Our article on the basic income grant debate was published in the Business Day today, below I repost our article.

The Institute for Economic Justice recently circulated a report on a big, bigger, and biggest basic income grant (BIG). Its big BIG (a “low ambition option”) would cost R275bn a year, the bigger BIG (“medium ambition option”) R375bn, and the biggest BIG (“high ambition option”) R500bn.

The institute’s modelling concludes that all these options will pay for themselves.

The report substantially overstates the affordability and positive macroeconomic effects of pursuing such a policy. We argue that its cure for SA’s ills is likely to be worse than the disease itself — that is, a big, bigger or biggest BIG would impede any sustained reduction in poverty, inequality and unemployment in SA.

How much is R500bn? It is a lot of money. The current R350 a month relief of distress grant costs R44bn a year. The government now spends about R450bn on education and culture, which includes primary, secondary and tertiary education, as well as support for the arts. Total healthcare expenditure is R250bn a year.

Even Eskom’s total debt is less than the upper-end estimates of the annual cost of a BIG, and the government has struggled to provide the funding required to sort out Eskom’s operational challenges. Eskom’s annual revenue from tariffs is R250bn. Rather than implement a big BIG, the government could set electricity tariffs at zero.

Those who say a BIG is easily affordable in SA have not looked carefully at the country’s accounts. SA will borrow R385bn a year in 2023/2024. We have been running persistent fiscal deficits since the global financial crisis, with spending exceeding revenue. Funding higher social expenditures will require some combination of further cuts to budgets for government services, higher taxation, higher debt or faster growth.

The BIG illusion being promoted is that such large additional expenditures can be easily funded. Let us take the Institute for Economic Justice’s proposed funding strategy for an ambitious BIG as an example. This scenario would require a 1% annual wealth tax and a 4% social security tax, which amounts to a huge increase in the amount of tax for the average taxpayer.

The big issue in the debate is whether a BIG will create economic growth, even in the short term. The frameworks used to promote a BIG assume the consumption growth and employment creation from higher transfers will outweigh the lower investment and consumption of those who must pay for the grants. Such an outcome is not what has been observed in SA after previous tax increases. It also ignores that the scale of tax increases required for such a large expenditure expansion will imply far larger macroeconomic effects than if existing transfers were increased slightly.

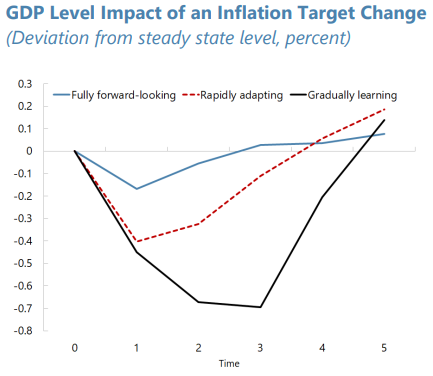

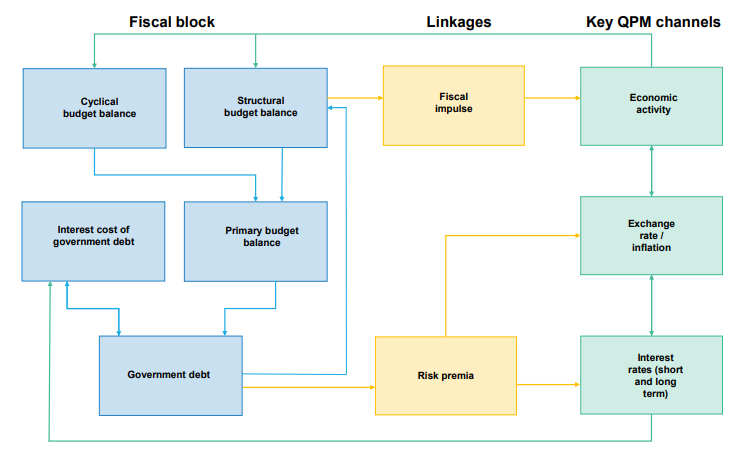

The fiscal modelling we have done, which is calibrated on historical taxation, expenditure and debt service cost outcomes, suggests permanent increases in transfers of the scale proposed will make SA’s fiscal position unsustainable and cause a large, sustained decline in economic activity. Unabashedly, the institute’s articles do not even acknowledge that others have offered technical counterarguments against the affordability of a BIG. Like its articles on the issue, recent BIG assessments from the department of social development pretend no research papers have been published that raise concerns over the cost and macroeconomic implications of a BIG in SA.

The government already prioritises social grant expenditure. It spends more than 10% of expenditure on grants, with about half of our population receiving a grant of some form, up from just 7% in 1996. Even making the current relief of distress grant into a permanent grant will require a continued annual expenditure increase in the order of R50bn — which will require higher public debt and tax increases given our small tax base and constrained fiscal situation.

Our modelling suggests that while such a policy would benefit poor households in the short term, it would ultimately lead to job losses and lower growth because it would require higher taxes and debt. To be able to afford enhanced social transfers SA needs to grow its tax base and enhance the effectiveness of government expenditure.

The tragedy in the BIG debate is that it is distracting us from the debate we should be having. SA desperately needs reforms that improve public sector service delivery and boost economic growth and job creation. We need to galvanise public support for reforms that solve our load-shedding problems, fix our infrastructure, and leverage the private sector to create jobs.

Dr Daan Steenkamp, CEO at Codera Analytics and Research Associate, Department of Economics, Stellenbosch University

Dr Hylton Hollander, Department of Economics, Stellenbosch University

Dr Roy Havemann, Research Associate, Department of Economics, Stellenbosch University

Our full paper is available here: https://econrsa.org/publications/technical-background-paper-the-macroeconomics-of-establishing-a-basic-income-grant-in-south-africa/