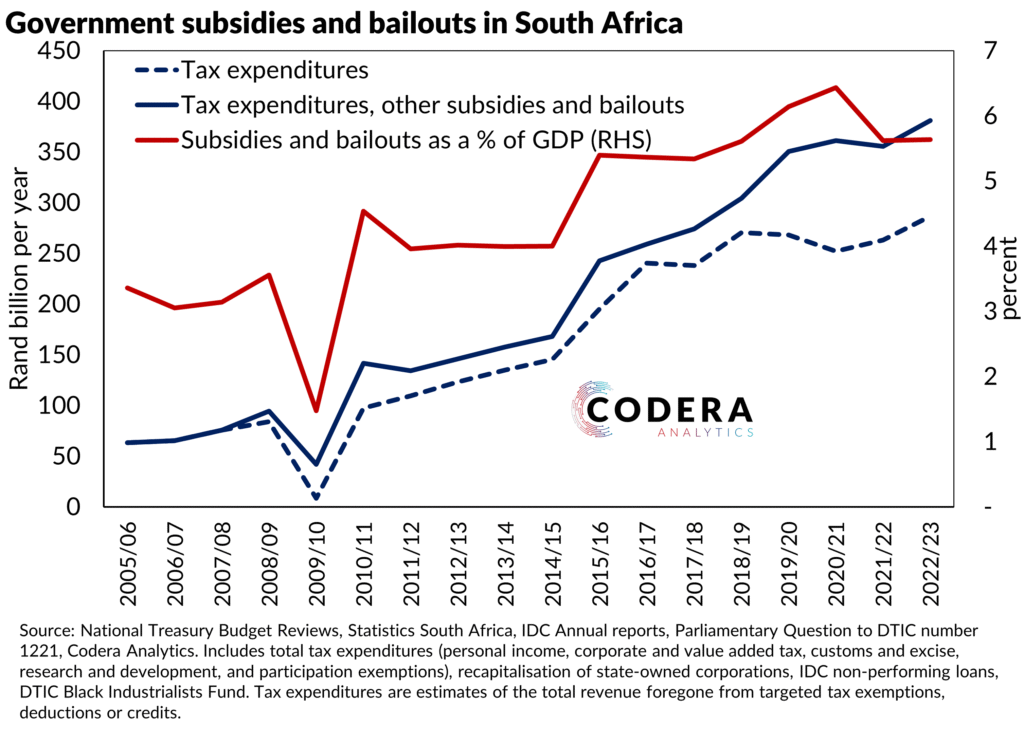

A large proportion of public spending is being directed at subsidies and support for state owned enterprises. Between 2008/09 and 2022/23, tax expenditures have totaled R2.7 trillion and recapitalisation of state owned corporations has totaled around R390 billion. To avoid possible double counting, the chart does not include explicit government subsidies and incentives, which have totaled over R450 billion over the same period. IDC non-performing loans have averaged between R20 and R30 billion every year and do not make a large impact on the aggregate figure in the chart. To give a sense of perspective, total subsidies and bailouts exceed 50% of GDP when you cumulate spending since 2010.

As we showed in earlier posts, a large proportion of this is tax expenditures (equivalent to almost 5% of GDP or around 20% of government revenue), which is high by international standards. Tax expenditures include things like tax incentives for firms, tax deductibility for saving by households, or tax relief on certain consumer goods.