Our estimates suggest that market pricing has long implied that South Africa’s neutral rate might be higher than SARB and many private sector economists have been assuming. Our updated estimate is currently at 7.5% nominal – implying 3% real (compared to SARB’s assumption of 2.5%).

A realistic estimate of the neutral rate matters because it helps one assess whether the SARB’s monetary policy stance is stimulative or contractionary and project where the policy rate may need to go over the medium term to meet the inflation target. If the SARB underestimates neutral, then it may need to raise rates by more than it currently expects would be needed.

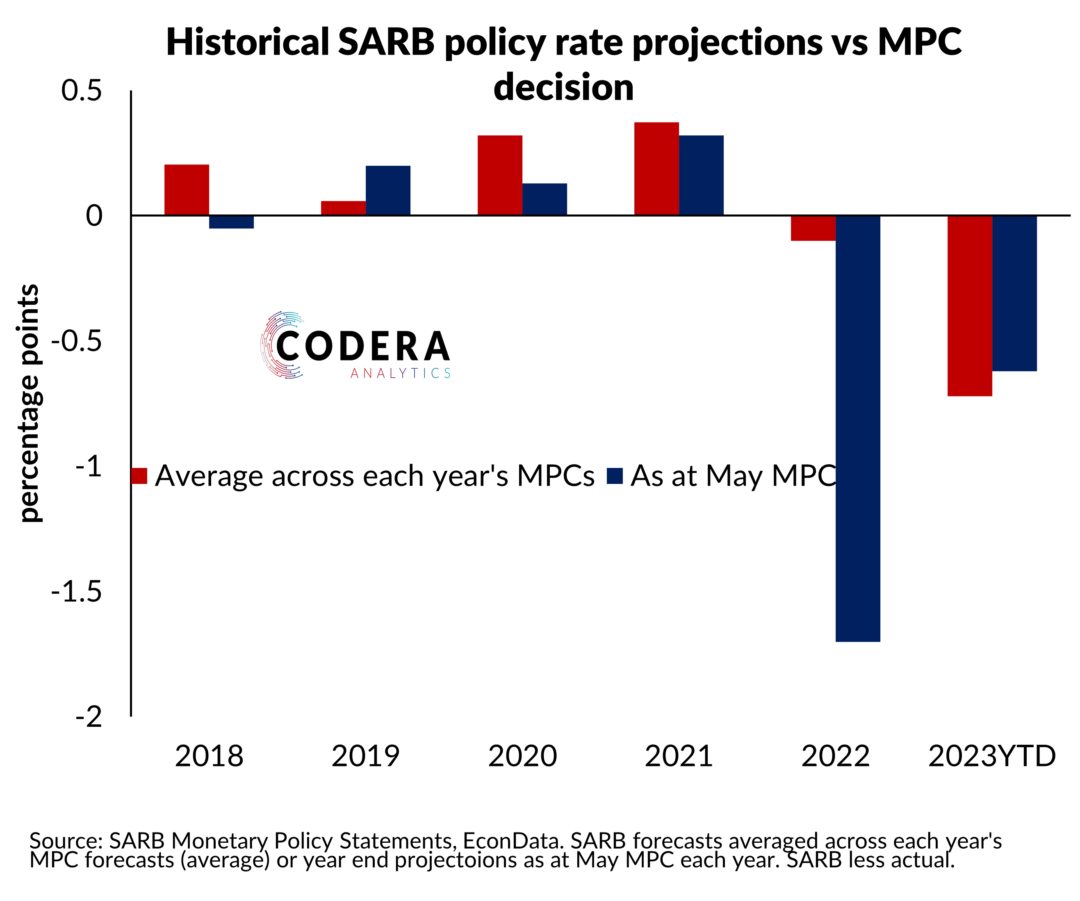

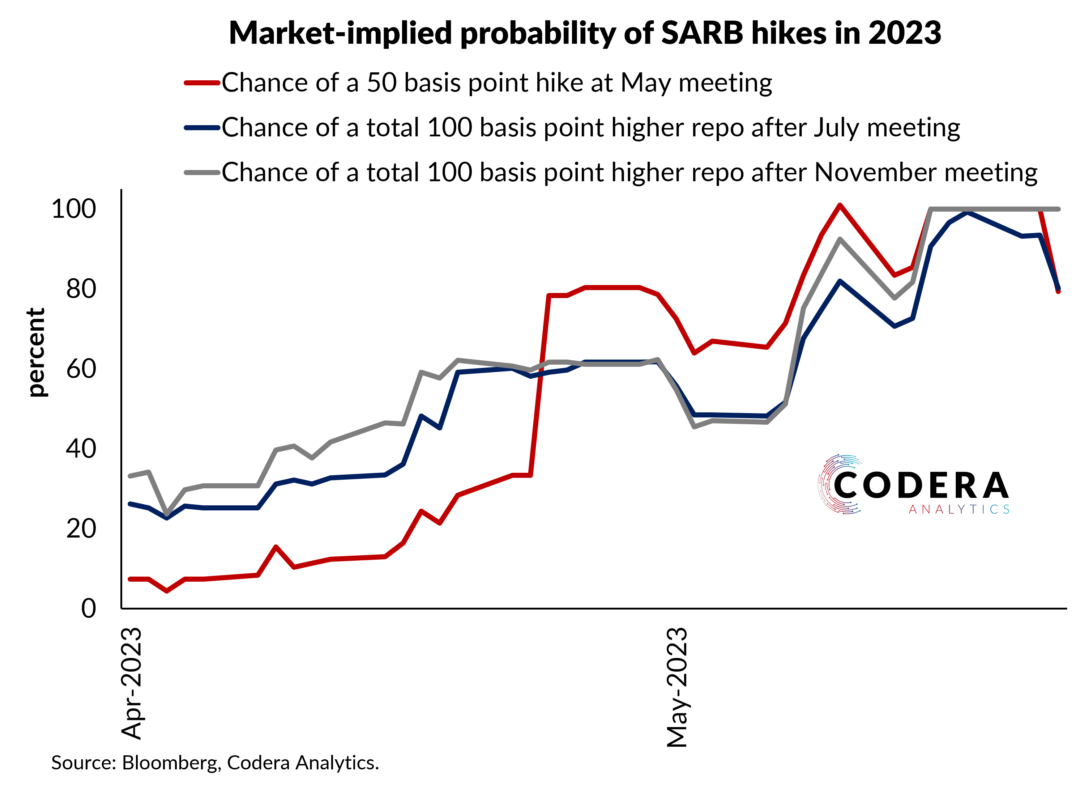

Since the neutral rate is ‘unobservable’, economists tend to disagree about whose estimate is right. Currently, the Bank’s projections suggest it does not expect further tightening will be needed, while the market expects there is more to come.

SARB has shifted its view of neutral over recent years. In the wake of the COVID-19 pandemic, SARB lowered its estimate of the neutral rate, characterising the pandemic as predominantly a demand side shock and front-loading policy easing. This implied much more policy accommodation than would be required for inflation to return to the target than if the pandemic was instead interpreted as predominantly a supply shock and the policy path was determined by the model’s reaction function. SARB has raised its terminal neutral rate slightly in 2023 (from 2.4% to 2.5%).

The expected release of the updated QPM in July offers SARB an opportunity to update its estimate not just of neutral, but of all the unobservables in the model. Enough time has passed for SARB to be able to have a better handle on how the long term trends of global interest rates, domestic inflation and potential growth have shifted since the pandemic. Together, this may imply a different level of neutral than has underpinned recent QPM projections and a different QPM-implied path of interest rates.

SARB models neutral estimate as a function of an estimate of the global neutral rate, a South Africa risk premium estimate and the expected depreciation in the real effective exchange rate.

But it may choose to change the determination of neutral in the updated QPM. Even without such a change, we know that the updated model will include a fiscal block, which will make it possible to characterise the link between South Africa’s fiscal position and the risk premium, which may also affect SARB’s updated neutral assumption. If the update involves a recalibration of QPM with equilibria filtered out consistent with the model structure (i.e. letting QPM determine unobservables instead of imposing them exogenously) the estimated neutral rate would also be likely to be different. It will also be interesting to see how the SARB’s assessment of the fair value of the currency has changed since their May Monetary Policy Statement and whether expected changes in the currency may contribute to a change in view of the terminal policy rate for this tightening cycle.