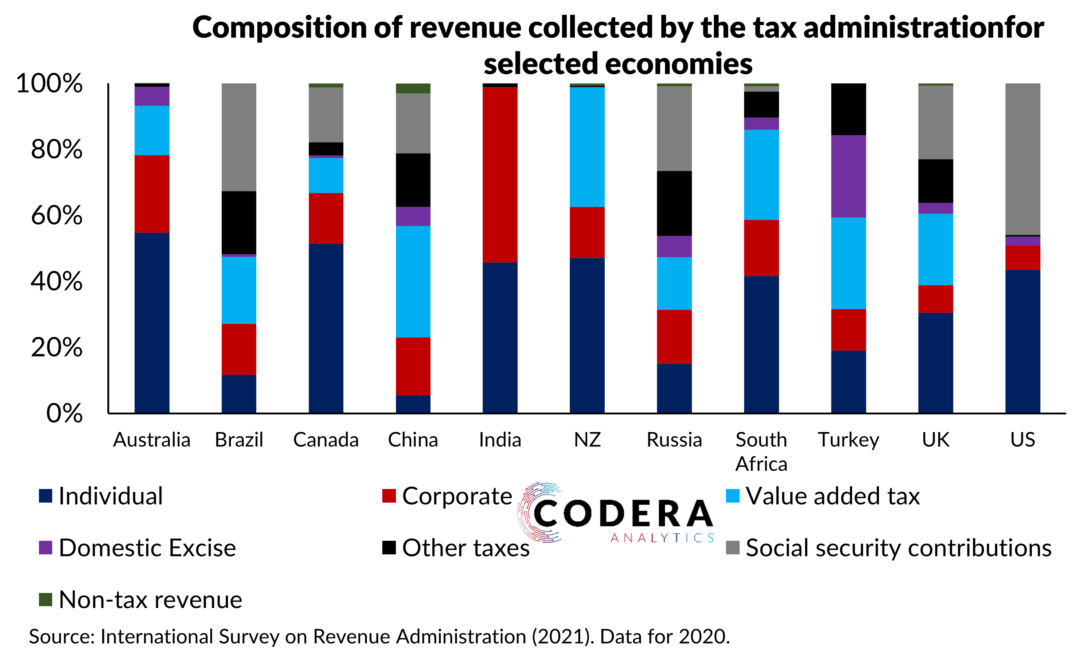

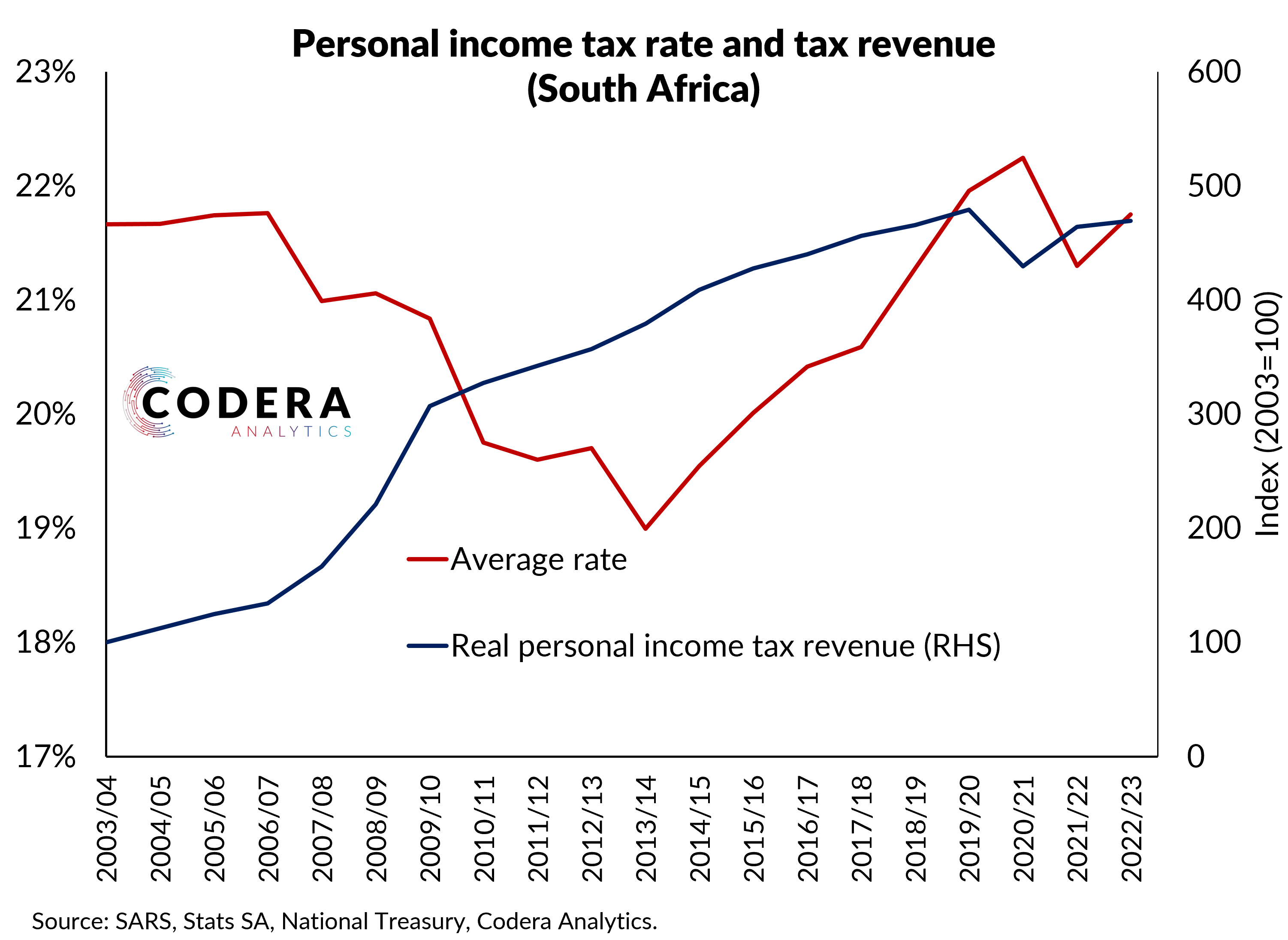

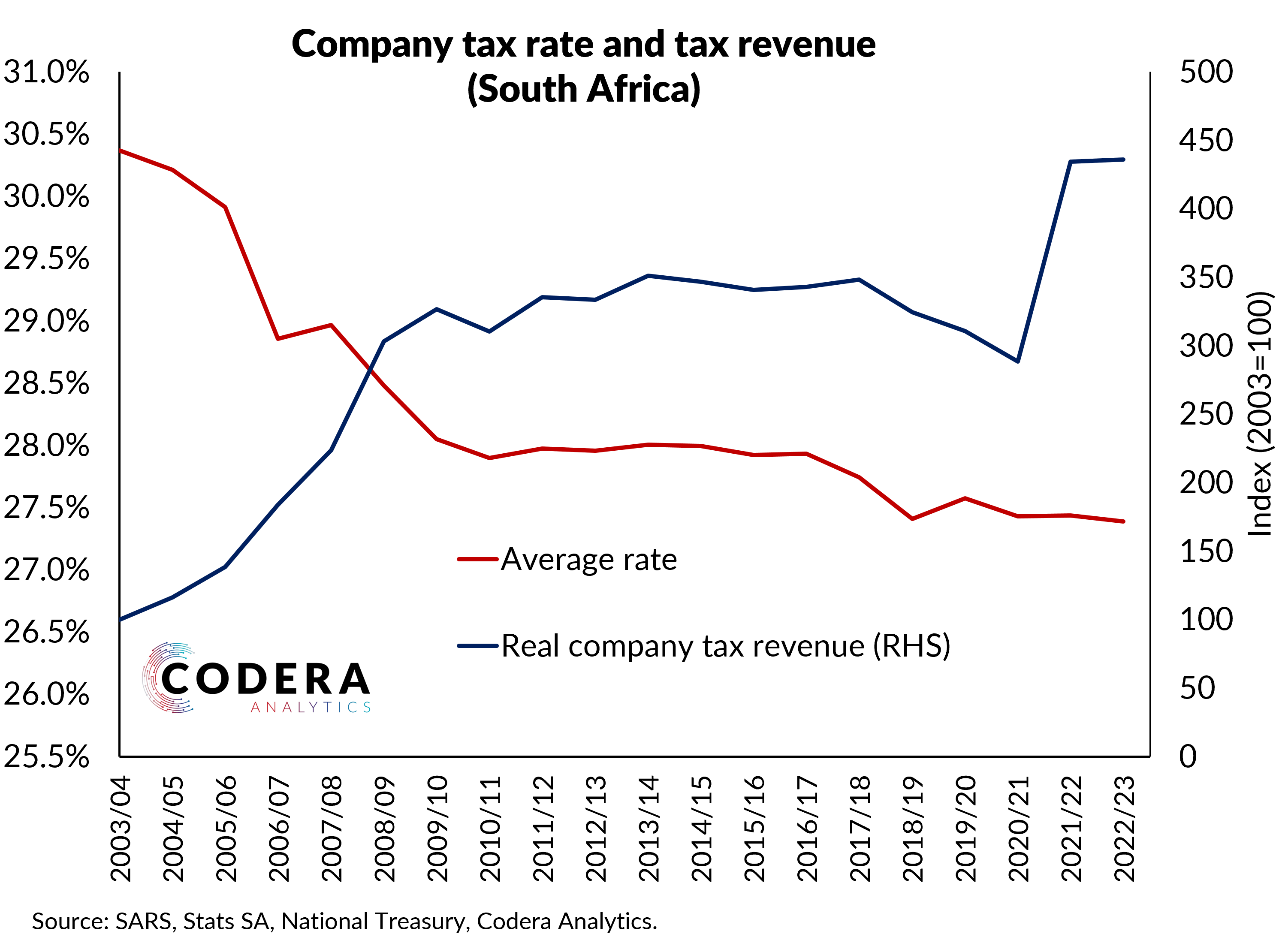

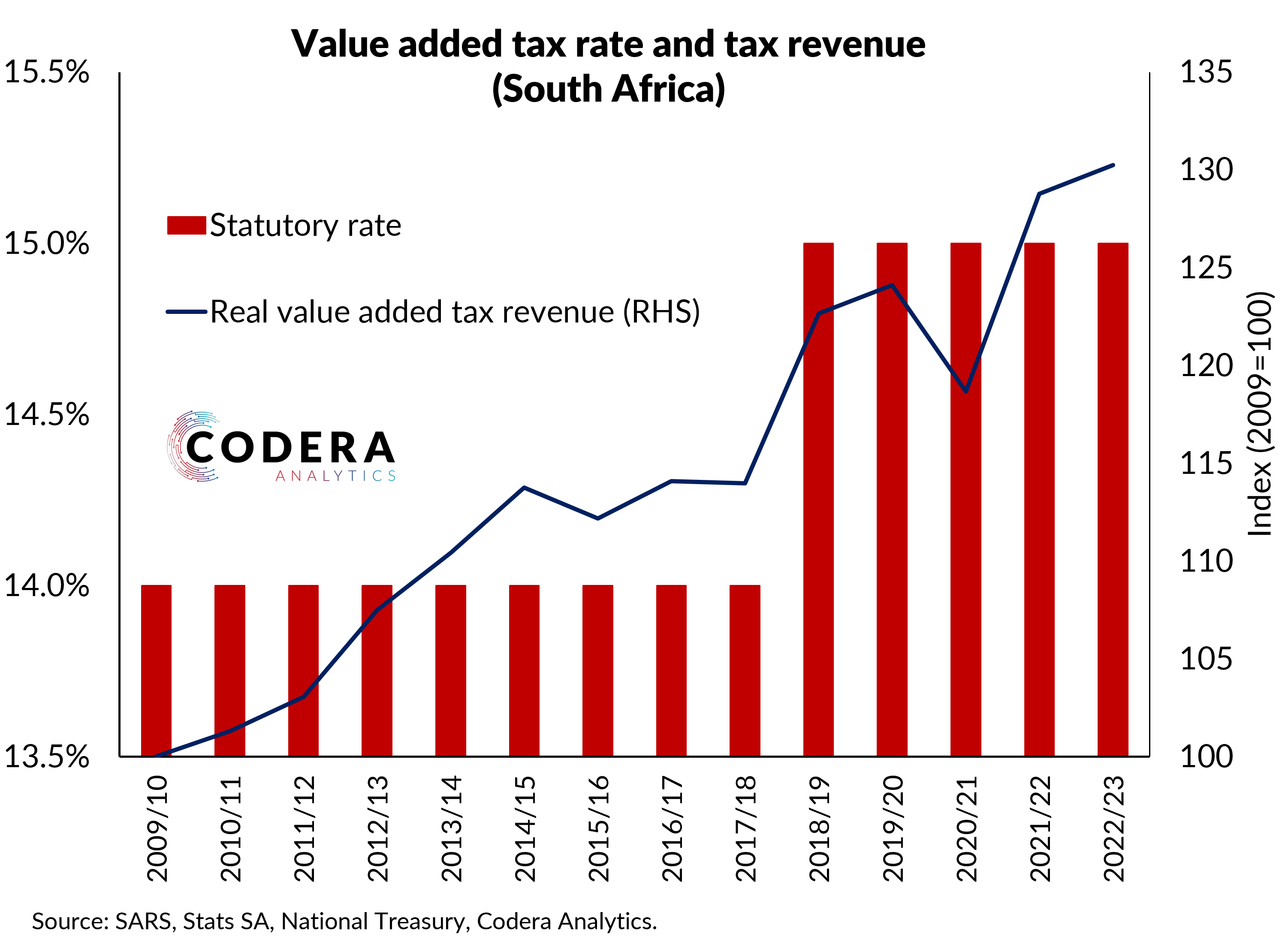

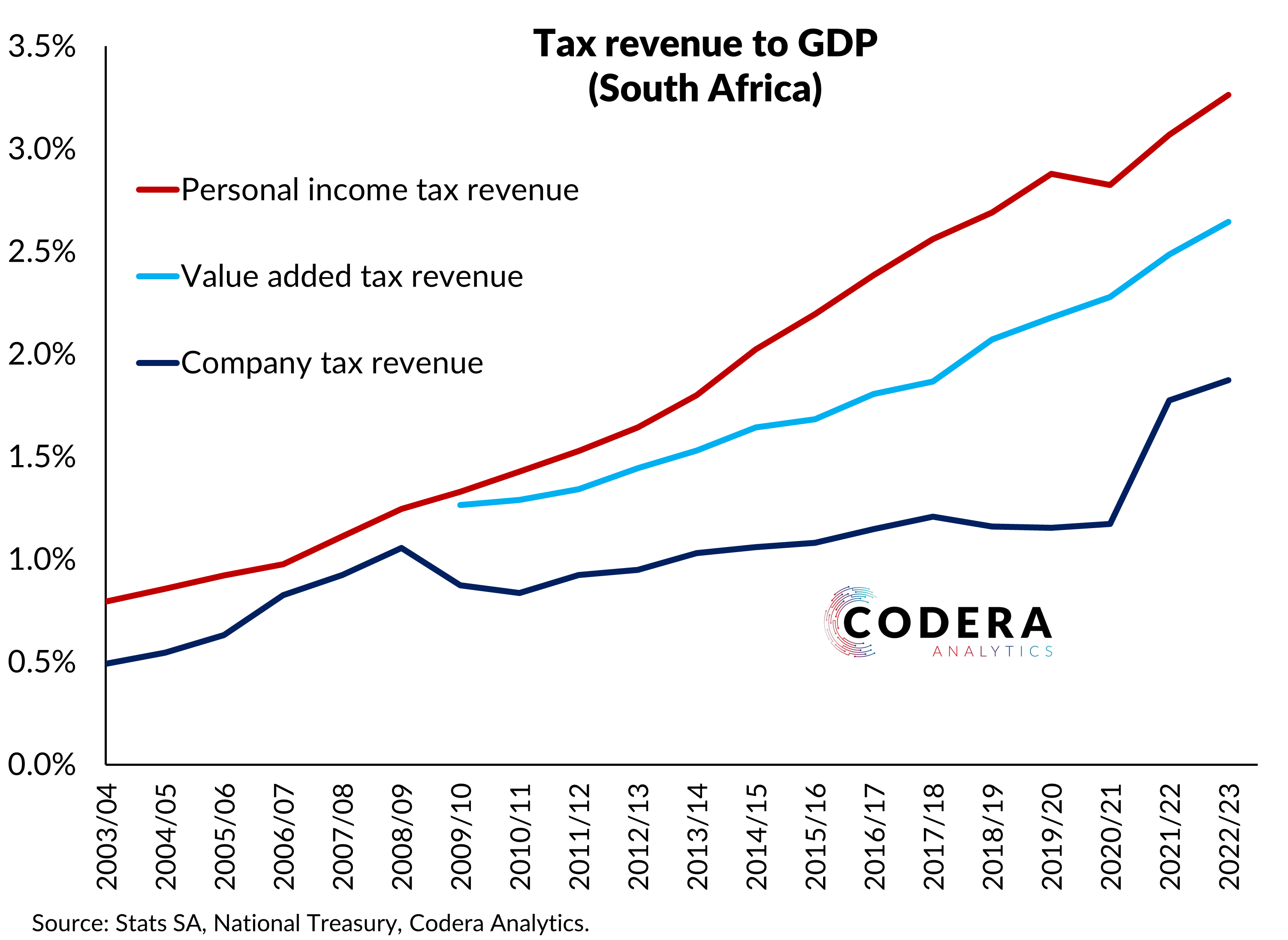

A key policy question is how tax revenues respond to changes in tax rates. Today’s post presents a summary of historical developments in tax rates and taxation receipts over time for different forms of taxation in South Africa. There has been a decrease in the average tax applicable for incomes between R100k and R1mil over the last decade. But the average tax rate across tax payers has increased as tax paid by those earning over R1mil has increased (see here for a distribution across tax brackets). Despite a higher average personal tax rate over recent years, the amount of personal tax revenue received has grown faster than CPI (first chart) and GDP (final chart). A reduction in the statutory corporate tax rate over the last two decades has seen the average tax rate paid by companies decline over time (see here for a distributional assessment), while the real value of company tax receipts grew. The value added tax (VAT) rate was raised to 15% in 2018/19 and receipts have held up in real terms and relative to GDP. Overall, the tax burden in the economy has increased substantially for high income earners (see final chart and here and here).

South Africa has a small tax base (see here, here and here) and so an important policy question given over a decade of budget deficits is whether South Africa is already at the point where raising tax rates further would see higher revenues or instead see revenues decline.

Kemp (2020) estimates that the elasticity of personal taxable income is between 0.2 and 0.4 for South Africa, which means that for every 1% increase in the tax rate, taxable income would be expected to decrease by 0.2%-0.4%.

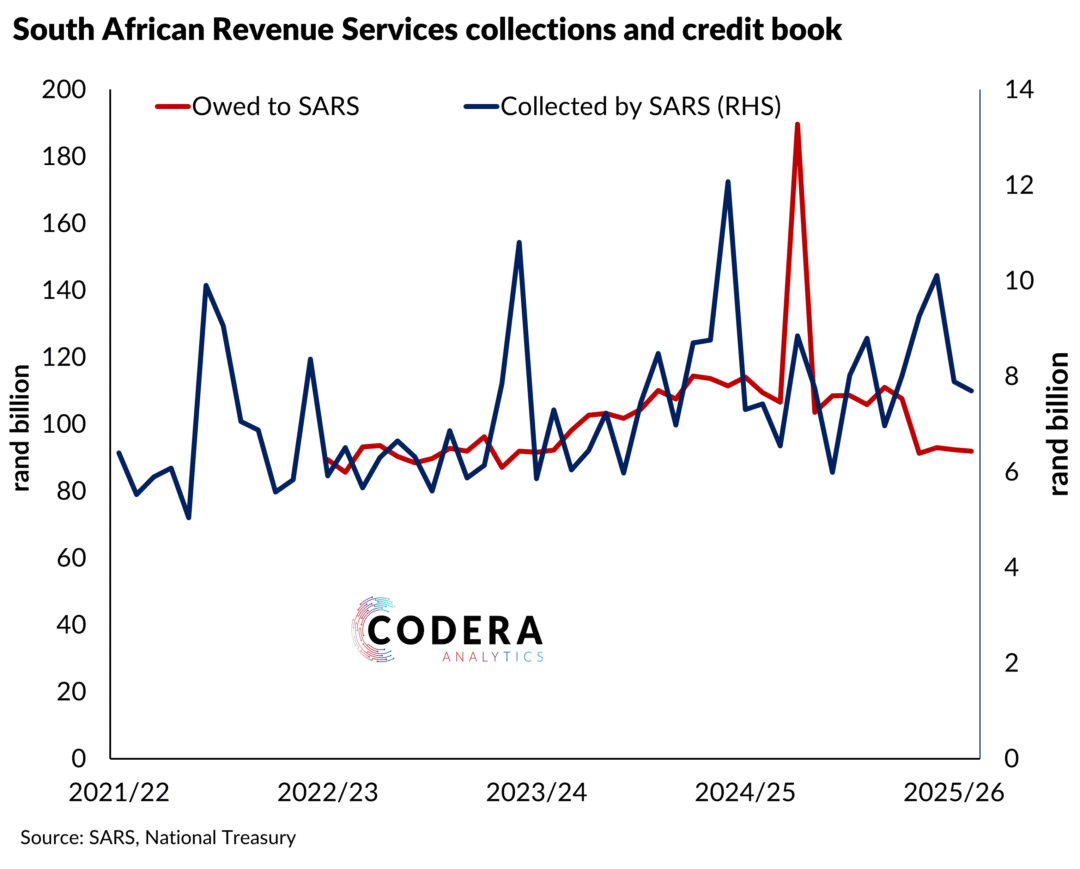

If higher taxes are estimated to decrease tax revenue, why then did personal tax revenue increase between 2013 and 2019 even as tax rates for some tax brackets increased? Possible reasons include expansion of the tax base over time, lags in responses by firms and taxpayers to tax changes, improved tax compliance and increased effectiveness of enforcement by SARS.

How close is South Africa to our ‘optimal’ tax rate? Kemp’s estimates of the optimal marginal tax rate for the top income brackets is close to the current top marginal tax rate for personal income tax.

But there are other ways to raise tax collections. If the tax base can be broadened, compliance and enforcement improved, VAT exemptions reduced and other tax reforms enacted, the IMF estimates that South Africa might be able to increase tax revenues by as much as 5% of GDP.

How do you broaden the tax base? In a recent paper, we present up to date estimates of the macroeconomic implications of different tax changes based on South African macroeconomic and tax data and argue that the way to sustainably boost revenue is by growing the number of taxpayers through employment creation and promotion of higher investment.