Today’s post estimates the cost of bank equity capital in South Africa. I show that there has been a decline in the banking sector’s equity-to-asset ratio over recent year, an increase in the equity risk premium and a concomitant rise in the cost of bank equity. I then discuss the implications of banking regulations aimed at raising bank capital levels for funding costs, lending and financial stability.

Banks fund their loans to consumers and firms from various sources, including retail and corporate wholesale deposits and debt instruments. Our funding cost proxy suggests that bank funding costs have been rising over the last two years as these sources have become more expensive. Though not a regular source of bank funding, banks can also use their capital base to fund loans. Their capital base comprises owners’ equity and accumulated profits. But because prudential policy assigns higher risk-weights for regulatory capital to certain forms of bank lending, the cost of equity capital tends to matter more for more risky forms of lending (such as business loans). While bank equity capital is not interest bearing like our funding sources, providers of equity (i.e. bank shareholders) do have an implicit required rate of return, and this is typically thought to be higher than the cost of other forms of funding. As a result, banks tend to change their lending rates to maintain target levels of returns to equity if their funding costs change. But there is also a relationship between equity costs and other funding costs, since higher equity levels could reduce bank credit risk and therefore lower debt funding costs.

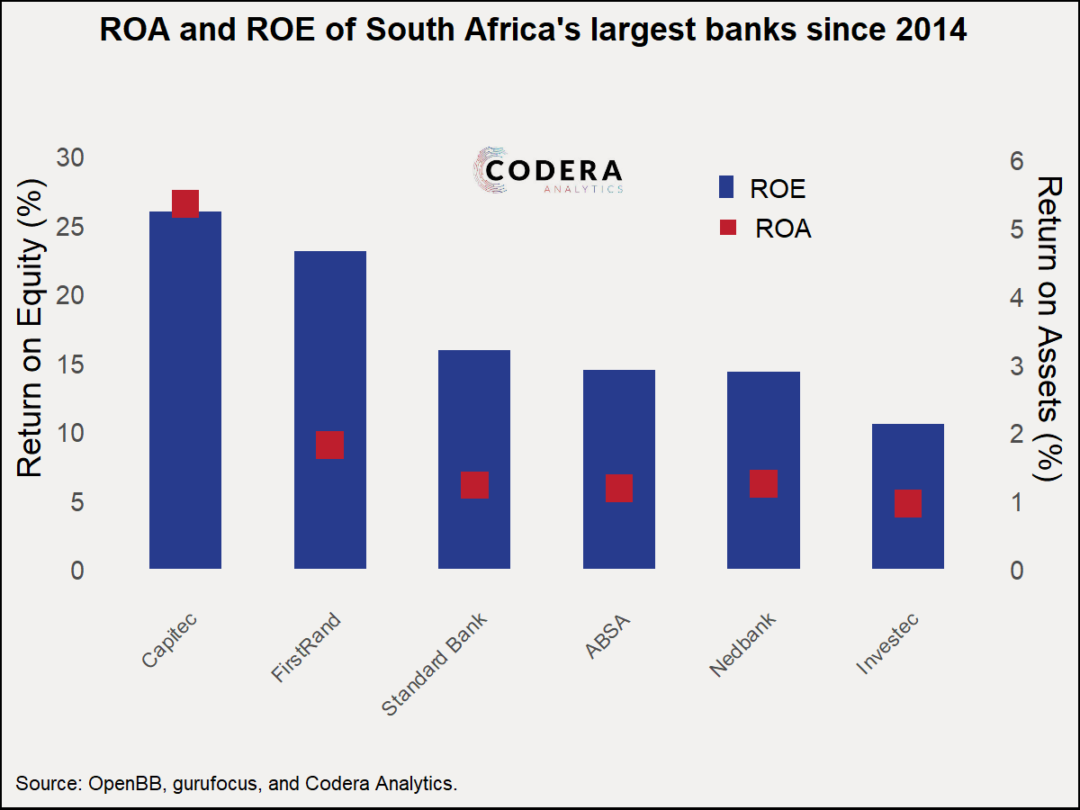

South African bank equity (and prudential capital ratios) rose to meet higher banking regulation capital requirements with the introduction of Basel III regulatory reforms after the global financial crisis. We observe that since then, the bank equity to asset ratio of the banking sector has declined.

What might prudential regulations aimed at raising equity levels have meant for the economy more generally? It is not clear a priori what the impacts of higher bank capital requirements would be for the cost of equity, the cost/volume of credit extension or funding costs. For example, higher bank capital levels increase shareholders ‘skin in the game’ and so may discipline against excessive risk taking and therefore could strengthen perceptions of banks’ financial position. On the other hand, higher mandatory capital requirements may see adjustments through bank assets instead, which could reduce credit extension. The cost of equity estimates presented are substantially higher than our weighted bank funding cost estimates, suggesting that if prudential regulations raised equity levels, they likely raised the cost of credit and reduced the supply of bank credit at the margin.