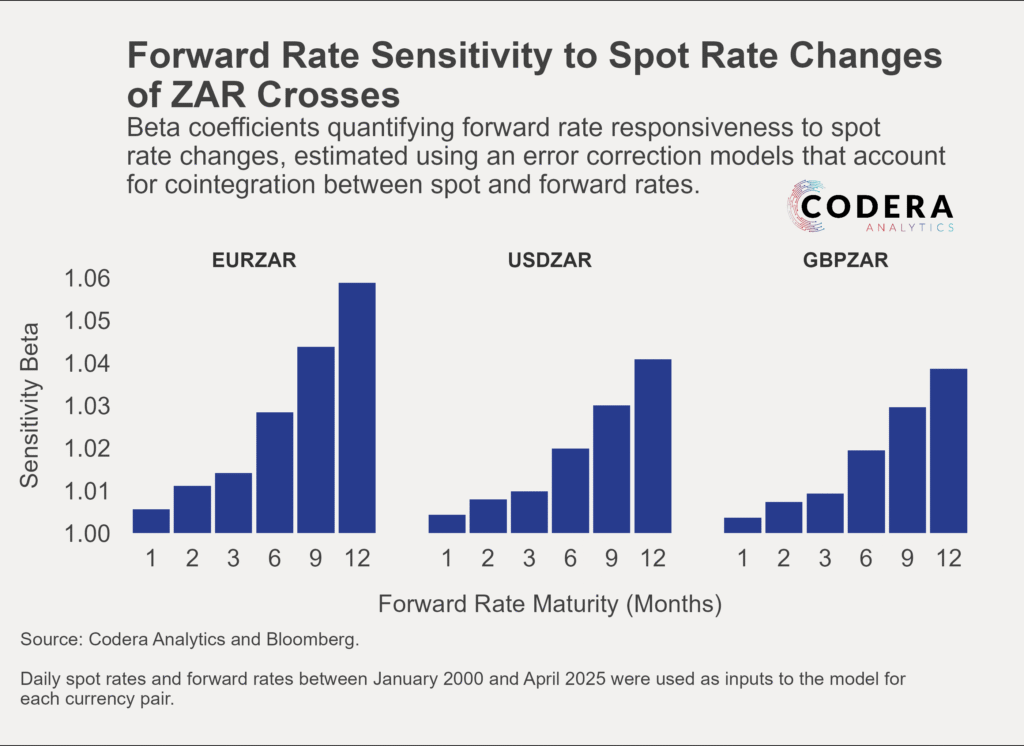

Today’s post by Oliver Guest estimates FX hedge ratios for selected ZAR crosses and shows that the ZAR typically exhibits a rising FX hedge ratio over forward maturities—meaning the beta (or sensitivity of forward rate changes to spot rate changes) increases with time to maturity. There are many possible explanations. As we showed in earlier posts, one likely reason is that high ZAR depreciation risk reflecting macro and political uncertainty (which is higher at longer maturities) that may cause over-reaction of forward rates to spot rate changes. Other possible explanations include is the possibility of lower liquidity in higher maturity forwards, or South Africa’s structurally higher interest rates and inflation.