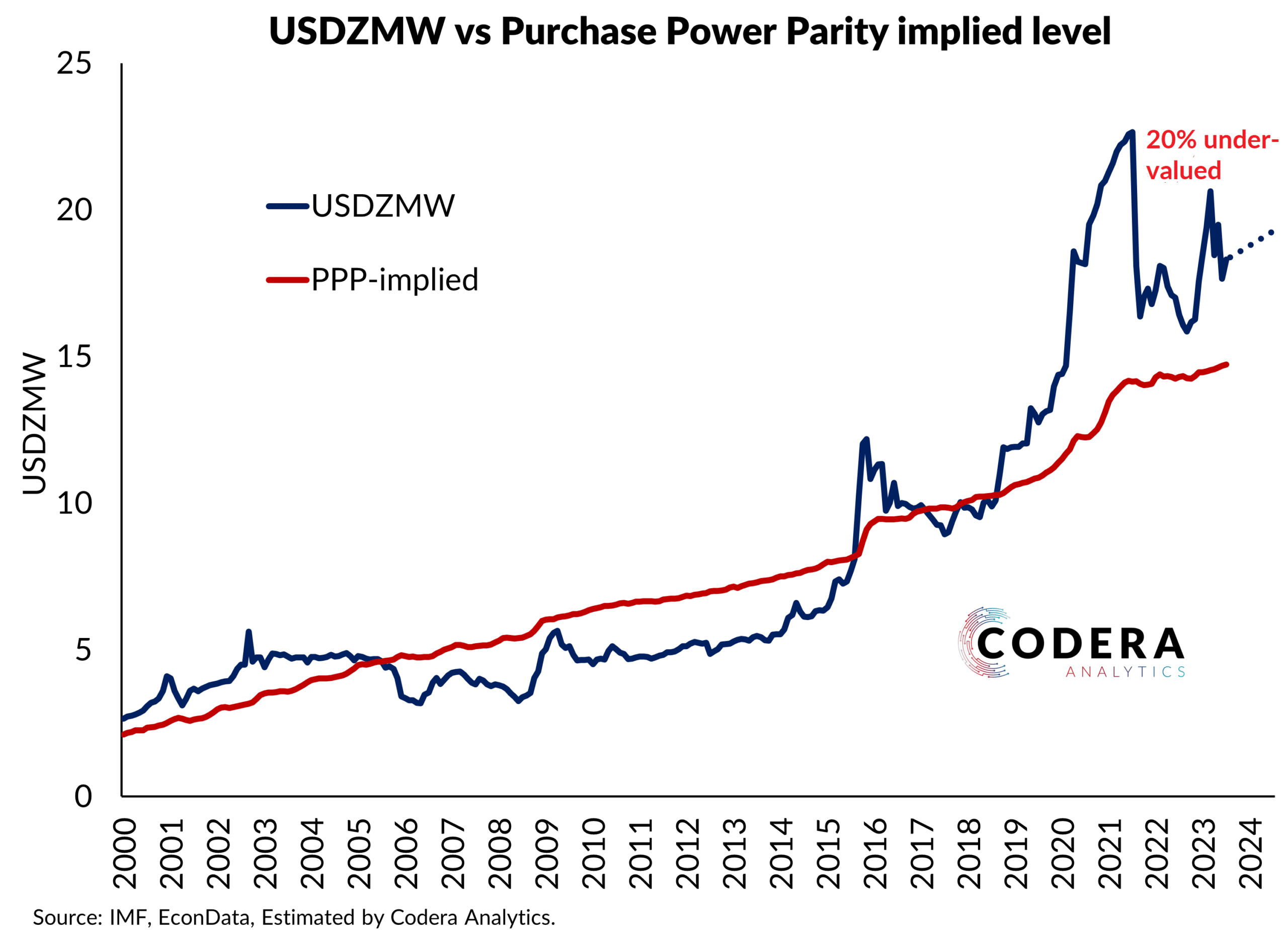

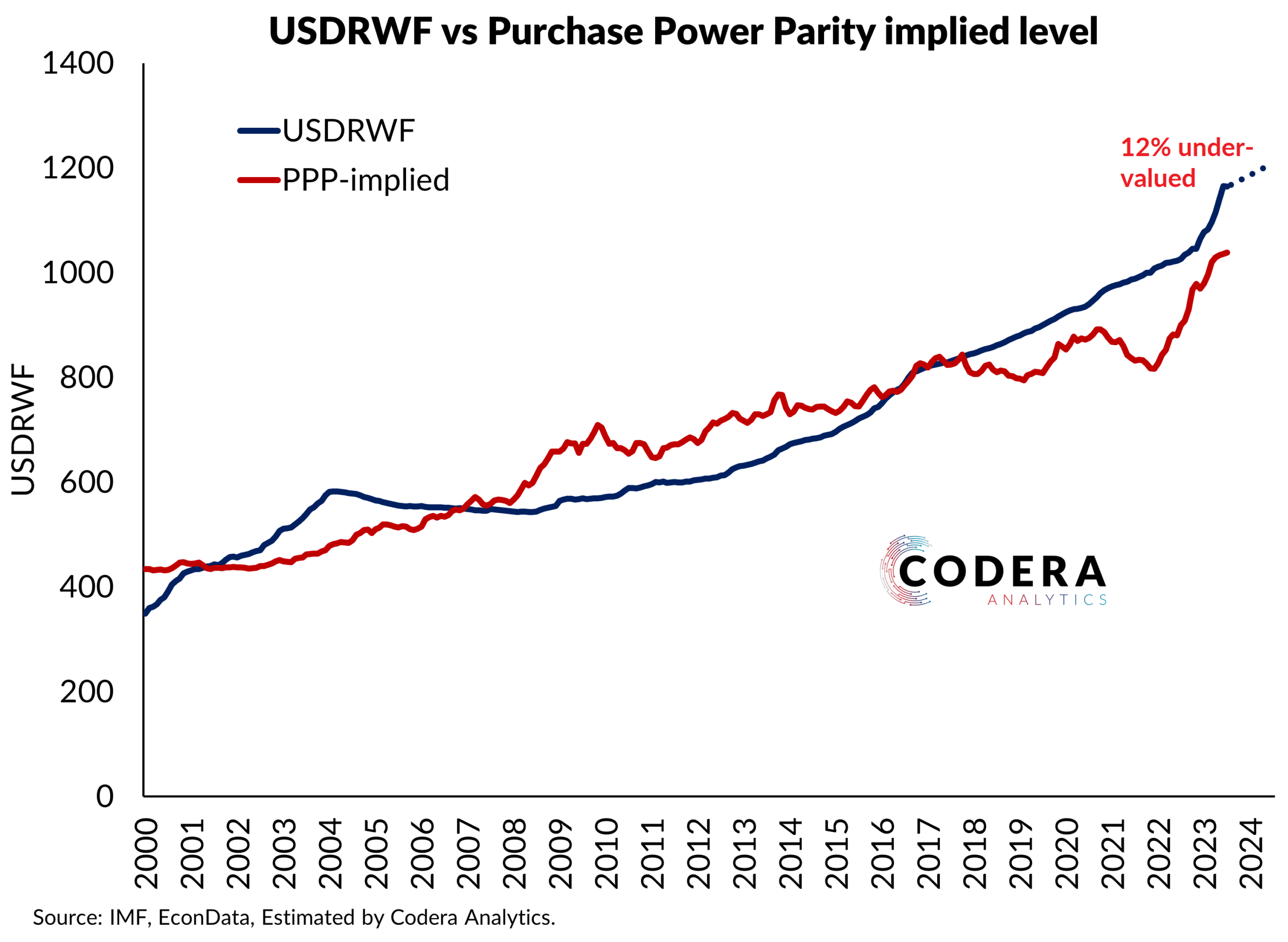

In this post, I show what relative prices would imply for the future value of selected African currencies based on a simple purchasing power parity (PPP) model using IMF CPI data.

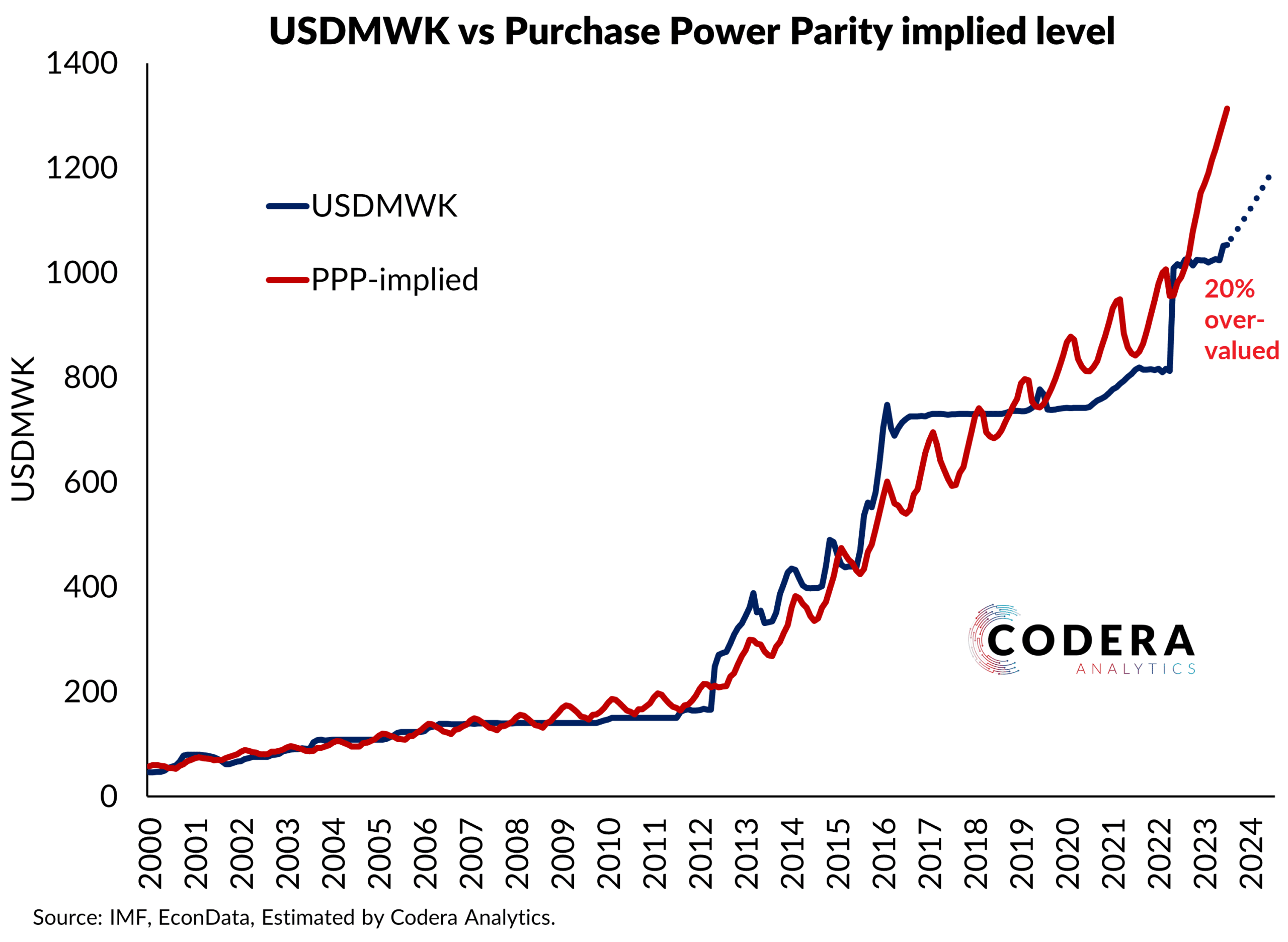

The South African rand (and the Eswatini lilangeni which is pegged to the rand) is more than 20% undervalued compared to relative prices against the USD, while the Zambian Kwacha’s deviation from PPP is around 40%. The Malawian Kwacha is still over-valued on this basis (at almost 20%) even after the 25% devaluation in May 2022 by the Reserve Bank of Malawi.

It is important to note that simple PPP models struggle to detect mean reversion in exchange rates and so typically provide poor forecasts even over a period out to a year as illustrated in this post. For this reason, forecasting models generally incorporate other explanatory factors that can explain deviations from PPP.

Footnote

Malawi’s inflation data appears to have residual seasonality.