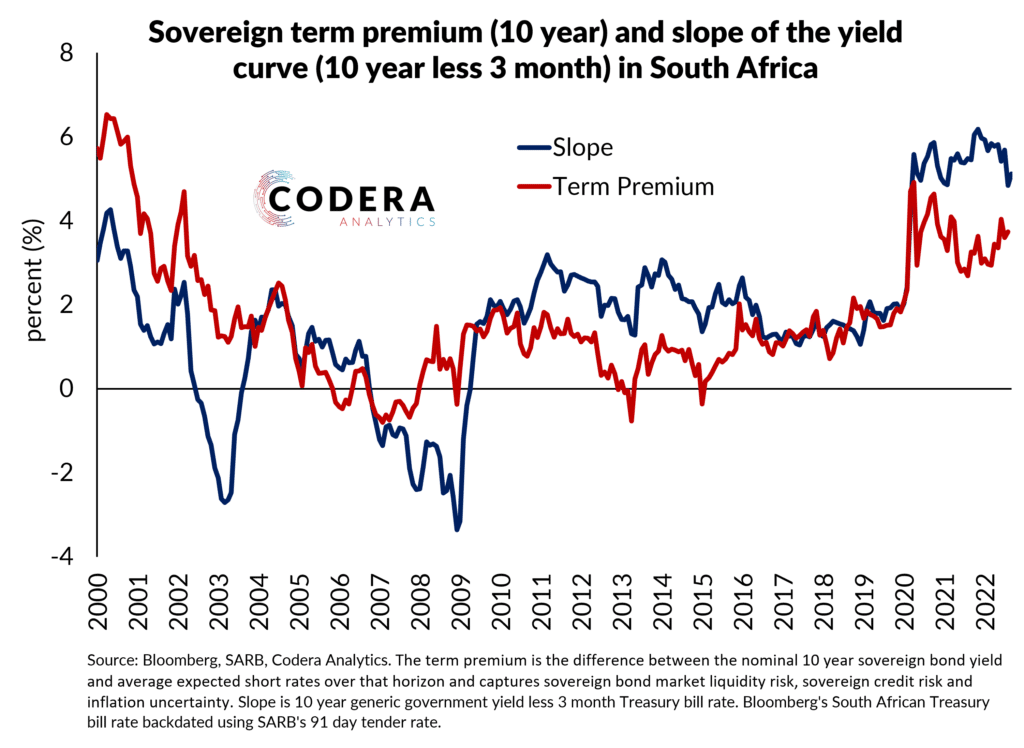

South Africa’s sovereign yield curve’s slope has steepened over recent years. A large part of this increase can be explained by an increase in the term premium embedded in long rates. We estimate that the term premium in South African sovereign bonds is currently lower than after the onset of the COVID pandemic, but still meaningfully higher than its historical average. This means holders of sovereign bonds are receiving higher compensation for the risk of holding South African government bonds over the long-term. Codera will be releasing a white paper soon describing our methodology for term premium estimation.