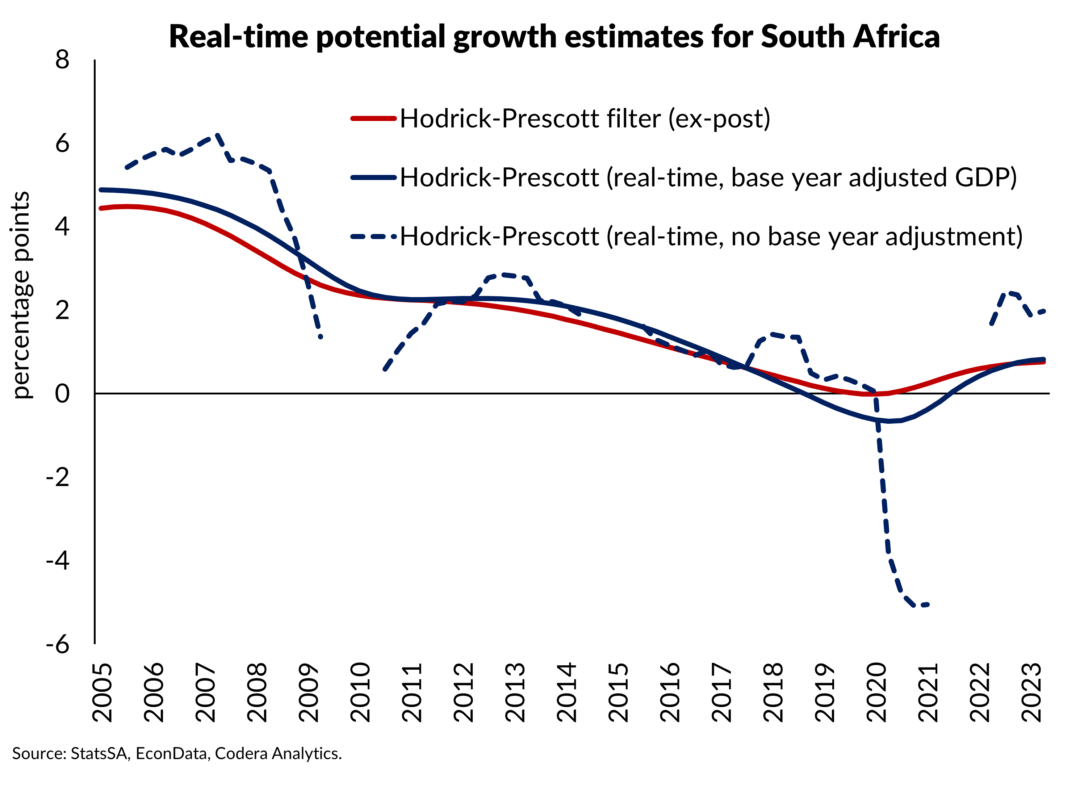

SARB published a paper on output gap uncertainty yesterday that presents estimates of potential growth and economic capacity pressures. The estimates suggest that the output gap has been negative since the global financial crisis (GFC) of 2008/09.

There is a major conceptual problem with the output gap estimates presented in the paper: they are systematically negative for the 13 years since the GFC. The statistical definition of an output gap implies that estimates should be approximately mean zero over the long term. The paper uses a statistical filtering approach that, judging by the plots presented, likely does not meet this requirement. Alternative filters, such as an HP filtered output gap on final vintage GDP data, would be approximately stationary.

The output gap is often used as an equilibrium concept, implying that deviations in GDP from estimates of potential should be eliminated over time. Again, judging by the charts in the paper, this looks unlikely to be the case for the estimates presented.

In structural models, such the one the SARB uses for forecasting (QPM), chronic negative output gaps are indicative of persistent economic slack requiring policy accommodation. Using estimates that look like the ones in the paper in structural models used to create projections can create problems for forecasters. If GDP does not converge on potential, models will either produce systematically biased projections or forecasters will need to make incredible (in the Latin meaning of the word) assumptions about the shocks that are affecting the economy. As I have previously argued, SARB, like other central banks, originally interpreted the COVID-19 pandemic as a massive demand shock, ultimately under-estimating the delayed inflationary impulse from supply shocks associated with economic lockdowns. Over time, SARB has also recognised that its potential growth estimates have been too high and have progressively lowered them.

There are three other tests of the credibility of output gap estimates that are worth mentioning. One is whether specific estimates are useful in explaining current GDP and inflation (i.e. the state of the economy) or forecasting future GDP or inflation. We showed in an earlier paper that output gap estimates similar to ones presented performed poorly at predicting GDP growth in models specified in line with SARB’s QPM. Output gap measures that were not persistently negative post-GFC performed best at predicting inflation and GDP growth. Oddly, the paper does not cite previous SARB assessments of real-time output gaps (such as here and here).

Another test is the reasonableness of the approach used to deal with the structural break in GDP data from the COVID-19 economic lockdown. Unfortunately, the paper only displays annual estimates of potential around the time of the COVID-19 pandemic. But the available charts suggest that the models anticipated the pandemic (which is impossible, given that no one saw the lockdowns coming several months before they were implemented). Figures 3b and 4 show that estimates of potential growth appear to fall ahead of the COVID pandemic. This suggests that the models may not have appropriately captured the COVID-19 shock as claimed in the paper. It is highly likely that the pandemic had a persistent impact on potential growth, as implicit in SARB’s own recent estimates. Yet the paper’s estimates do not show a slowdown in potential post-pandemic.

A third test is whether estimates accord with economic narratives of the current state of the economy and are a good guide to policy given the data available at the time of policy decisions. The estimates from the paper imply a specific economic narrative about the state of the business cycle that is different from alternative approaches to output gap estimation. The estimates presented in the preferred model imply that there has been chronic resource under-utilisation post-pandemic.

Since GDP data get revised, it is also important to assess whether the same estimation approach would produce the same policy advice over time. The revision properties of the preferred model is not systematically assessed, though the preferred model implied meaningfully less negative historical output gaps using data available at the end of the sample than produced for the same periods using data from earlier in the sample. Interpreted in isolation, the preferred model now implies that less policy accommodation was needed for most of the period since around mid-2012 (in line with SARB’s own measure) than was implied by estimates based on data available during earlier periods. Discussion in the paper focuses instead on specific points in time, noting, for example, that ‘SARB’s easy monetary policy stance throughout 2020 and 2021 could in hindsight have been even looser’. The model’s estimates have been subject to large revisions, suggesting that the output gap estimates have been overstated in real time, on average. As such, the paper does not systematically assess the implications of ‘data uncertainty’ for output gap estimation. And since the paper does not provide comparisons to estimates from other benchmark approaches, one cannot judge the potential extent of ‘model uncertainty’ either. The paper does not try to ‘disentangle the impact of changing economic conditions on actual and potential output’ as it recommends to others in its conclusion.

There is no such thing as a ‘definitive’ output gap. But practitioners need a systematic way of assessing whether gap estimates adequately describe the current economic context. Practitioners also need to understand the uncertainty around a particular estimate at a given point in time. As such, it is a pity that the paper does not assess how data and model uncertainty have affected assessment of the adequacy of the model’s estimates. Such assessments also need to be done in the context of the frameworks used by SARB for forecasting and monetary policy assessment.

Footnotes

The paper uses data back to 1970 which should provide a long enough sample to test whether the output gap estimates obtained are approximately mean zero and whether GDP and potential are cointegrated.

Unfortunately, the paper’s estimates are quite out of date, even though updated GDP data are currently available to 2023Q2.

The framework uses an ad-hoc approach to the inclusion of predictor variables, so it is surprising that there is no assessment of which specifications produce the ‘best performing’ output gaps along the lines suggested above, or any assessment of whether the estimated relationships with the included predictors make sense.

An interesting avenue for future research might be to construct structural estimates of potential that take South Africa’s resource under-utilisation (think structural unemployment) or electricity constraint into account.