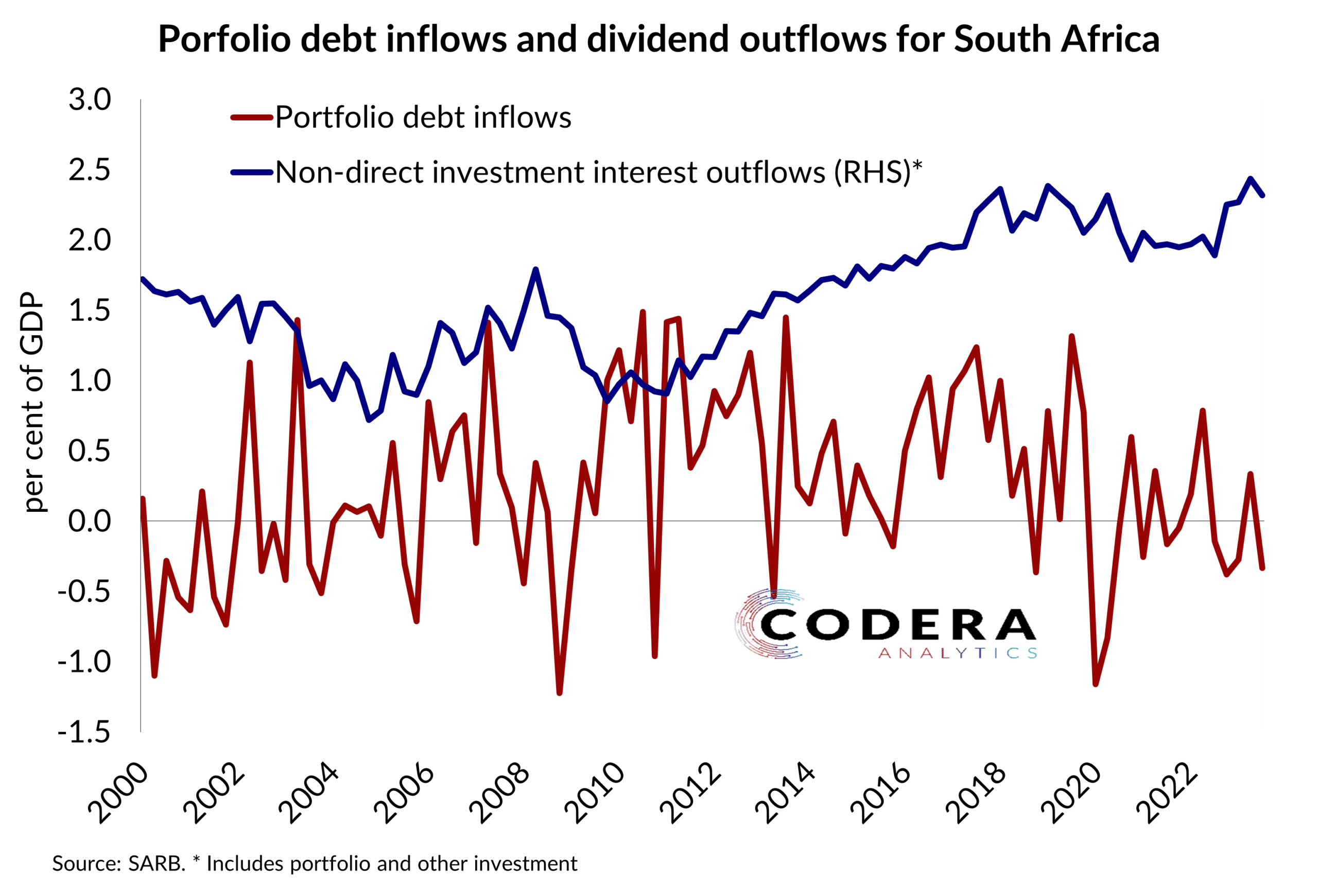

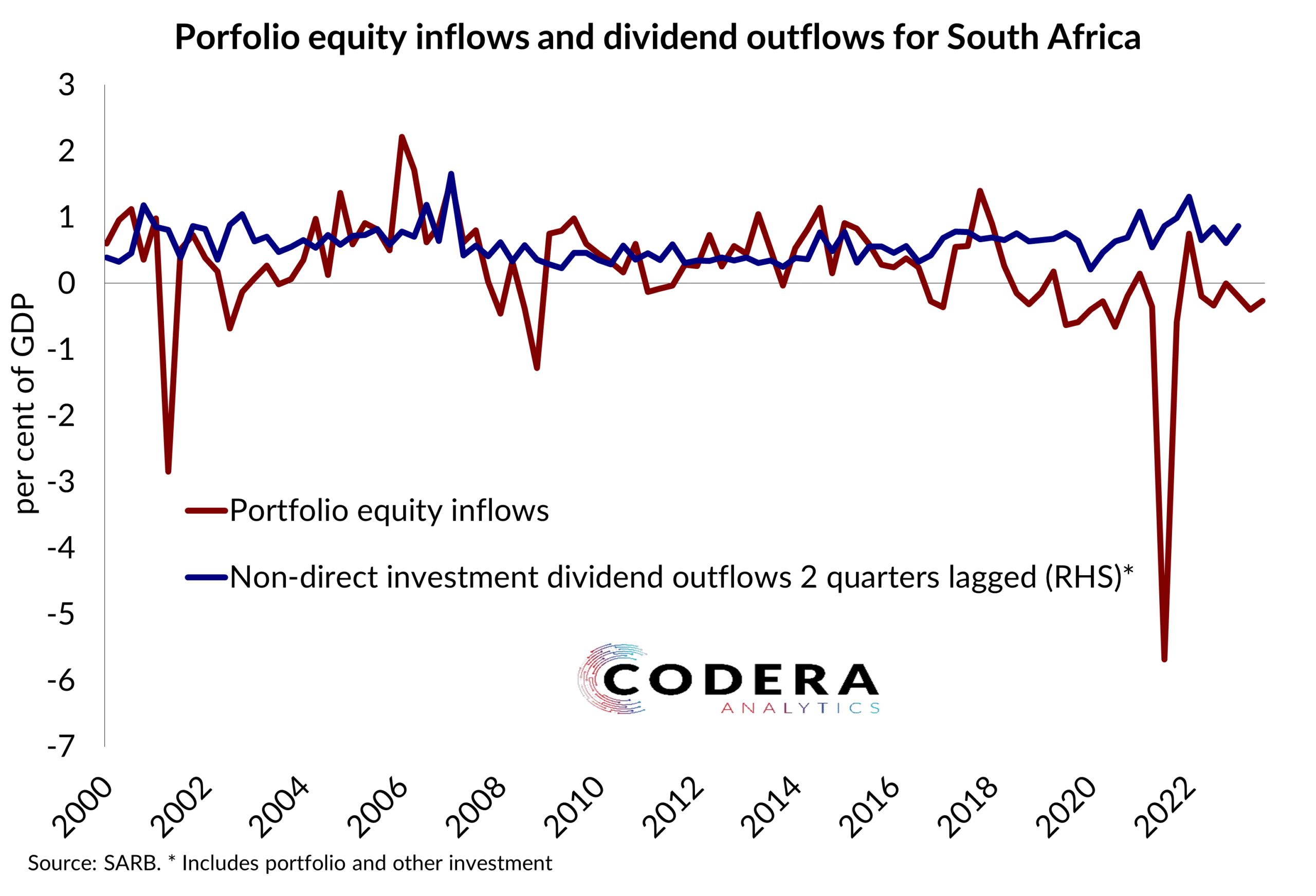

Something that is not generally appreciated about relying on foreign savings to finance South Africa’s persistent current account deficit is that this implies growing claims on the income of South African assets. Today’s charts shows that periods of higher inflows (with stocks of portfolio equity liabilities rising) have tended to see higher outflows of dividend payments. There has been net outflows for most of the period since 2018Q3, with a particularly large net outflow of portfolio equity investment in 2021Q3. Rising portfolio debt levels and borrowing costs have also been interest payments rise on non-direct debt.