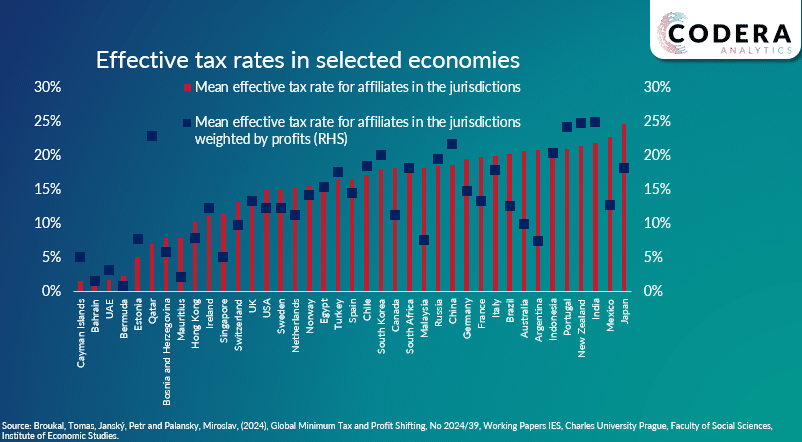

Effective tax rates for multinational affiliates vary significantly across economies, reflecting differences in tax policy, incentives, and enforcement. Analysing these rates provides valuable insights into global tax competitiveness and the strategic decisions driving cross-border investments. In today’s post we summarise estimates of effective tax rates on profits of multinationals affiliates operating in different countries, but not headquartered there. In earlier posts, we discussed evidence that almost 40% of global multinational profits are shifted to tax havens (10% of global corporate tax receipts), as well as the extent of profit shifting by multinationals headquartered in South Africa.