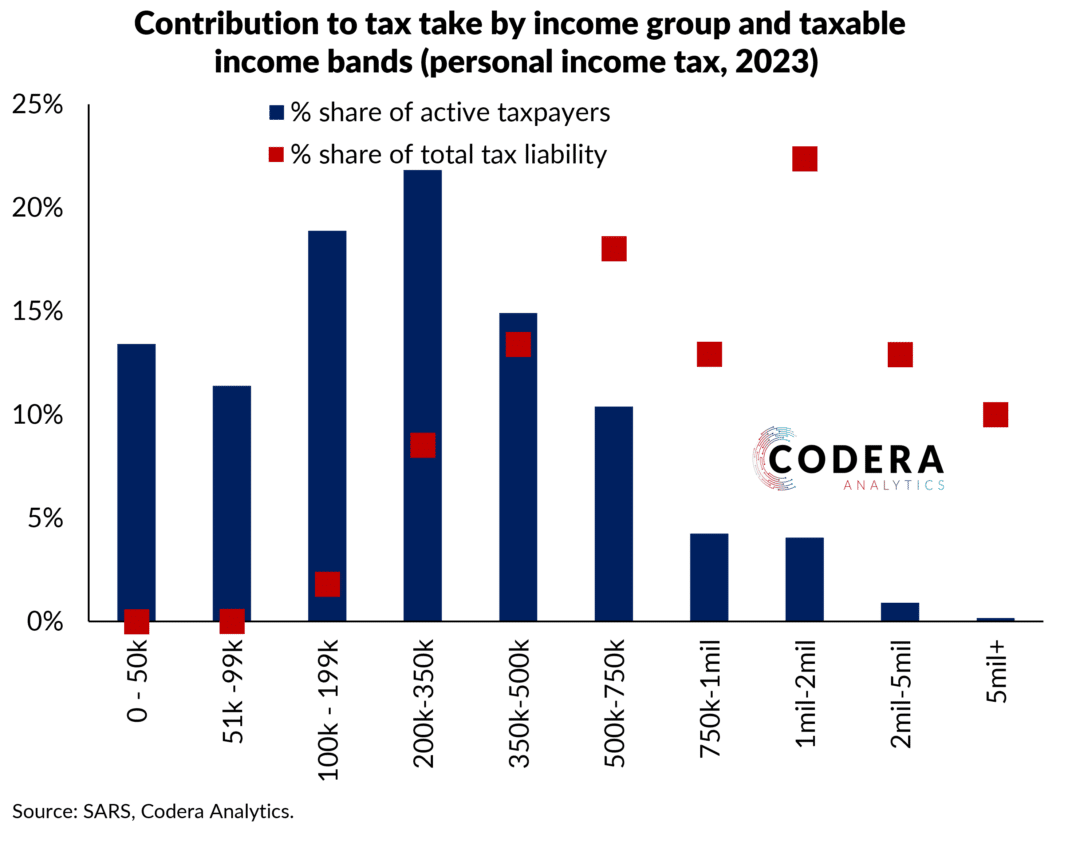

Something that many do not fully appreciate is how concentrated the corporate sector in South Africa is, and consequently how dependent South Africa is on the tax contributions of high earners. In a previous post, we showed that roughly 100 000 people (around 0.7% of taxpayers) who earn over R1.5 million contribute over almost a quarter of the total personal income tax take. In the case of companies, the most recently published tax statistics show that companies with taxable income greater than R100 million (just over 700 companies) represented only 0.7% of taxpaying companies in 2020 but contributed over 65% of assessed tax. Most of this tax is however paid by a small sub-group of large companies with assessed taxable income over R200 million. The 2020 data shows almost 60% of the total assessed company tax was paid by only around 300 firms.

Footnote

It is also worth noting that the 2020 tax year was an exceptionally difficult year, with only 20% of assessed companies reporting positive taxable income, about a quarter reporting assessed losses, and the remaining half of companies reporting zero taxable income.