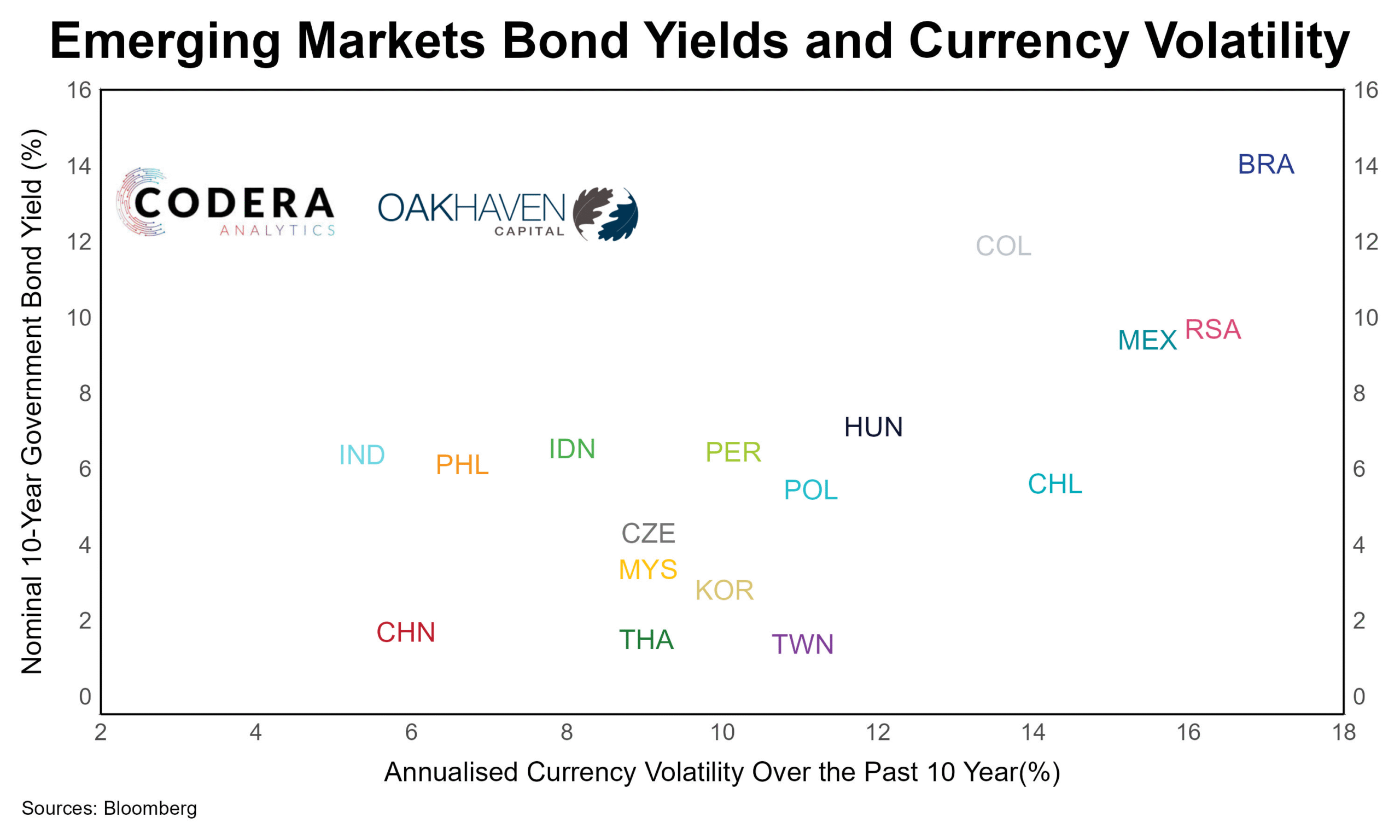

Emerging market investors often look at the sovereign yield pickup per unit of sovereign risk—essentially, how much extra return they earn relative to the credit risk of a country. Today’s post by Takudzwa Mutetwa compares yield pickup for a unit of sovereign risk across EMs. On this measure, Turkey and Chile currently stand out with the highest yield pickup, reflecting a mix of elevated yields (Turkey owing to inflation and policy credibility concerns, Chile owing to monetary tightening) against moderate risk perceptions. By contrast, South Africa and China offer among the lowest pickups, as South Africa’s high credit risk offsets its yield advantage, while China’s yields remain compressed despite relatively stable credit fundamentals.