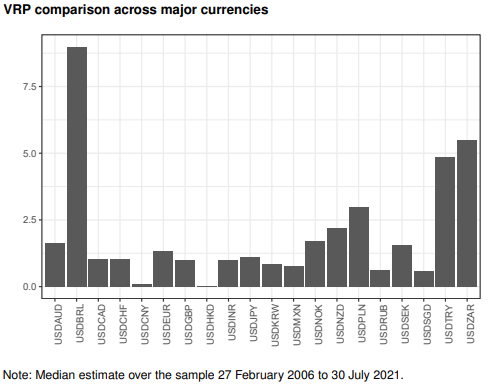

In our recent paper, we show that intra-day information and implied market expectations of exchange rates extracted from options prices can improve the accuracy of the South African Reserve Bank’s rand forecasts. We also estimate ‘variance risk premia’ (VRP) for a range of currencies, which are the difference between implied variance estimated from options and expected realised variance using a model drawing on intraday data. The VRP measures the cost to hedge variance risk and also describes the returns from speculative trades involving the writing of insurance options against FX variance. The VRP has been shown to have predictive power for spot exchange rates and is a popular measure of the risk appetite of FX investors. We show that the average level of the rand VRP is relatively high by international standards. We suggest in the paper that rand volatility is strongly affected by global FX liquidity and that the rand acts as a ‘bellwether’ emerging market currency.