The South African Reserve Bank (SARB) governor recently said that South Africa is entering an era of low inflation. In this blog post, we argue that it is still too early to judge whether trend inflation has persistently fallen.

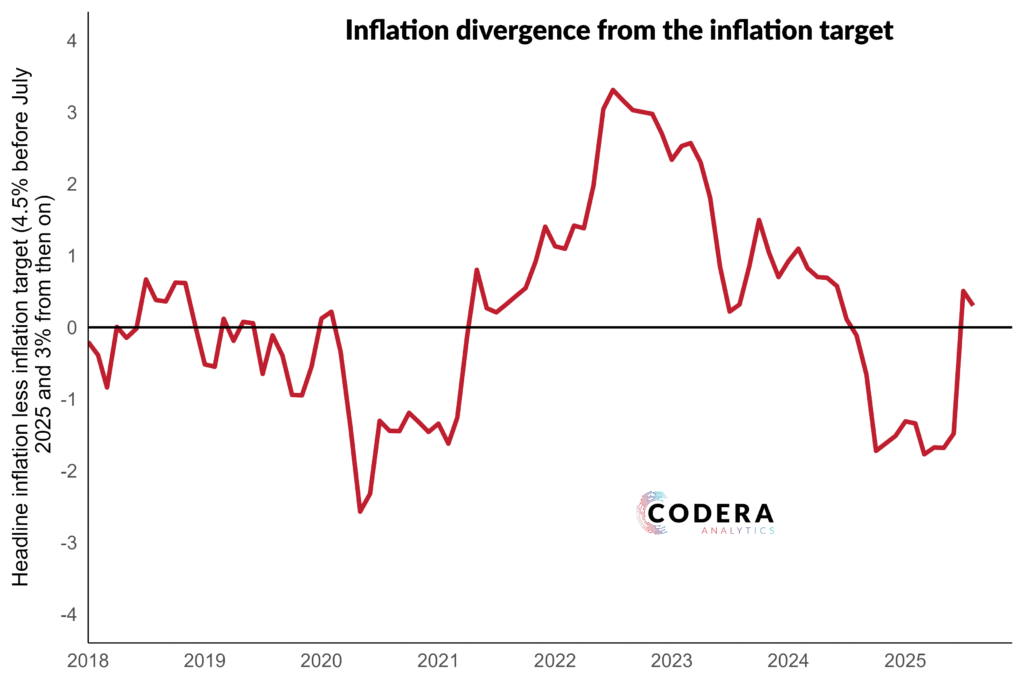

In July, the Reserve Bank monetary policy committee (MPC) announced a 3% preferred inflation target, even though the de jure target remains between 3 to 6%. Although inflation pressure has been near post Global Financial Crisis lows in 2025, it is worth reflecting on historical experience following periods of below-target inflation. The chart below shows that periods of stable, near target inflation has been relatively short-lived since the mid-point target was adopted.

A simple test of whether the governor’s statement aligns with the data involves running a model that tests for shifts in the inflation regime. However, Markov Switching models of various specifications do not detect a recent change to a low inflation regime (see footnote for more). If SA is entering an era of low inflation, there is no evidence from a simple model that we have entered it yet. Our estimates of trend inflation also do not suggest that aggregate trend inflation has fallen in South Africa post-pandemic.

There is, on the other hand, evidence that inflation shifted to a lower regime in other countries such as the US since the COVID-19 pandemic.

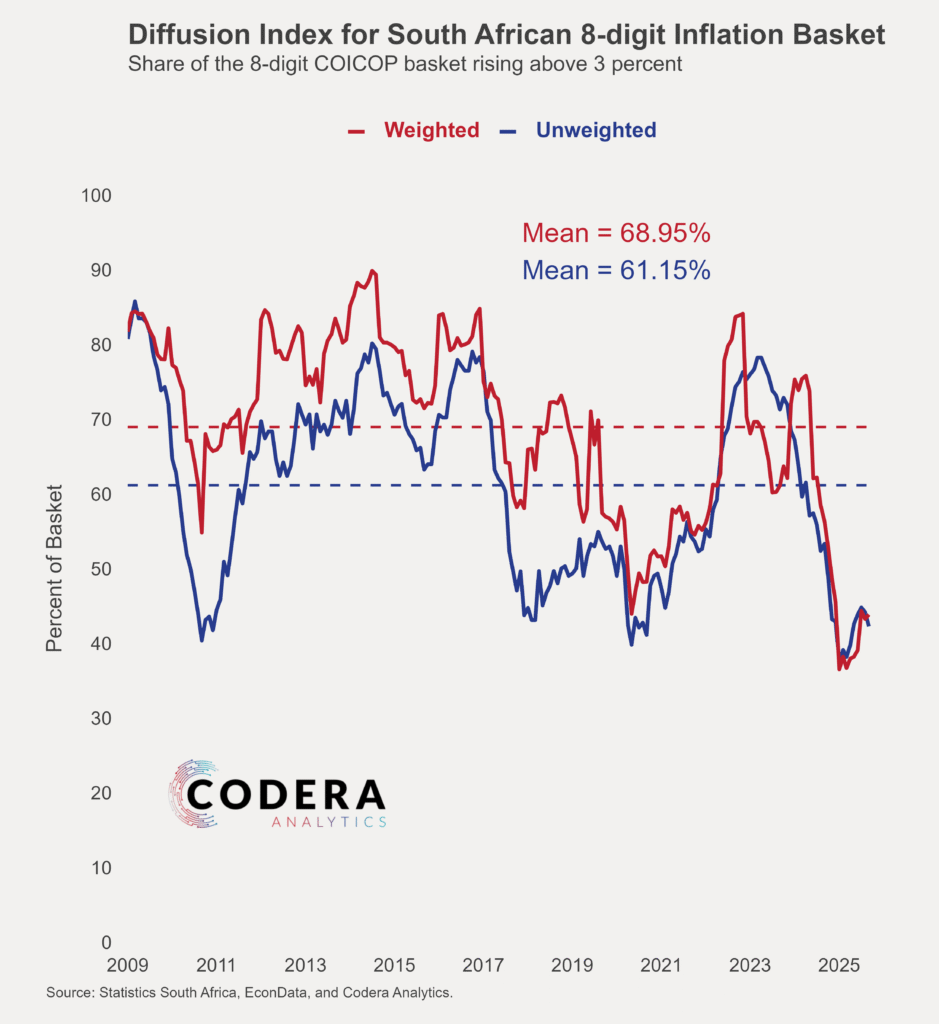

That does not mean that the recent decline in inflation has not been broad-based. The chart below shows that the proportion of price categories in the consumer inflation basket that are rising rapidly is low by historical standards (since 2009).

But there are a many products and services whose prices have persistently grown at above the mid-point of the inflation target, even though the mean of consumer prices is the near the mid-point of the target range.

Administered prices, which include prices set by government agencies or regulators (such as electricity tariffs, water charges, fuel prices and public transport fares), have played a key role in deviations in South Africa’s inflation from the inflation target.

But inflation deviations from target have not only reflected government-related prices as a large proportion of categories in the CPI have tended to increase much faster than 3%. The chart below shows that the prices of over two thirds of the South African consumer price of components have historically risen by more than 3%.

There is also particularly high degree of dispersion across price categories that comprise the consumer price basket in South Africa. The chart below shows that the distribution of inflation components in SA shows positive skewness on average, indicating that while most items experience moderate price changes, a smaller number of items have large price increases that pull the average upward. A high standard deviation suggests wide variation in price movements across individual products, reflecting diverse inflationary pressures within the economy. Kurtosis spikes in the early 2010s, the period between late 2021 to 2022 and in 2025, reflecting, amongst other things, very large relative increases in some government‐related price categories and some food price categories. This pattern reflects persistent supply-side shocks and structural bottlenecks, suggesting that headline inflation often masks substantial variation in consumer price experiences.

The implication is that lower headline inflation outcomes have not necessarily been associated with less inflation uncertainty. As we show in our recent policy brief, our inflation pressure measure (see chart below), which draws on hundreds of goods and services categories, describes divergences in inflation from the inflation target, with inflation tending to rise when the inflation distribution widens.

This means that above-target inflation is a more widespread phenomenon than traditional measures of underlying inflation suggest. Codera’s core inflation measure continues to suggest that there is more broad-based inflation pressure than implied by the Statistics SA core or trimmed mean measures of underlying inflation.

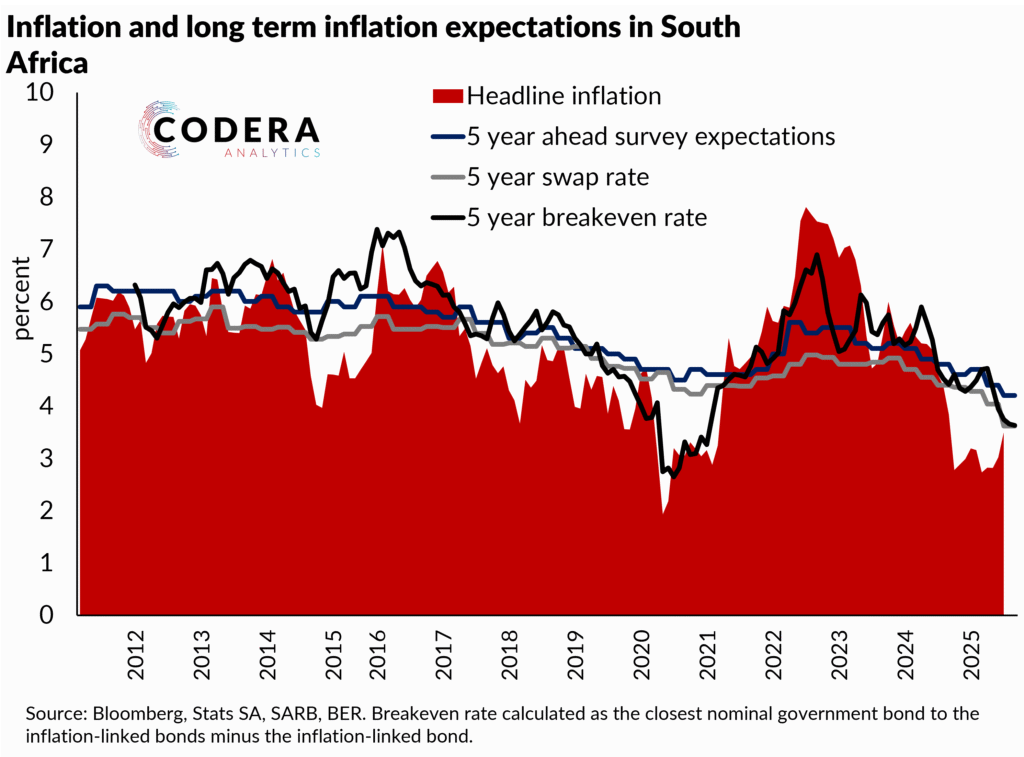

Our analysis suggests that a lower average inflation level may not automatically imply lower inflation dispersion in South Africa, making it harder to anchor inflation expectations at a lower inflation target. The chart below compares headline inflation and survey-based, and market-based long term measures of inflation expectations. Encouragingly, inflation expectations are continuing to decline.

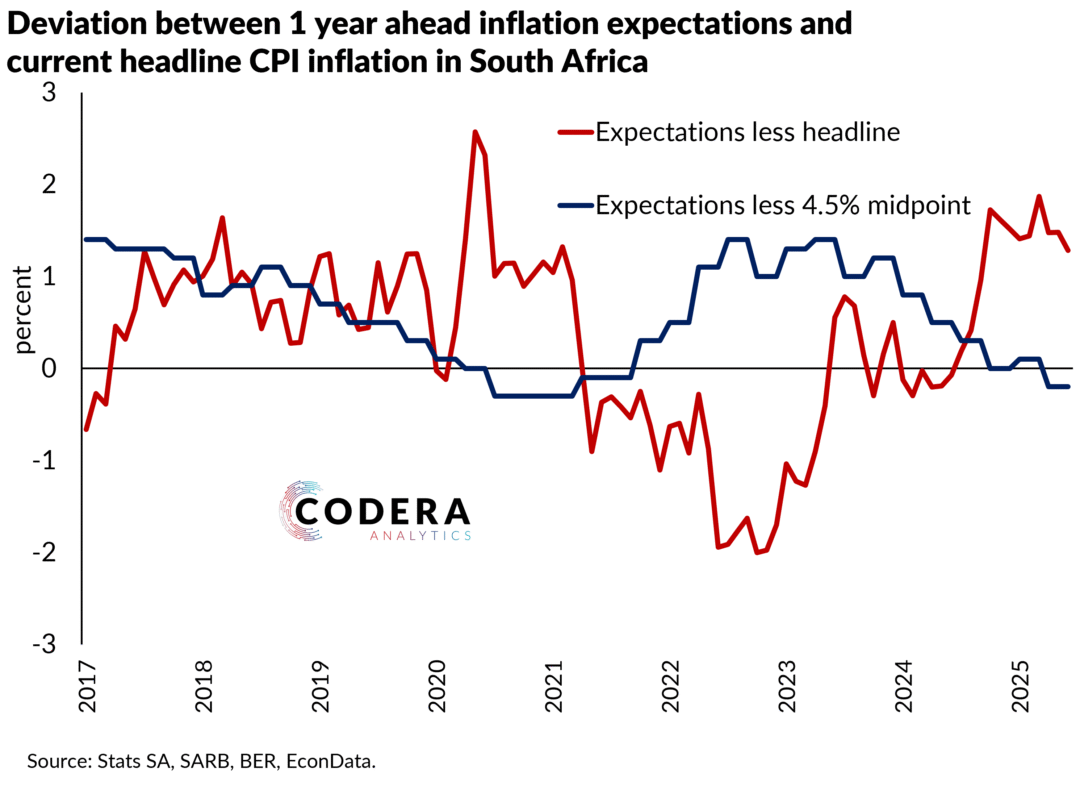

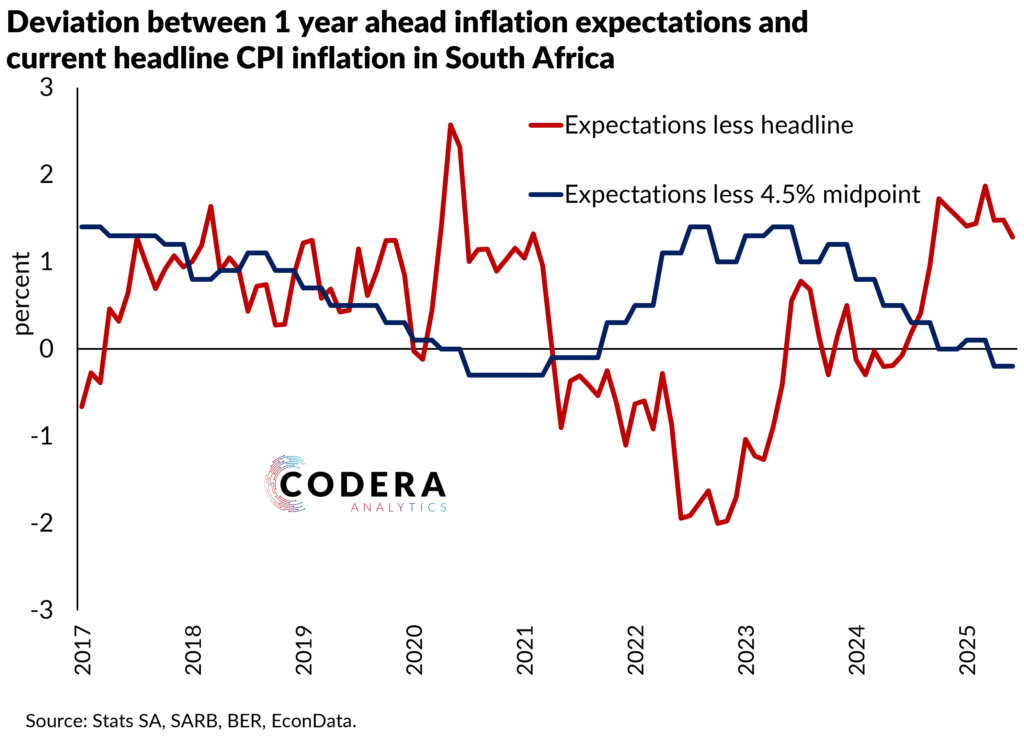

But it has historically taken extended periods of below de jure target inflation to bring expectations down. History offers a cautionary tale (see chart below): when the midpoint target of 4.5% was introduced in 2017, it took around four years (and helped by an unprecedent pandemic shock) for expectations to converge temporarily, reflecting the slow-moving nature of entrenched inflation perceptions. The post-pandemic cost of living crisis saw inflation expectations unanchor once again, and only again converge on the target in late 2024 as the inflation cycle turned.

As we have demonstrated in our policy paper on the gaps in the inflation targeting debate, inflation expectations are backward-looking in South Africa – meaning that inflation expectations will only decline sustainably if inflation remains at the new preferred level for an extended period.

This means that reforms to address persistently high administered price inflation and monetary policy communication focused on what policy must do to address inertial price and wage settings are particularly important.

The problem with the governor’s statement is that it is not yet clear from the data that low inflation will persist and the SARB have not published any estimates that suggest that trend inflation has been falling.

Footnote

Markov Switching models of various specifications do not show that the mean of the current inflation regime is below 5 percent.

These models may not be well estimated given the relatively small information set used (i.e. only inflation data). It may be that one could construct a multivariate model that includes GDP and interest rates that might show that trend inflation is falling. But our trend growth estimates based on such an approach does not show this.

The burden of proof that we are entering a low trend inflation environment therefore lies with SARB.