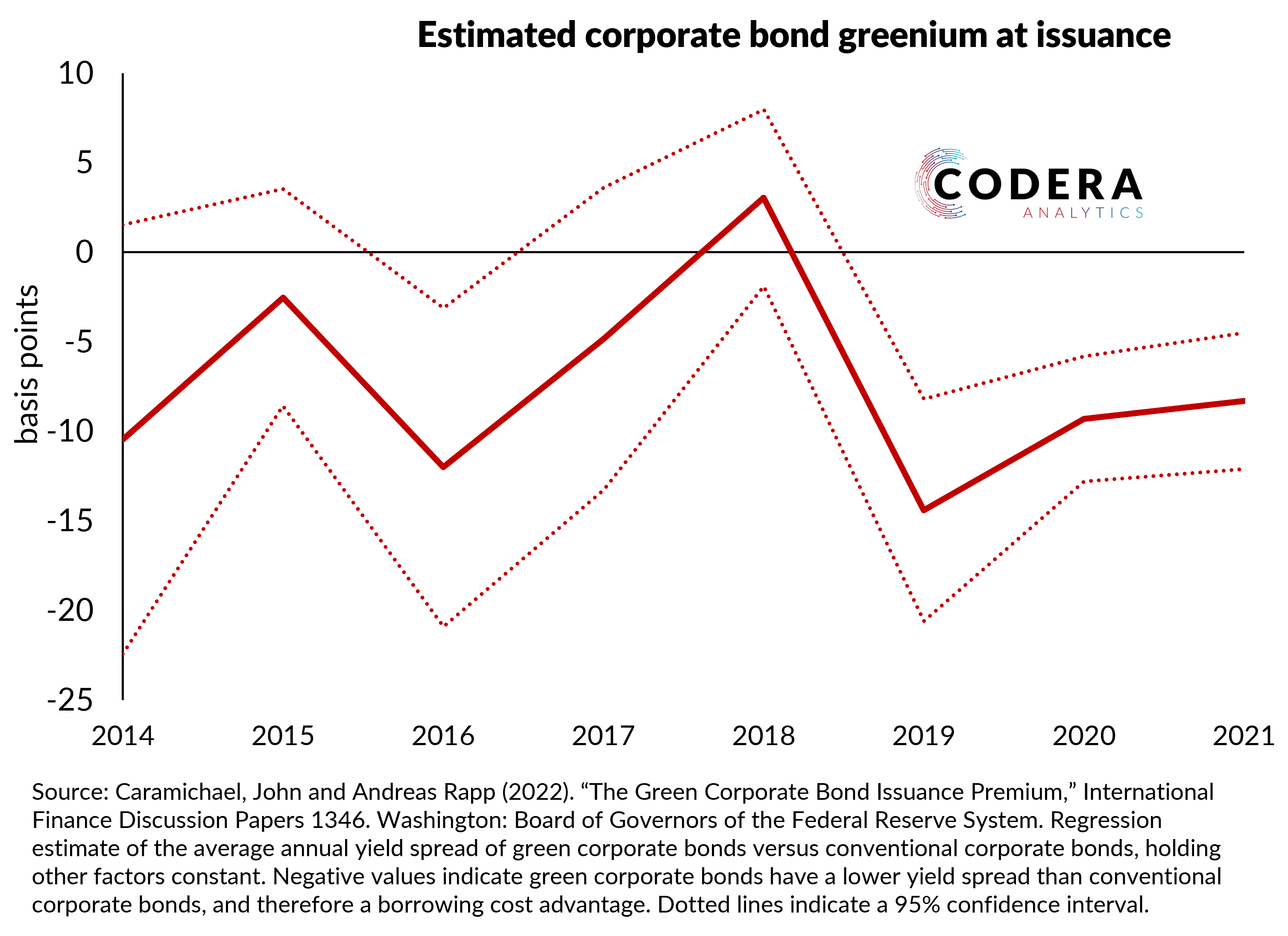

Green bonds, which raise funding for environmental projects, tend to provide a borrowing cost advantage relative to conventional bonds. Caramichael and Rapp (2022) study global bond issuances and find that this ‘greenium’ has been associated with bond oversubscription and inclusion in bond indices, with the largest cost advantages accruing to large investment-grade issuers such as banks.

.