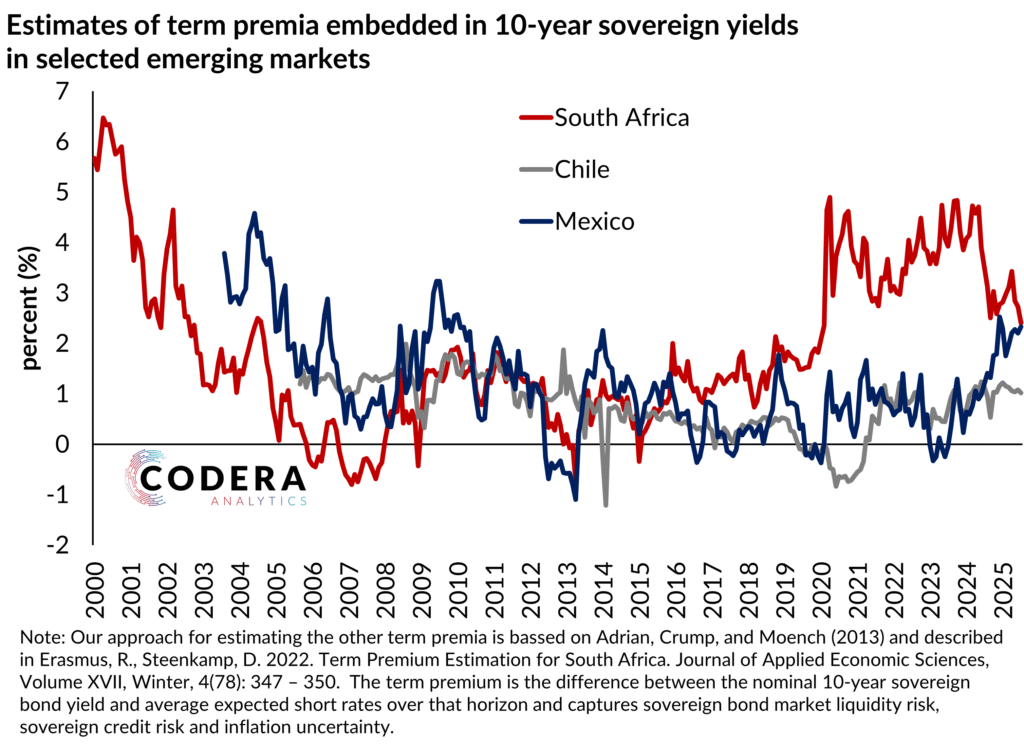

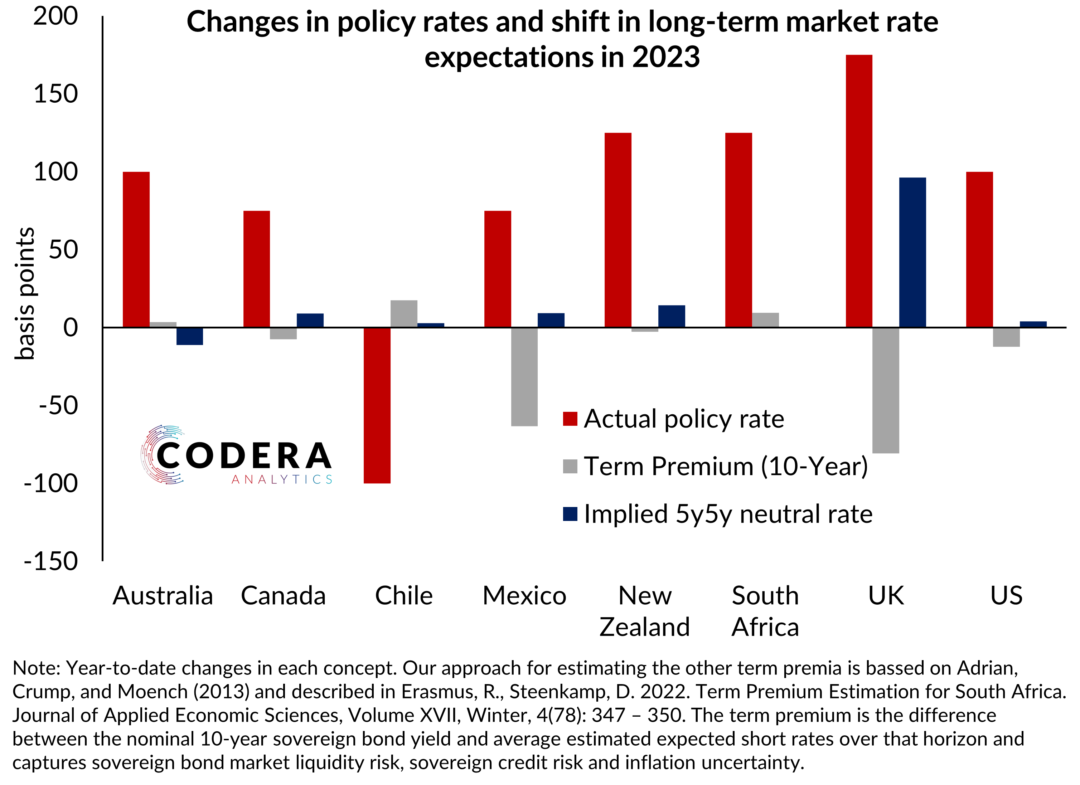

Our estimate of the South African sovereign term premium has declined over the last six months, but remains elevated, both by historical standards and against other major emerging market sovereigns. A high term premium keeps South African government’s borrowing costs high and implies that the neutral rate of the economy (reflecting where short-term interest rates are expected to settle in coming years once the effects of shocks have faded) has not declined meaningfully over this period. We previously showed that a higher term premium tends to be associated with increased economic slack and a weaker currency.