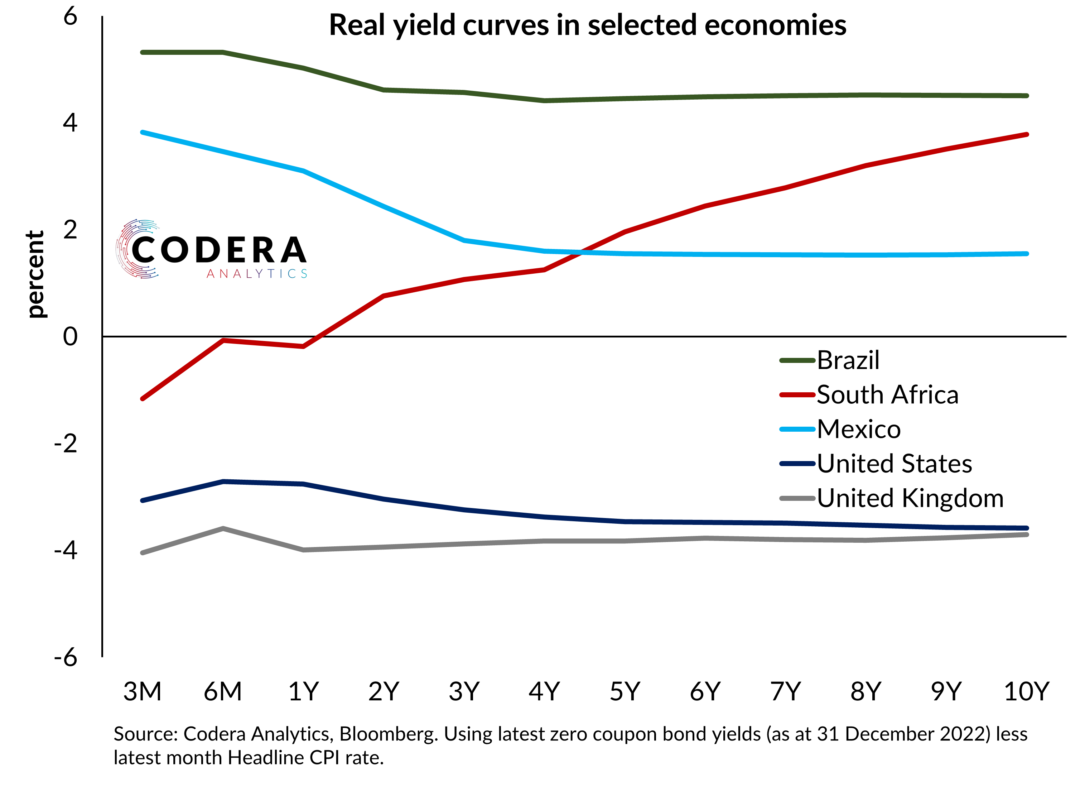

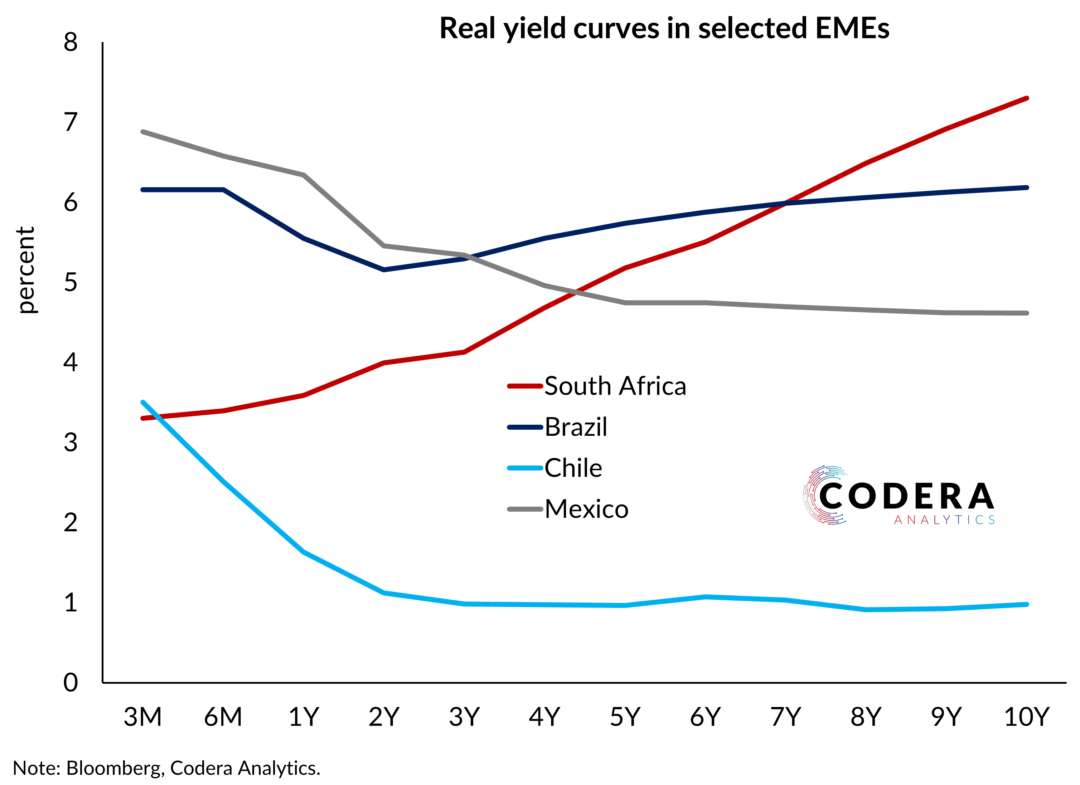

Higher term premia have been embedded at the short end of the US sovereign yield curve recently, contributing to an inverted yield curve. The opposite is true in South Africa. As we have argued previously, elevated long-term term premia in the South African curve suggest that risks around sovereign credit and exchange rate depreciation are being priced in.