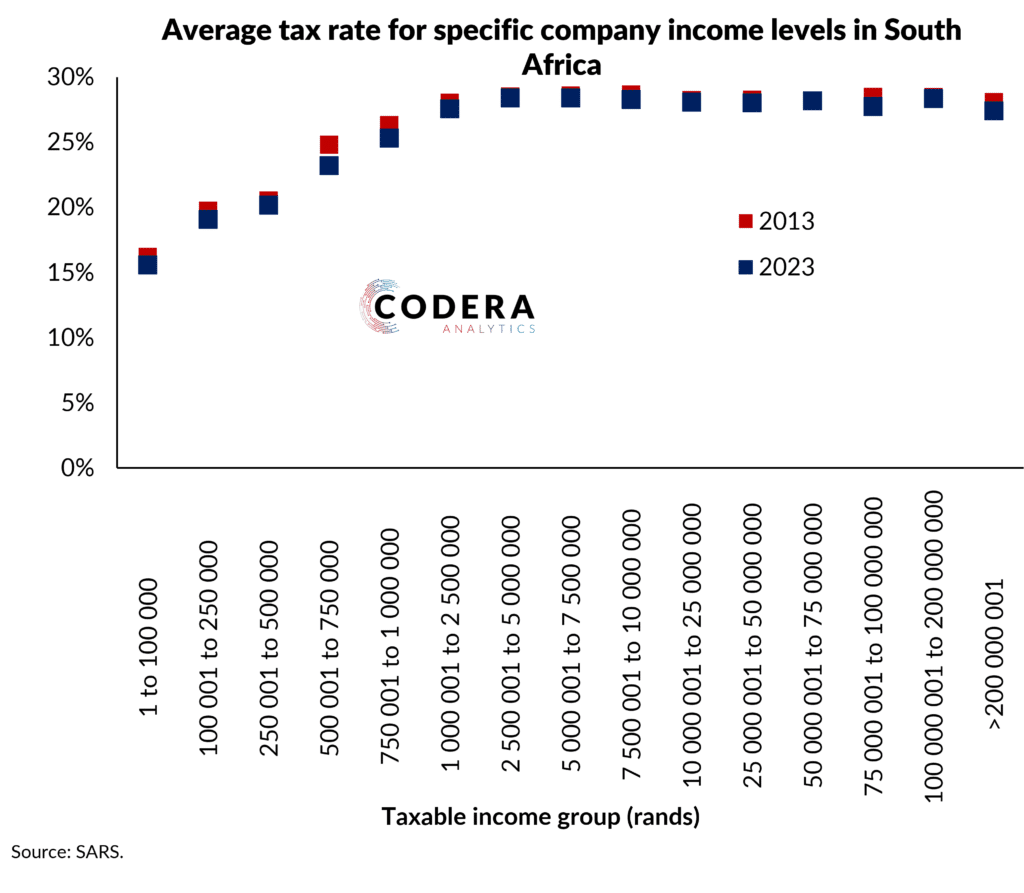

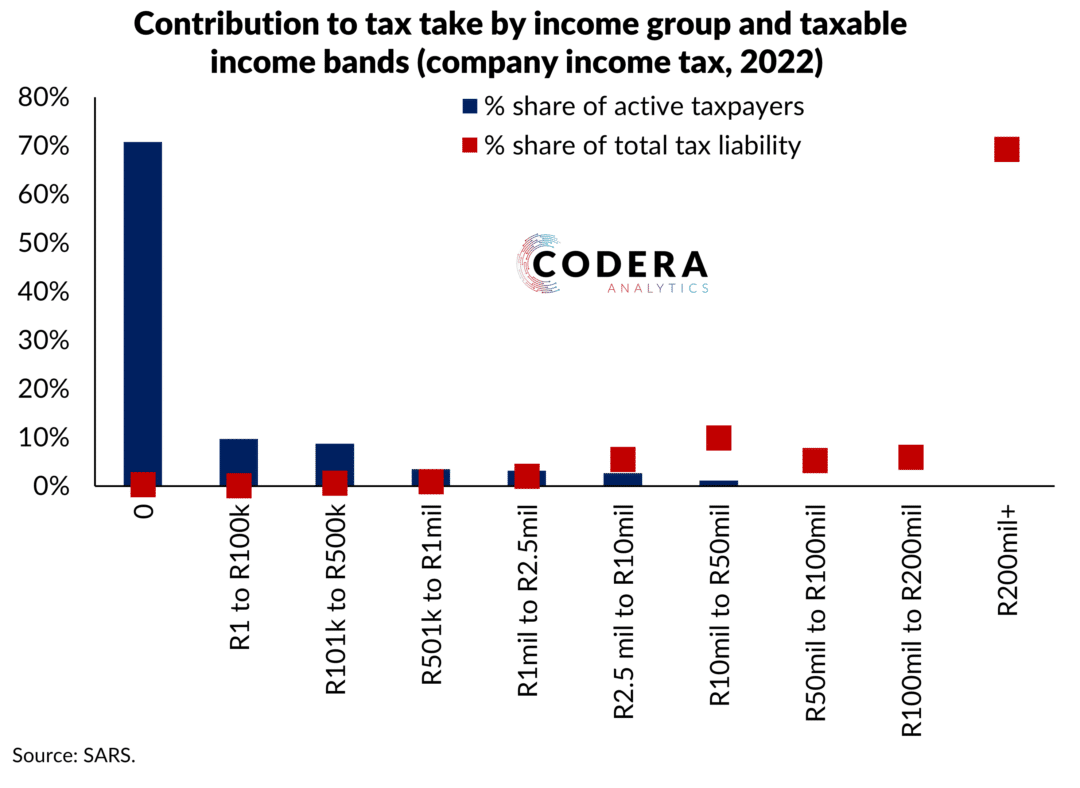

South Africa’s company tax regime is less progressive than its personal income tax system. Companies are taxed at a flat 16% on their first rand of taxable income, with a significant increase in the average tax rate as taxable income approaches R500,000, after which the rate levels off at 28% (which declined to 27% after April 2024). Despite potential inflation-related distortions, SARS data indicates a slight decline in company tax rates at lower income levels between 2013 and 2023. These figures highlight South Africa’s reliance on a small number of large corporate taxpayers. Companies earning over R200 million in taxable income (around 500 companies) contributed almost 70% of the total company tax take in South Africa in 2023. While global comparisons of average tax rates are not easily available, South Africa’s corporate tax rate remains relatively high by international standards.