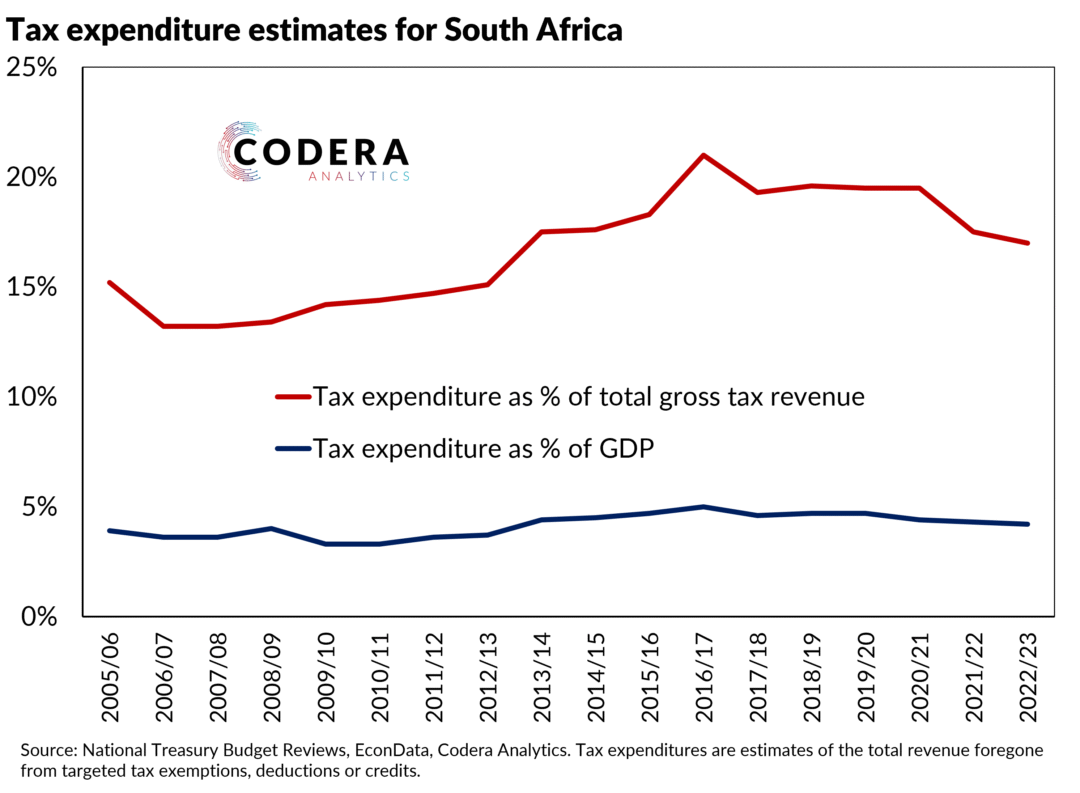

South Africa typically spends just under 5% of GDP (around 20% of tax revenue) on tax expenditures, putting us around the median among large economies globally. Tax expenditures include things like tax incentives for firms, tax credits for medical aid, tax deductibility for saving by households, or tax relief on certain consumer goods. The largest tax expenditure is deferred and forgone tax revenue on pension fund contributions, followed by zero-rated value-added tax items and medical tax credits. Regarding the latter, the government provides medical tax credits on contributions and out-of-pocket expenditure amounting to R36 billion according to the latest available estimates.