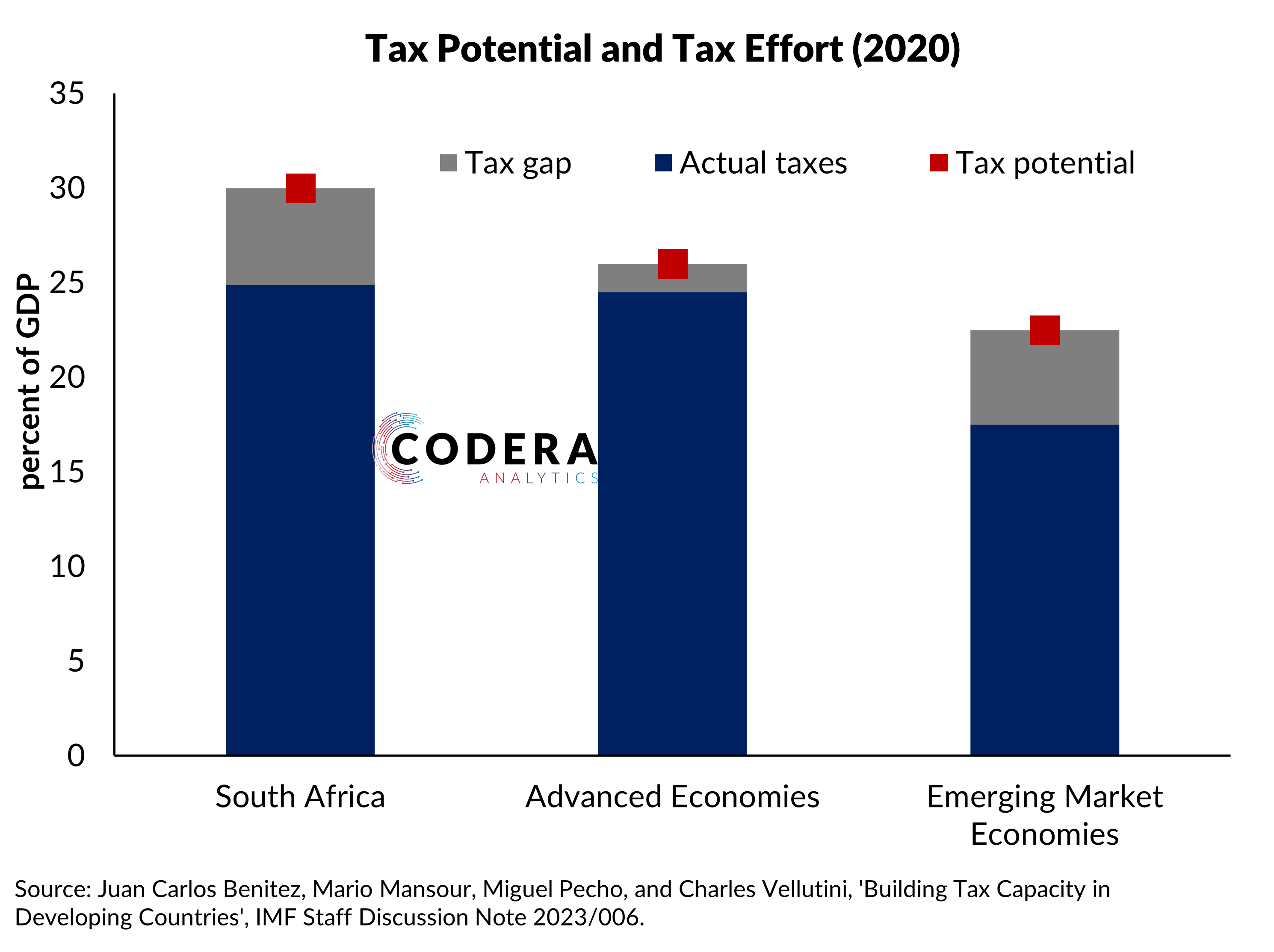

A recent IMF note suggests that it might be feasible for South Africa to raise the tax-to-GDP ratio by as much as 5 percentage points through tax system reform and institutional capacity building. The note estimates the ‘potential tax’ for each country as the highest observed level controlling for country characteristics including GDP per capita, the size of the agriculture sector, and government effectiveness and the perception of

corruption in the public sector. ‘Tax effort’ is the ratio of the observed level of tax collection over the tax potential, so a ratio below one implies higher tax revenues might be feasible. The note suggests that South Africa’s tax potential amounts to 30% of GDP, implying an average tax effort estimate of 0.83. By comparison, advanced economies and emerging market economies have estimated tax potentials of 26% and 22.5% of GDP, implying tax effort of 0.94 and 0.78. The implications are that South Africa might be able to increase tax revenues if the tax base can be broadened, compliance and enforcement improved, VAT exemptions reduced and other tax reforms enacted. Its worth emphasizing that different approaches yield dramatically different potential tax estimates. This ERSA paper suggests SA has a potential tax ratio of 55% of GDP, well over double our current level!