Codera is making it possible to automate sophisticated analysis of economic and financial data. Our EconData platform, for example, makes it easy to evaluate historic IMF, SARB and National Treasury forecast errors and data revisions.

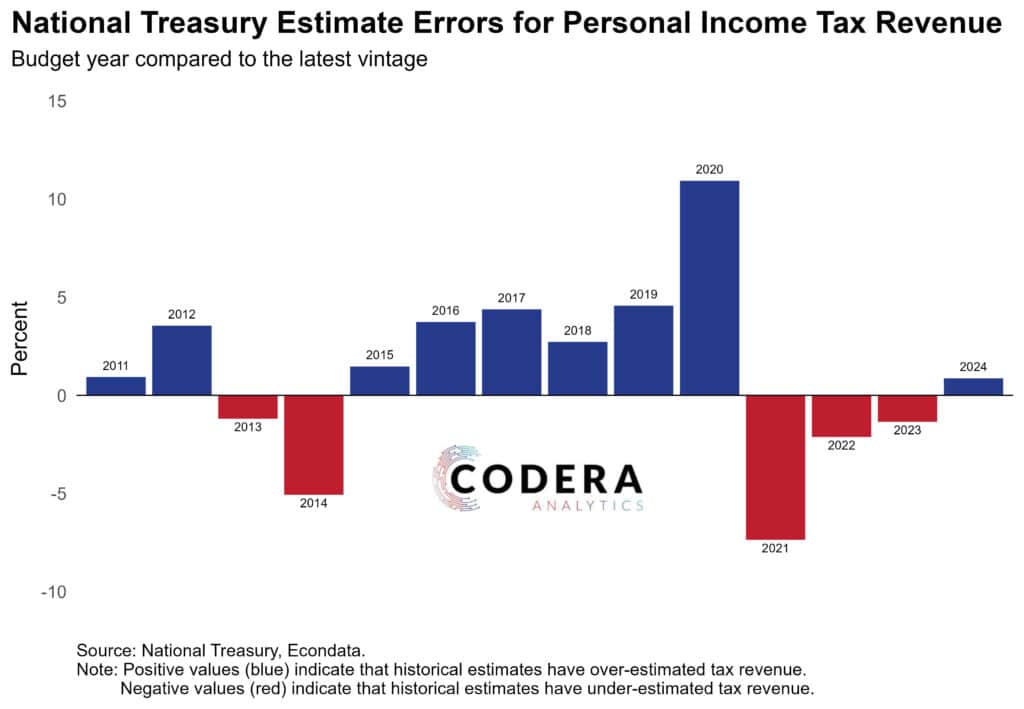

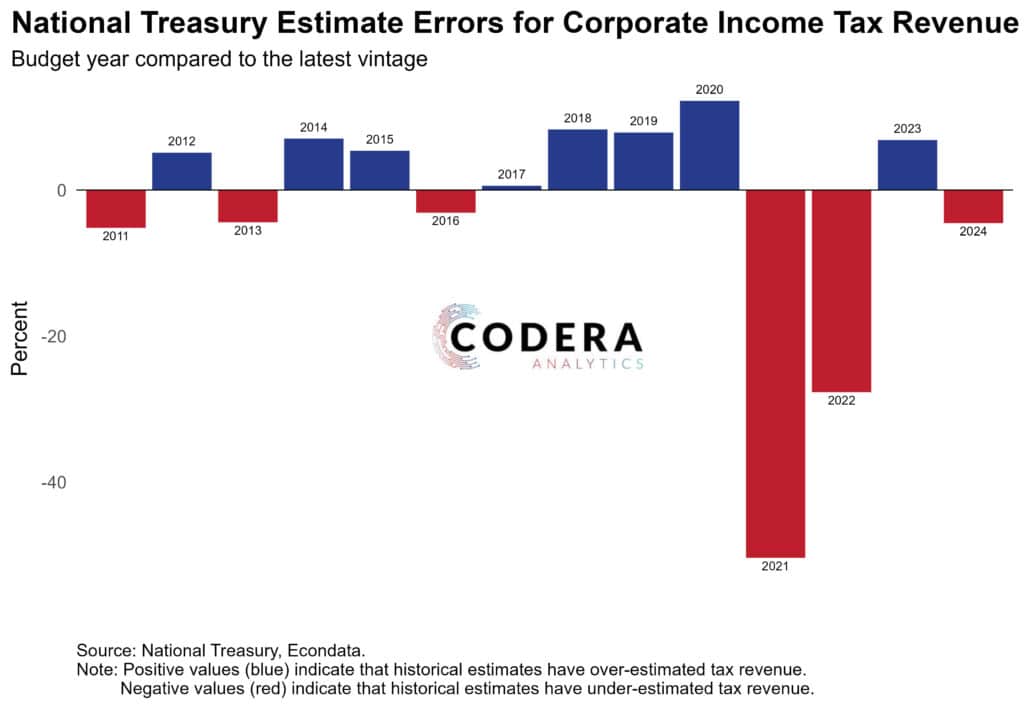

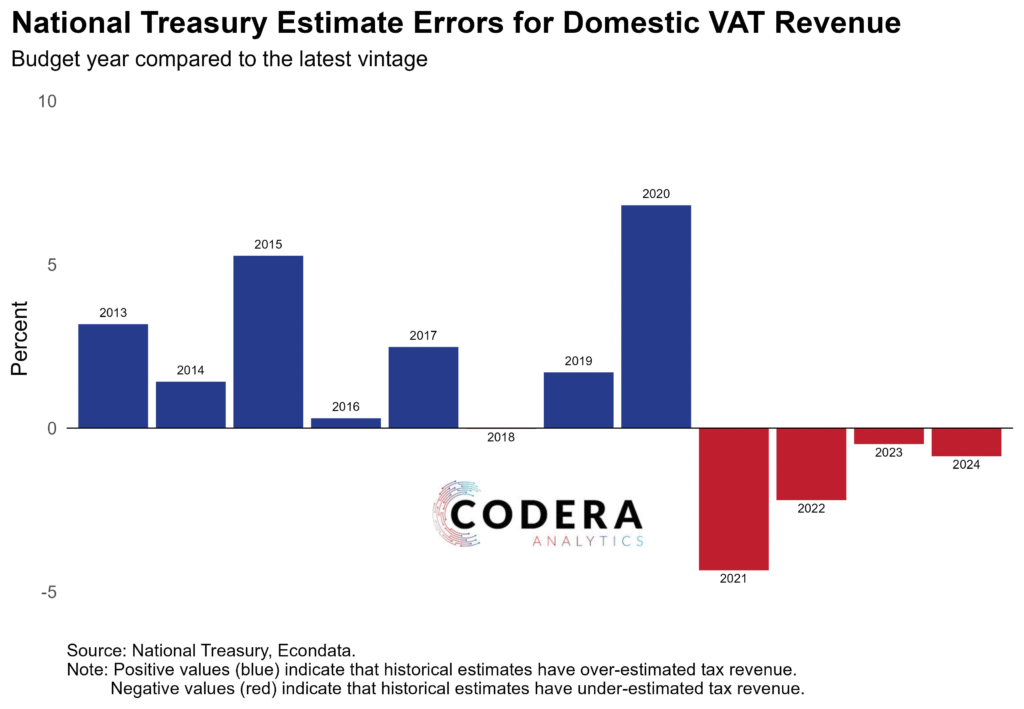

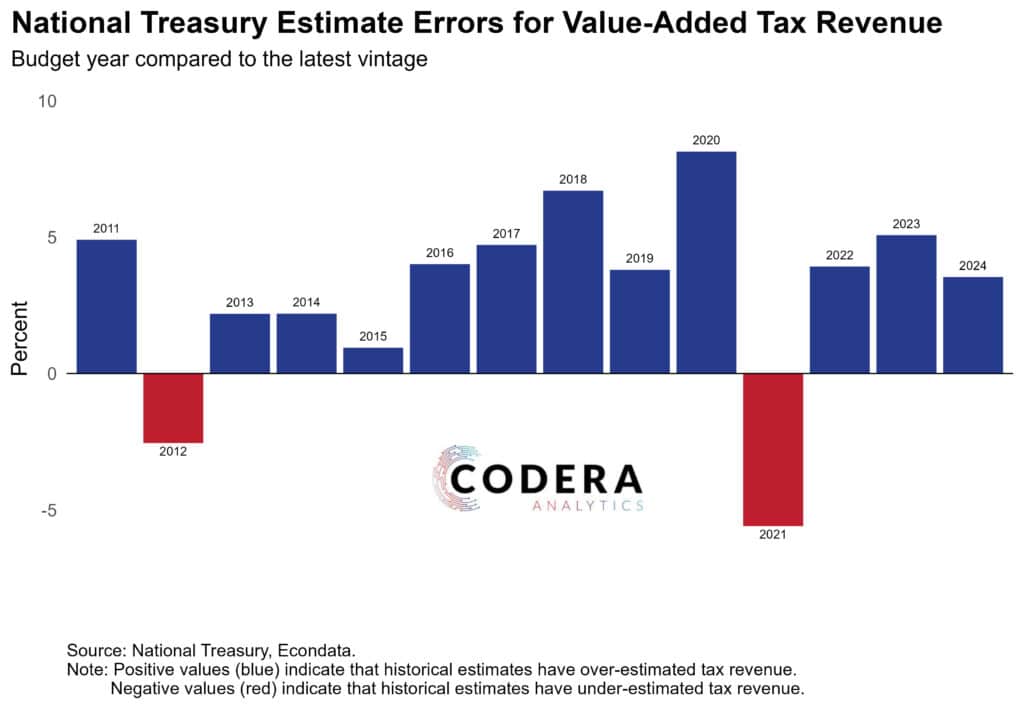

Today’s post by Lisa Martin compares the initial Budget Review estimate of the main forms of government revenue for the current year against Treasury’s finalised revenue estimate. With a couple of exceptions, National Treasury tended to over-estimate personal income tax (PIT), corporate income tax (CIT) and value added tax (VAT) receipts pre-pandemic. Post-pandemic, PIT, CIT and domestic VAT were all under-estimated, in part reflecting higher commodity revenues from unexpectedly high global commodity prices. It is particularly notable how large post-pandemic CIT revenue surprises were, even though this represents a relatively small share of total revenue.