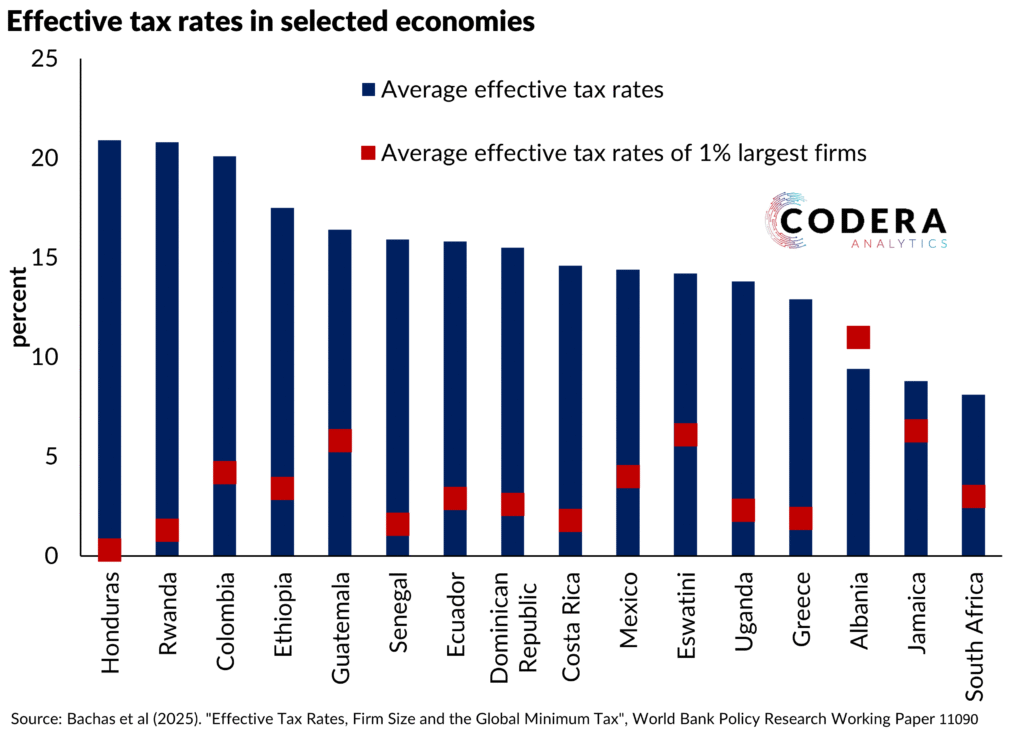

What impact would a global minimum tax have? A new World Bank study finds that effective tax rates exhibit a hump-shaped pattern across firm sizes: small firms benefit from reduced rates, large firms leverage tax incentives, and mid-sized firms face the highest effective rates. Although statutory tax rates exceed 15 percent in all sample countries, more than a quarter of top firms face effective rates below this threshold, challenging the straightforward distinction between tax havens and non-havens.

With respect to South Africa, a global minimum tax is only estimated to raise an extra 0.3% of corporate income tax. The top 1% of firms in South Africa (160 firms based on revenue or 128 if based on profits) represent over 60% of total company revenue, profits and corporate income tax. Top 1% firms with effective tax rates below 15% only represent around a quarter of Top 1% revenue and around a sixth of profits.