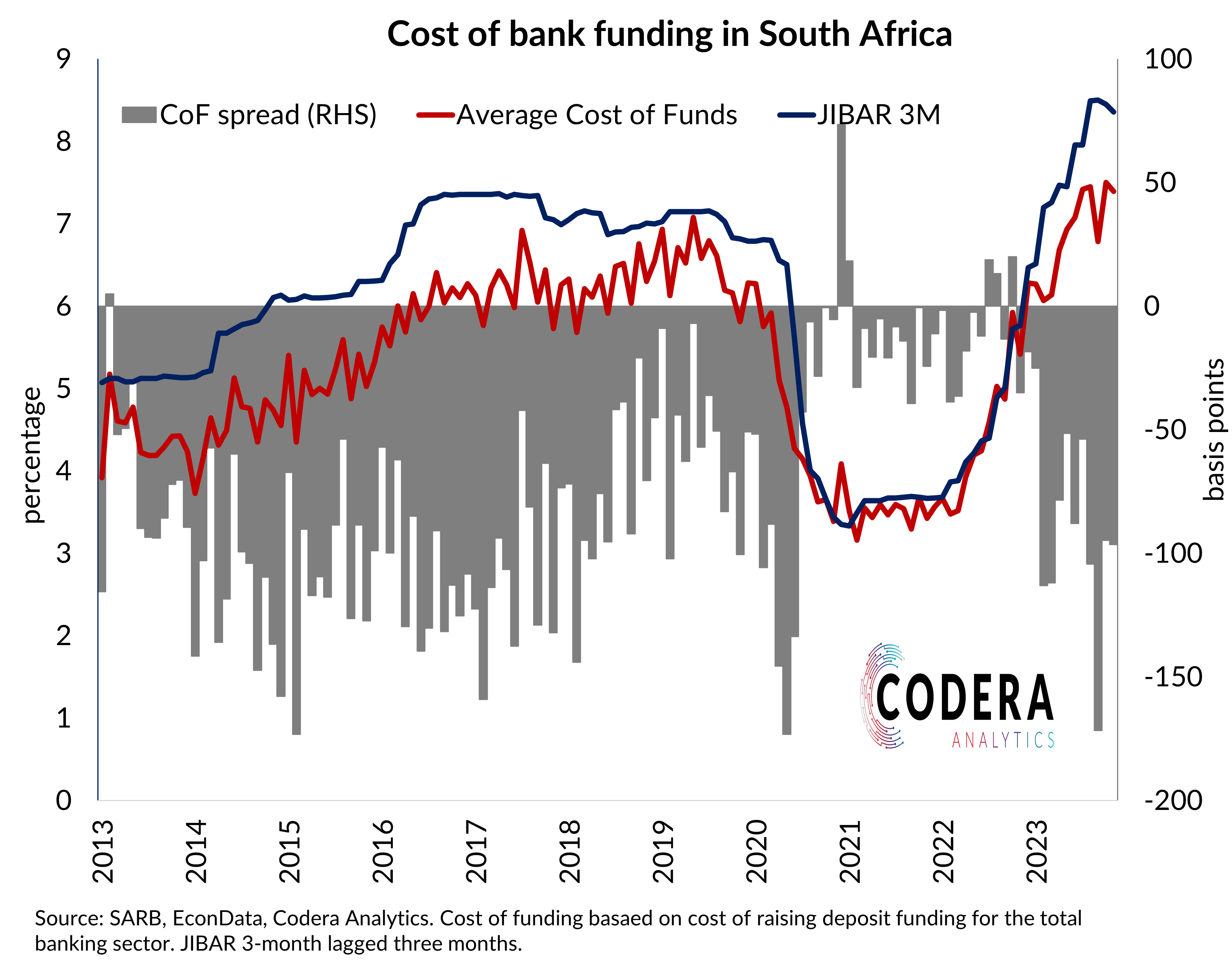

An interesting feature of the South African banking system is that proxies of bank funding costs have often been below the policy rate (see here for more). This is because South African banks are highly dependent on deposits as a form of bank funding and the relative cost of raising deposit funding compared to other forms of funding has historically been below money market reference rates (see the chart below). This is in sharp contrast to advanced economies such as Australia, or New Zealand, where bank funding costs have generally been above the policy rate. South African bank funding spreads rose dramatically with the onset of the COVID-19 pandemic. The opposite was observed in many advanced markets (see charts here for Australia), where bank funding costs fell on the back of policy easing by central banks.

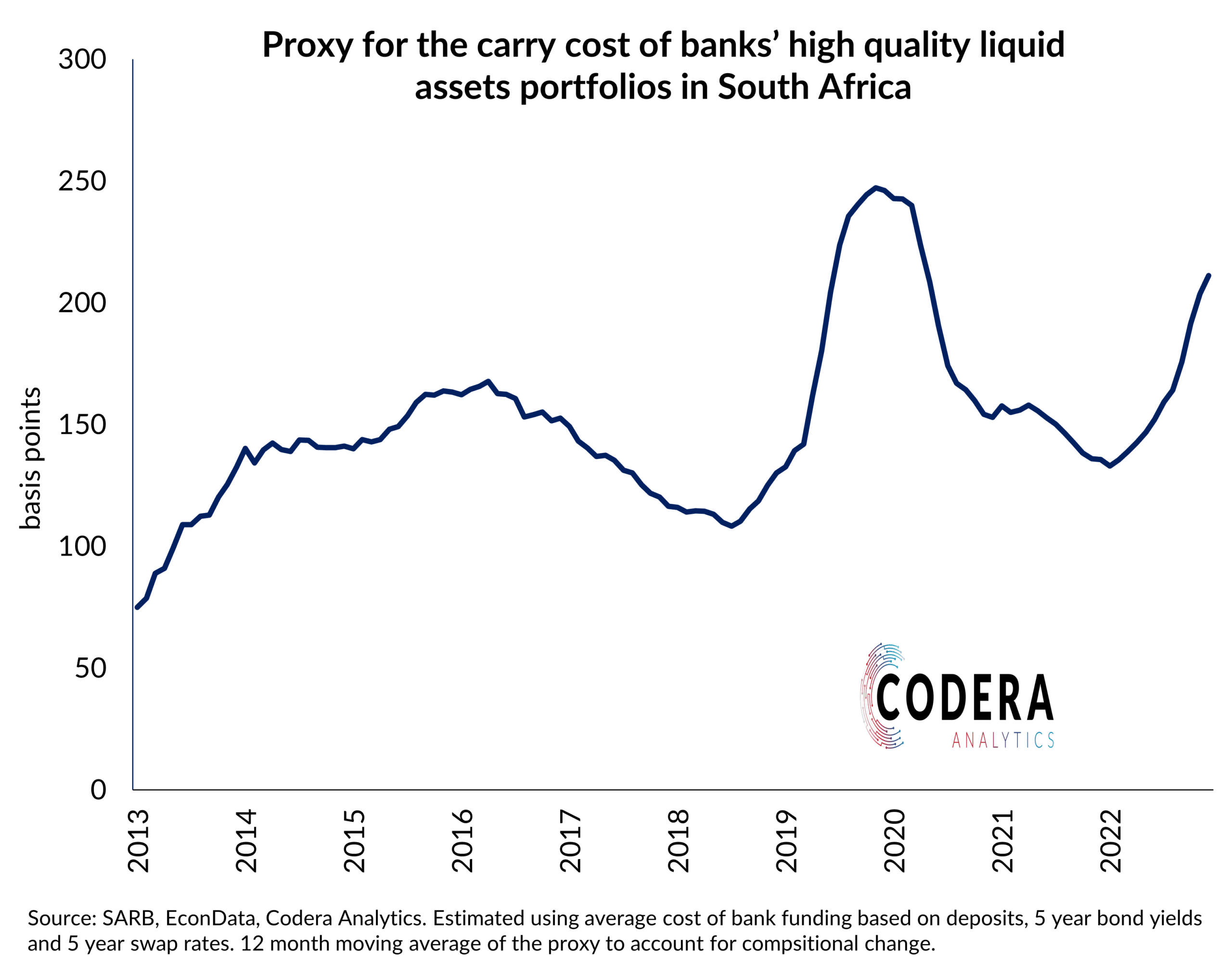

In today’s post, we use data on bank funding in South Africa to create a proxy of bank funding costs and the carry cost of banks’ high quality liquid asset (HQLA) portfolios. The proxy is calculated using long bond yields as a proxy for the unhedged yield on HQLA, as well as swap rates under the assumption that banks hedge their HQLA holdings, and our measure of average bank funding costs, expressed as a spread to a money market reference rate (taken as 3 month JIBAR). We take the 12 month moving average of the proxy to account for gradual compositional change.

A positive carry suggests that the return on HQLA has been higher than our proxy of the average cost of bank funding. As we argued here, a positive carry suggests that the liquidity coverage ratio requirements introduced as part of the ‘Basel’ regulatory reforms that bear on banks have only created an opportunity cost in terms of forgone income from higher yielding loans or other investments, as opposed to a direct cost to banks from additional holdings of HQLA. This is somewhat unusual by international standards and reflects the attractive relative returns on such assets in South Africa. This is also likely one reason South African banks hold a lot more HQLA than required under prudential regulations.

The cost of carry proxy has a broadly similar profile to the estimate we presented in an earlier SARB paper, where we did not take basis risk into account. In that paper, we also estimated that carry on HQLA was positive and also spiked during the COVID-19 pandemic.

It is therefore likely that Basel III regulations served to increase banks’ funding costs in South Africa by increasing the duration of banks’ funding liabilities and the relative cost of deposit funding (see here for more). This has implications for monetary policy by raising borrowing costs and potentially affecting interest rate pass-through. The impact of these regulations on funding costs also has implications for financial stability policy because it affects financial conditions and the sensitivity of bank balance sheets to sovereign creditworthiness.