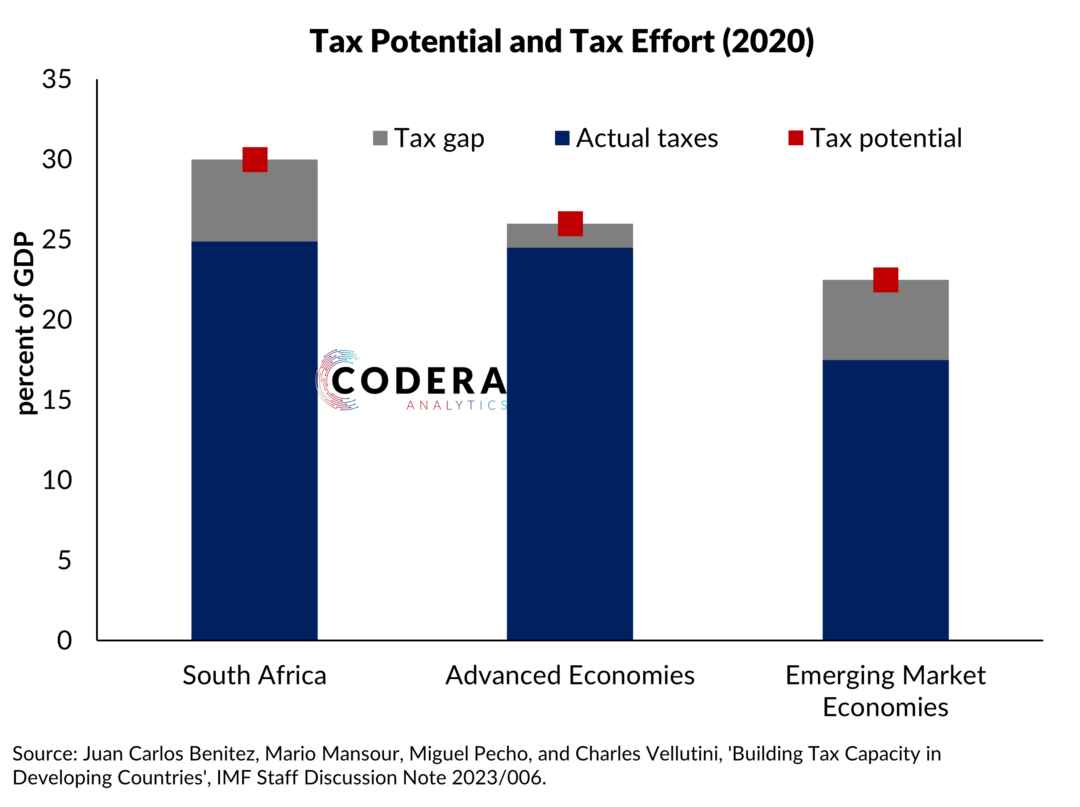

How do tax revenues respond to changes in tax rates? In a South African context, policymakers need to know the answer to this question if National Treasury is to understand how it could use tax settings to close the budget deficit or fund new programmes such as National Health Insurance. Given South Africa’s already relatively high tax rates, would further increases in taxes on the wealthy raise revenues?

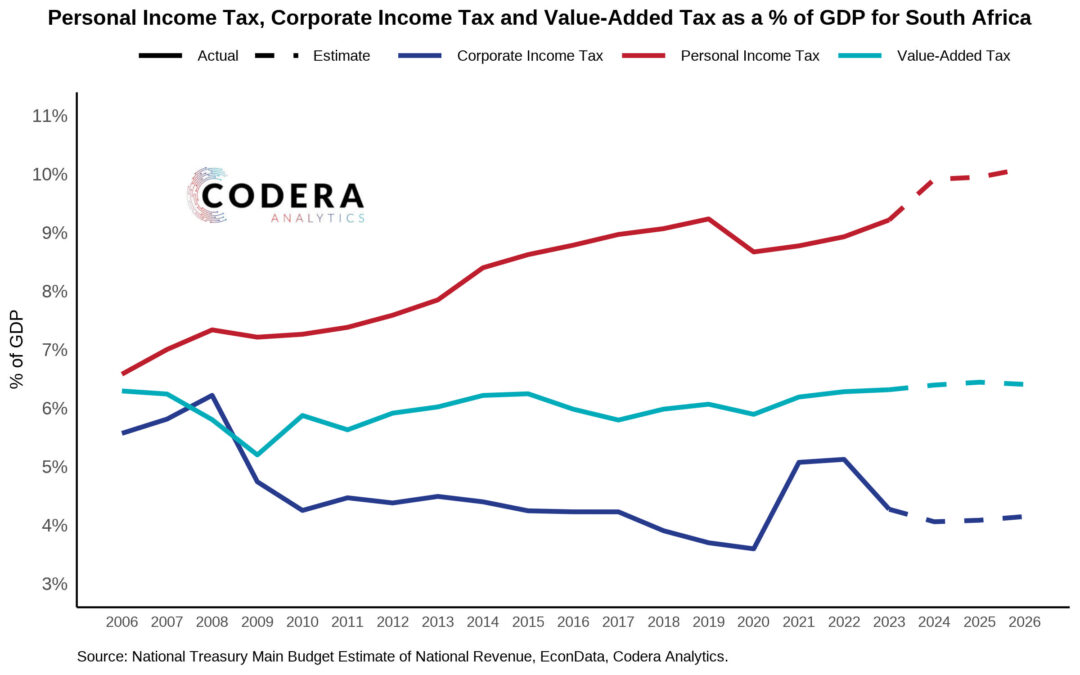

In an earlier post we showed that, despite higher average tax rates for some tax brackets in South Africa, personal tax revenue increased between 2013 and 2019. While our post described how aggregate revenue and average tax rates have changed over recent years, one cannot draw causal inference about the effects of tax rate changes on tax revenues from our calculations as we did not control for changes in income and their drivers. What has been observed might just have reflected expansion of the tax base over time, lags in responses by firms and taxpayers to tax changes, improved tax compliance or increased effectiveness of enforcement by SARS.

A new SA-TIED paper addresses the question of how taxpayers have responded to tax changes in South Africa. Specifically, the paper draws on administrative data to study how an increase in the top marginal tax rate affected taxpayer behaviour. In response to the increase in the top marginal tax rate from 41% to 45% (which applies to around 0.6% of all income earners), taxpayers earned less and, despite legislative attempts to limit tax avoidance, shifted their income to reduce their tax burden, and decreased their reported investment income. The paper links personal income tax information to firm information and presents evidence that tax increases also reduced firm output.

What are the policy implications of the paper? One is that South Africa is already beyond the point where raising tax rates further would see higher revenues and instead see revenues decline. Another is that it is important for policymakers to take the macroeconomic consequences of tax changes into account, as tax increases can reduce labour supply from highly productive members of society, or reduce their investment in economy. This is something proponents of tax increases to fund new government programmes often disregard in their assumptions.