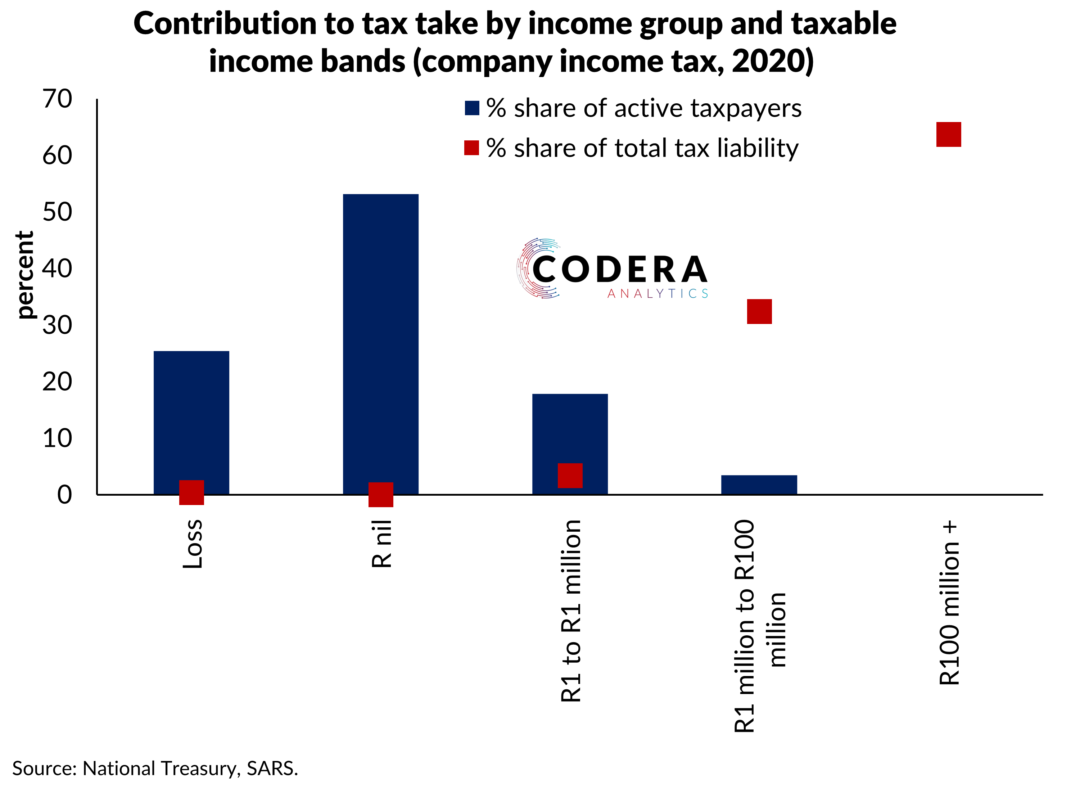

Compared to personal income tax, there is less progressivity in South Africa’s company tax regime. Companies pay a 16% tax rate on the first rand of taxable income they earn, and there is a big step up in the average tax rate as companies approach R500 000 in taxable income, after which the rate approaches 28%. Even though inflation likely distorts the comparison between 2020 and 2011 somewhat, data from SARS suggests that there has been a small decrease in the company tax rate at lower levels of taxable income. The implication of these tax figures is that South Africa remains reliant on a small number of large corporate taxpayers. Up-to-date comparisons of average tax rate estimates across the world are not easily accessible, but South Africa’s company tax rate is also relatively high by international standards.