Codera has posted over 2000 blog posts, a large share of which involve significant data analysis or modelling. We are passionate about democratising data and analytics, and our posts provide insights about industry and macroeconomic trends and contribute to public discussion about important policy issues. Below is a selection of our favourite blog posts since we launched almost four years ago:

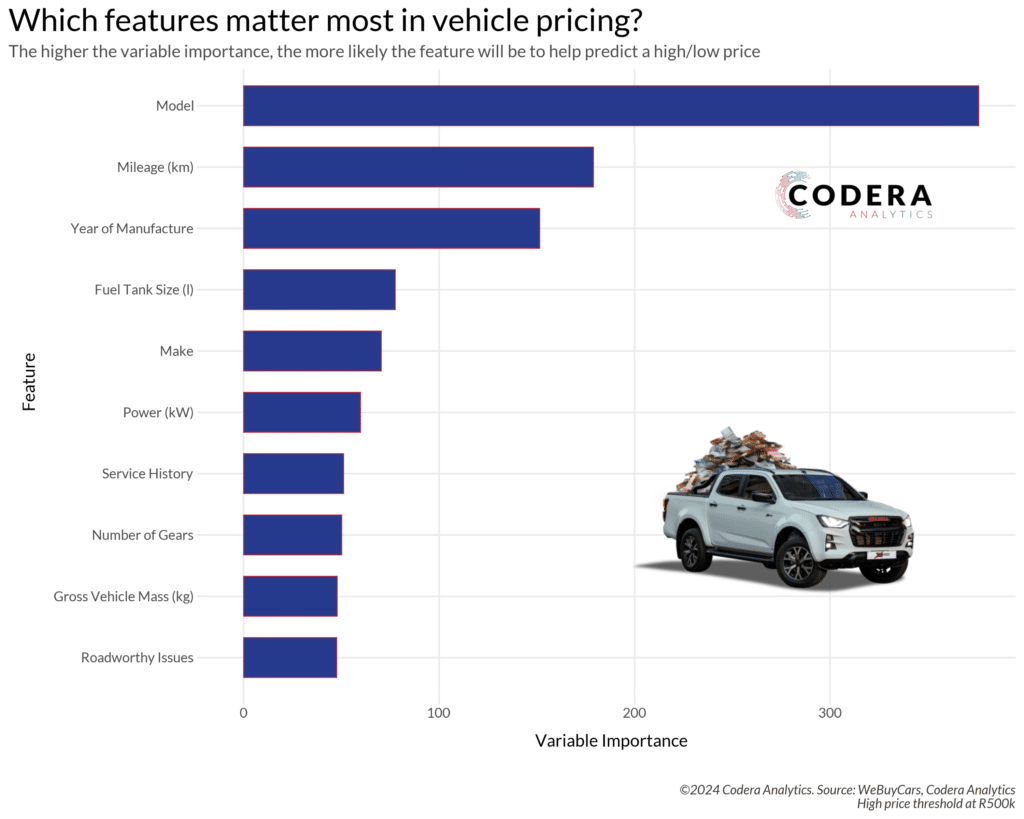

Which features matter most in vehicle pricing?

In this post, we use scraped data from WeBuyCars listings and use a machine learning model to identify the features that most significantly impact vehicle pricing. Read more

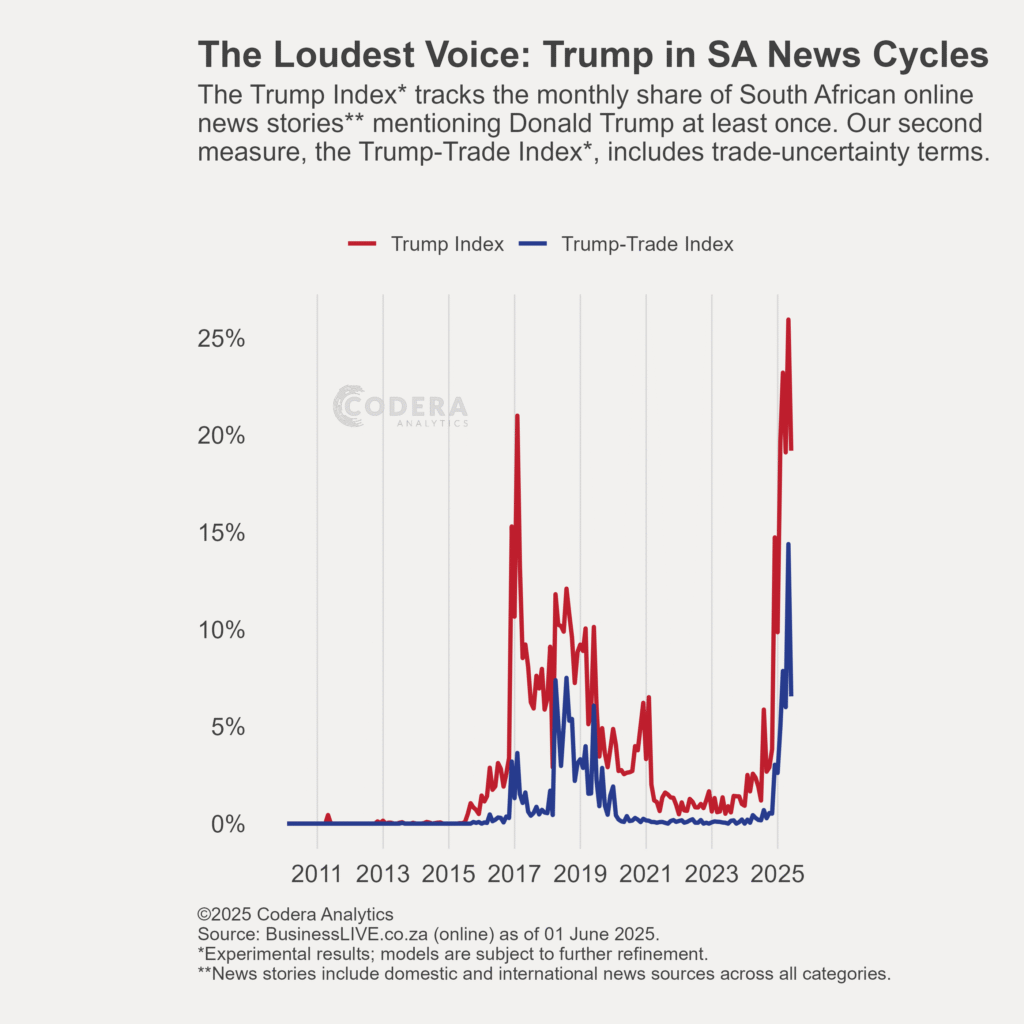

The Codera Trump Index

In this post, we construct a ‘Trump Index’ and ‘Trump-Trade Index’ to measure the frequency of mentions of US President Trump and the combination of ‘Trump’ and ‘Trade’ in the same South African and global news stories. Read more

Sheep vs population in selected countries

After peaking at over 22 in the early 1980s, New Zealand’s ratio of sheep to people has fallen below five to one. The ratio is below three to one in Australia and South Africa.

Estimates of the cost of load shedding in SA

What should AirBnB owners do to boost rents?

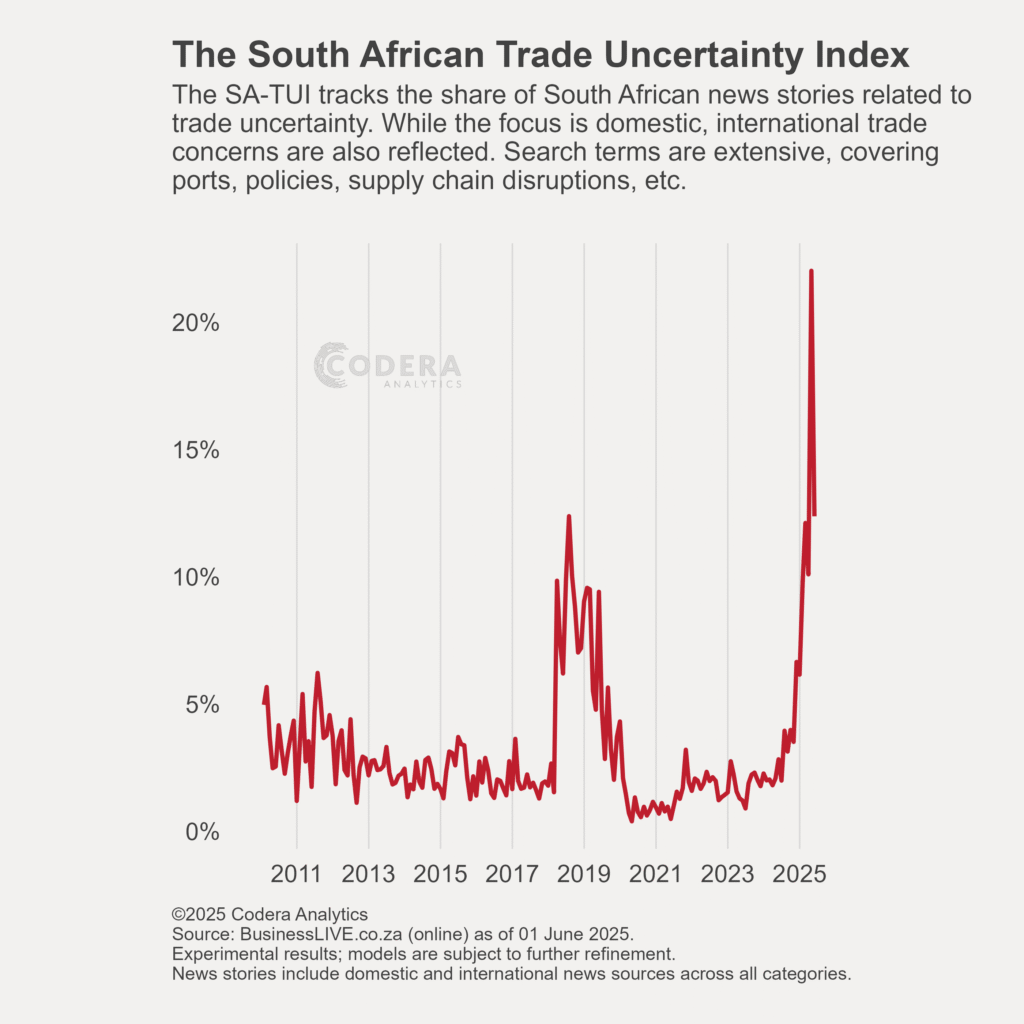

The Codera SA Trade Uncertainty Index

The South African Trade Uncertainty Index measures mentions of trade uncertainty in newspapers. Read more

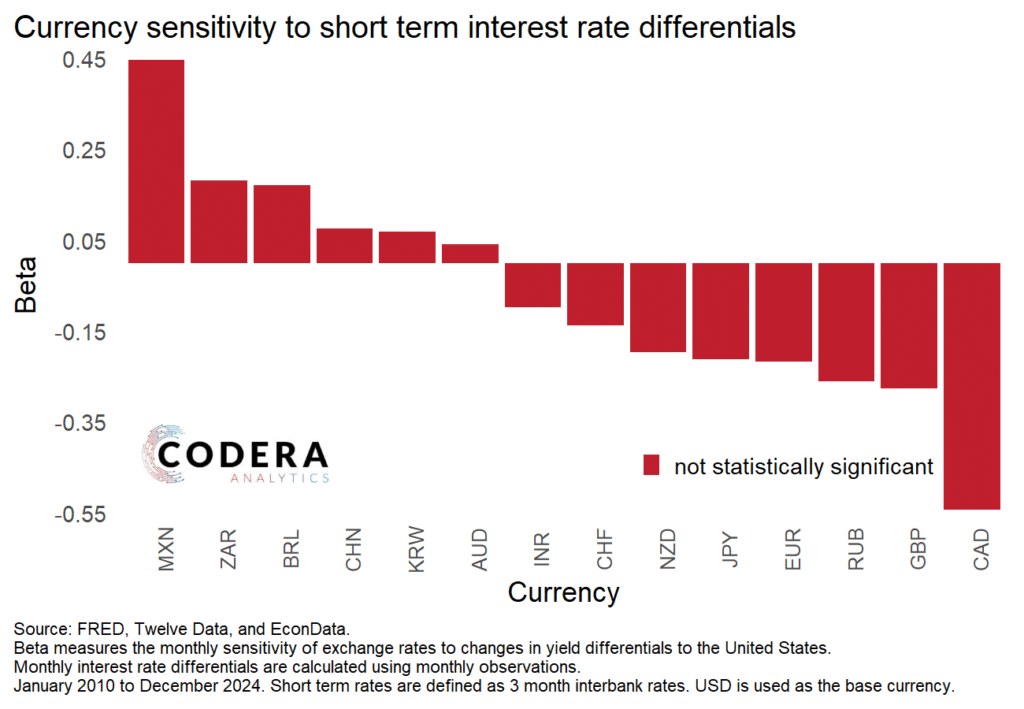

FX sensitivity to interest rate differentials

This post compares different currencies’ interest rate beta. Read more

Market-implied cost of bank equity and bank capital in SA

This post estimates the cost of bank equity capital in South Africa. Read more

Tax rates and revenues in SA

A key policy question is how tax revenues respond to changes in tax rates. This post presents a summary of historical developments in tax rates and taxation receipts over time for different forms of taxation in South Africa. Read more

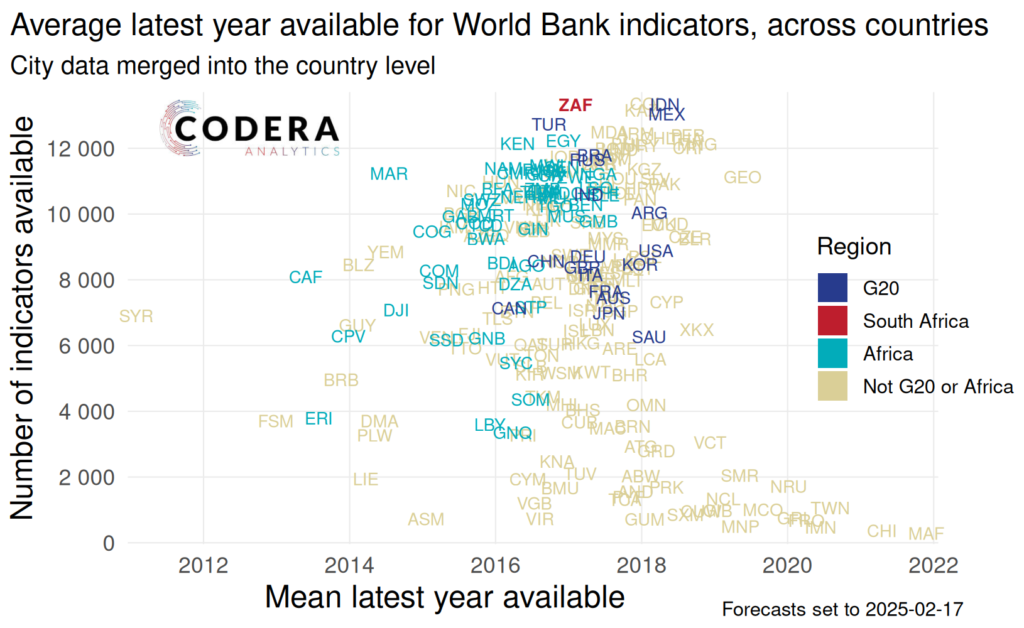

Measuring data availability by country

How does data availability compare across countries? The World Bank is a major source of country-level economic, financial and socioeconomic data. In this post, we summarise the number of data series available from the World Bank for different countries as a proxy for macroeconomic and social data availability. We update our earlier estimates, this time dropping missing values, and inspecting 100% of the available indicators, to provide a more accurate description of data availability. Read more

What drives the rand?

A challenge forecasters face is interpreting the drivers of model-based forecasts. In an exchange rate context, this can be particularly challenging given the volatility of currencies and the fact that currencies reflect changes in economic and financial fundamentals, as well as sentiment and expectations about the future. Fundamentals, sentiment and expectations are unobserved, so there is always uncertainty around whether

Read more

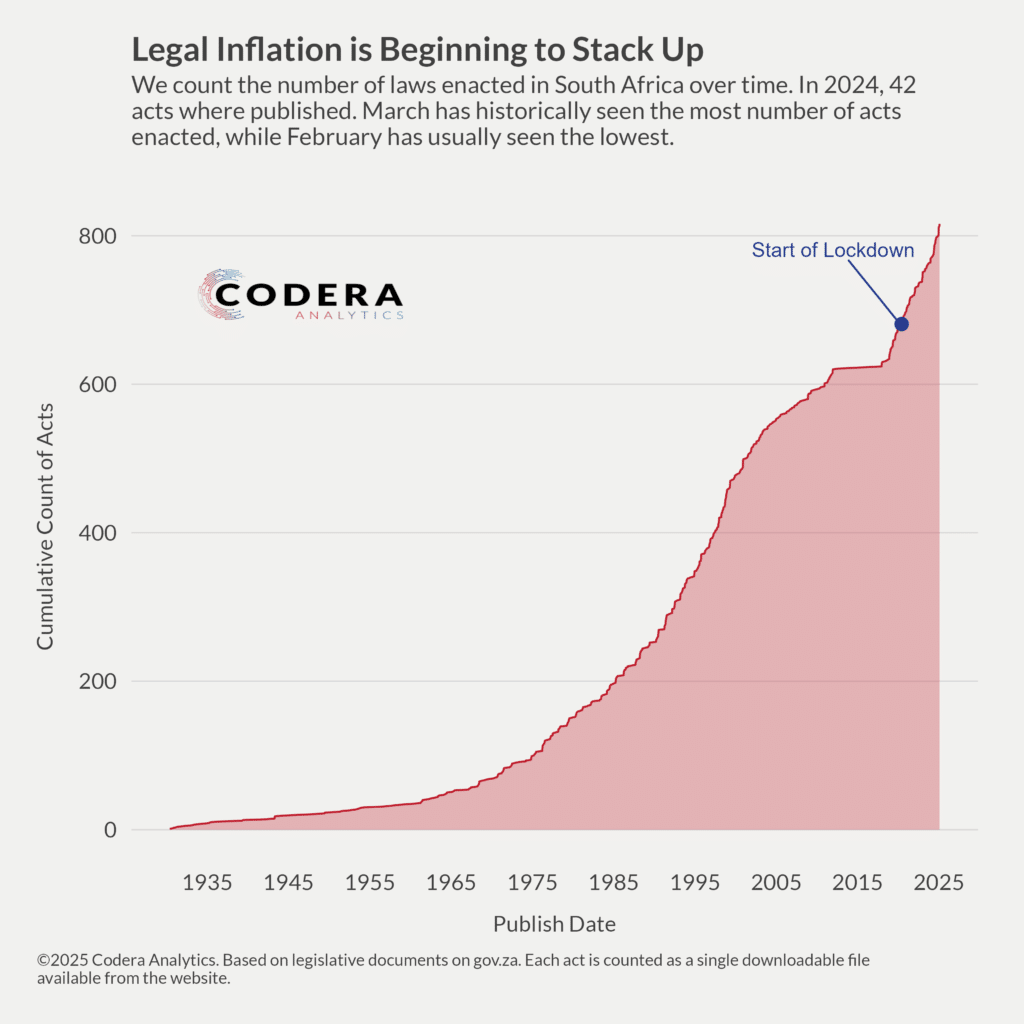

South African legislation over time

This post shows that the number of acts of legislation in South Africa has steadily increased over time. Read more

How does SA’s data ecosystem stack up internationally?

Here I repost my article published in the Business Day: How does South Africa’s data ecosystem stack up internationally? Data matter. Reliable and timely data are crucial for decision making. Data drives innovation and is an important source of value. In the public sector, data helps drive better development outcomes through evidence-based policies, and improved transparency and accountability. Estimates from … Read more

Estimating the costs of holding foreign reserves in SA

The Reserve Bank is responsible for managing South Africa’s foreign reserves. Among other things, South Africa invests in liquid foreign reserves to provide resources for dealing with external shocks. As the amount of reserves South Africa holds has risen over time, so has the implied holding cost of our reserves. Since our inflation tends to be higher than in our … Read more

Deposit and loan betas for large banks in SA

This post summarises how South African bank-level deposit and loan balances have changed with policy rate changes. Read more

Measuring fiscal slippage in SA

This post compares historical revenue and expenditure under/overshoots, comparing each budget year’s projection for the next fiscal year to outcomes from the historical data provided in the May 2025 Budget Review. Read more

FX Hedge Ratios

This post estimates FX hedge ratios for selected major currencies. Read more

Patents and Productivity in SA

In this Business Day article we discuss why there is no correlation between patents and productivity in SA. Read more

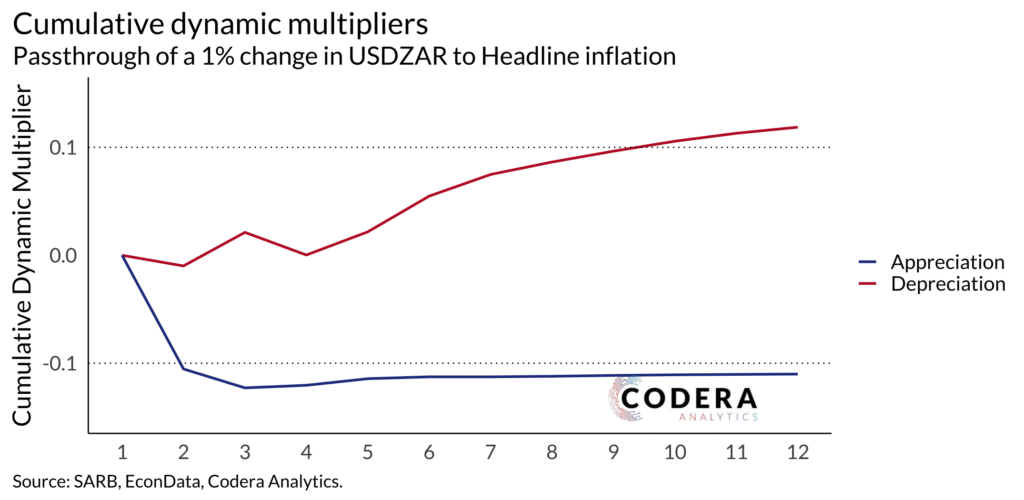

Exchange rate pass-through in South Africa

In this Policy Brief we estimate exchange rate pass-through in South Africa using a non-linear cointegration approach.

Options-implied expectation for ZAR

This post demos Codera’s estimates of FX option-implied market expectations. Read more

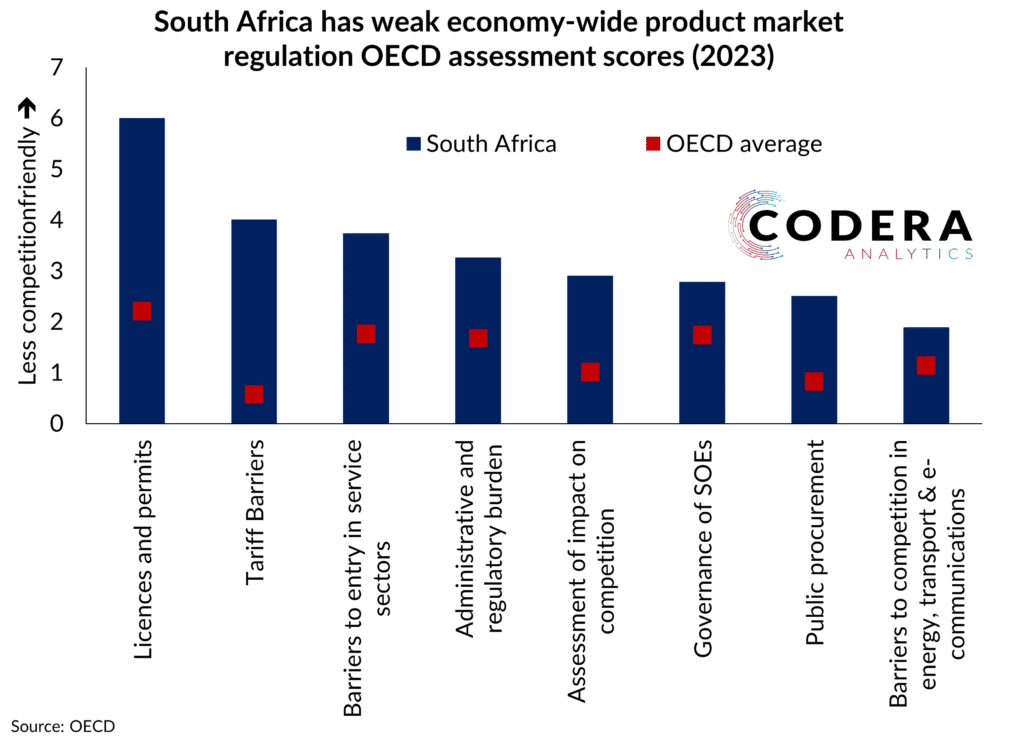

Why is it hard to start a business in SA?

In this Business Day article we presents data on why SA is ranked near the bottom globally in terms of our entrepreneurship rate and argues that the root cause of our economic stagnation is a culture of interventionism. Read more

How to drive return on equity in SA banks

This slidepack discusses banking profitability, implications of shifts in payments landscape and how SA banks can boost their ROE. Read more

Forecasting economic downturns in South

Africa using leading indicators and machine

learning

In this Policy Paper we show that using a large number of indicators produces substantially better business cycle predictions, especially when using machine learning techniques. Read more

Gaps in the South African inflation targeting debate

This paper presents a primer on assessing South Africa’s optimal inflation target and the implications of the economy’s structural characteristics for the conduct of monetary policy. To help advance the debate about South Africa’s inflation target, the paper discusses five unresolved questions around South Africa’s inflation targeting framework. Read more

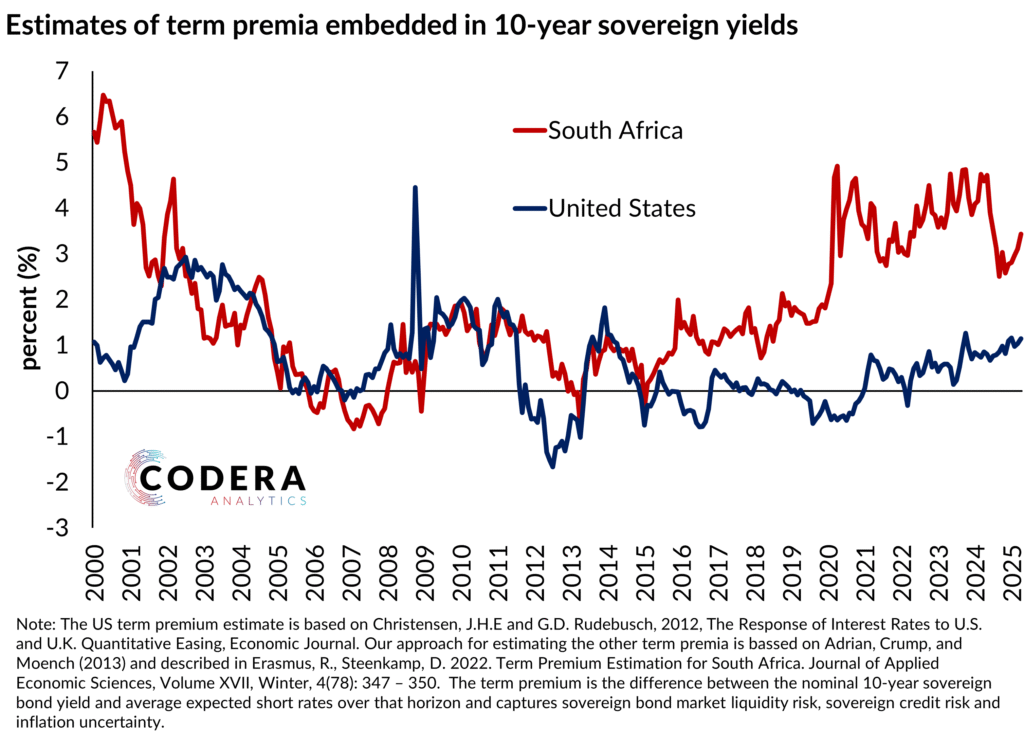

SA’s term premium on the rise

Our model implies that South Africa’s term premium is higher than in many other emerging markets. Read more

ZAR misalignment based on a Bayesian Threshold VECM

This post assesses whether the rand has been misaligned relative to its economic fundamentals compared to the dollar. Read more

Beef and sheep livestock yields in SA vs selected economies

SA’s beef yields are similar to other major producers, while sheep yields are particularly high by major producer standards, second only to Japan. Read more

What would an optimal SARB equity transfer approach look like?

This post discussions reform options for the way SA’s foreign exchange reserves are managed by SARB. Read more

Which central banks are the largest in relative terms?

This post shows that the South African Reserve Bank’s budget is large relative to advanced economy central banks, but it does not stand out in terms of its total number of employees. Read more

Historical CPI weights 1970 vs current in SA

Historical CPI weights back to 1970 are now available on our EconData platform to premium enterprise subscribers. As far as we are aware, EconData is only source of these historical weights. This post shows that the most significant shift between the regimes of 1970–2000 and 2008–2019 is the increase in the Miscellaneous Goods and Services category weight. Read more