A recent RMB Morgan Stanley Research paper by Andrea Masia compares modelling scenarios evaluating what monetary policy would need to do to achieve a lower inflation target. The paper’s conclusions are in line with our own from our February policy brief on the gaps in the inflation targeting debate. The paper concludes:

- A lower inflation target is desirable

- Transition costs are worth bearing, but may be higher than the South Africa Reserve Bank (SARB) asserts they will be

- Inflation risk is skewed to the upside of the SARB’s forecasts

- Coordination between monetary policy and fiscal policy would support a successful transition

- Policy communication is key to anchoring inflation expectations and price setting to a lower level.

The paper shows that, should inflation expectations slowly adjust towards a lower target, this would allow some space for further monetary policy easing. The RMB MS paper suggests 50 basis points of cuts are expected in 2026 and 75 to 100 basis points in 2027 under its baseline projection (compared to SARB’s 25 basis points more in 2025, 75 basis points in 2026 and possibly one more 25 basis points cut in 2027 from the July MPC statement).

In line with our estimates, the paper suggests that inflation expectations in South Africa are partly backwards-looking, meaning that SARB’s assumption that the policy rate can be cut deeply over the short term may not be realistic.

The paper acknowledges that the announcement of a preference for a 3% target does not automatically imply that the current monetary policy stance is tighter, because the economy’s neutral rate may not decline concomitantly. Our own estimates implies that the market-implied neutral rate has not declined after the announcement, and is still around 7.25%. The SARB’s current neutral estimate is 2.8% real (5.8% nominal assuming a 3% inflation target). Our estimate implies that monetary policy is currently not as tight as the MPC argues, as the policy rate is 7%. Instead, bond market pricing suggests that the current policy stance is broadly consistent with a neutral stance.

The outlook for the policy rate will depend on whether inflation expectations adjust downwards and whether the market will be convinced that a lower inflation target is credible and can be achieved without higher interest rates.

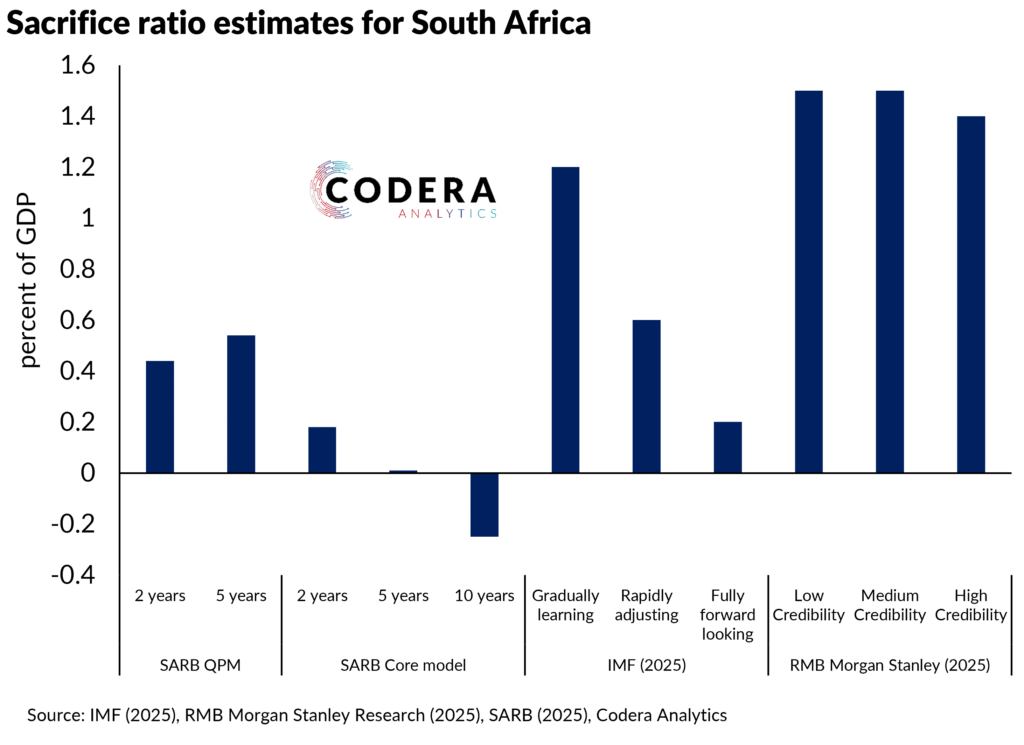

This is clearly demonstrated in the chart below that compares estimates of the sacrifice ratio for South Africa that captures the extent to which lower inflation requires the sacrifice of output (IMF paper summary here, SARB paper summary here). If inflation expectations are slow to adjust, monetary policy must remain tighter for longer, implying higher economic costs to sustainably lower inflation. It is important to note, as we have argued before, such estimates are highly sensitive to the sample period used, the theoretical framework and estimation approach used, the measure of inflation considered, as well as the measure of the output gap (a measure of economic slack) that is used. These comparisons are also not perfectly comparable as they cumulative over slightly different periods.

Our view is that the SARB estimates are very much a best case scenario given the assumptions underlying their modelling, with the near term likely to be characterised by worse debt dynamics.