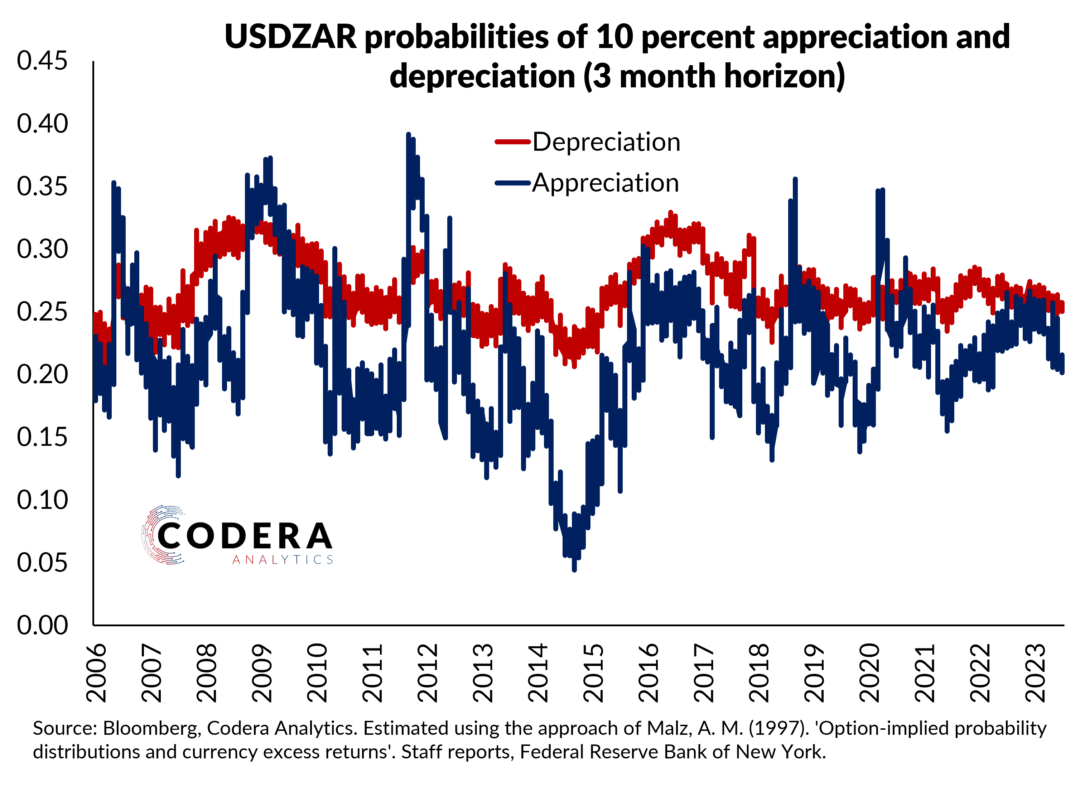

The risk of ZAR depreciation implied by options prices is relatively low at the moment. Risk reversal is measure of the risk that the ZAR could move in a particular direction. A positive risk reversal value indicates that the market has always priced a greater risk of depreciation than appreciation into currency options. Viewing the ZAR as a risky currency, market participants tend to take out insurance against ZAR depreciation using FX options.