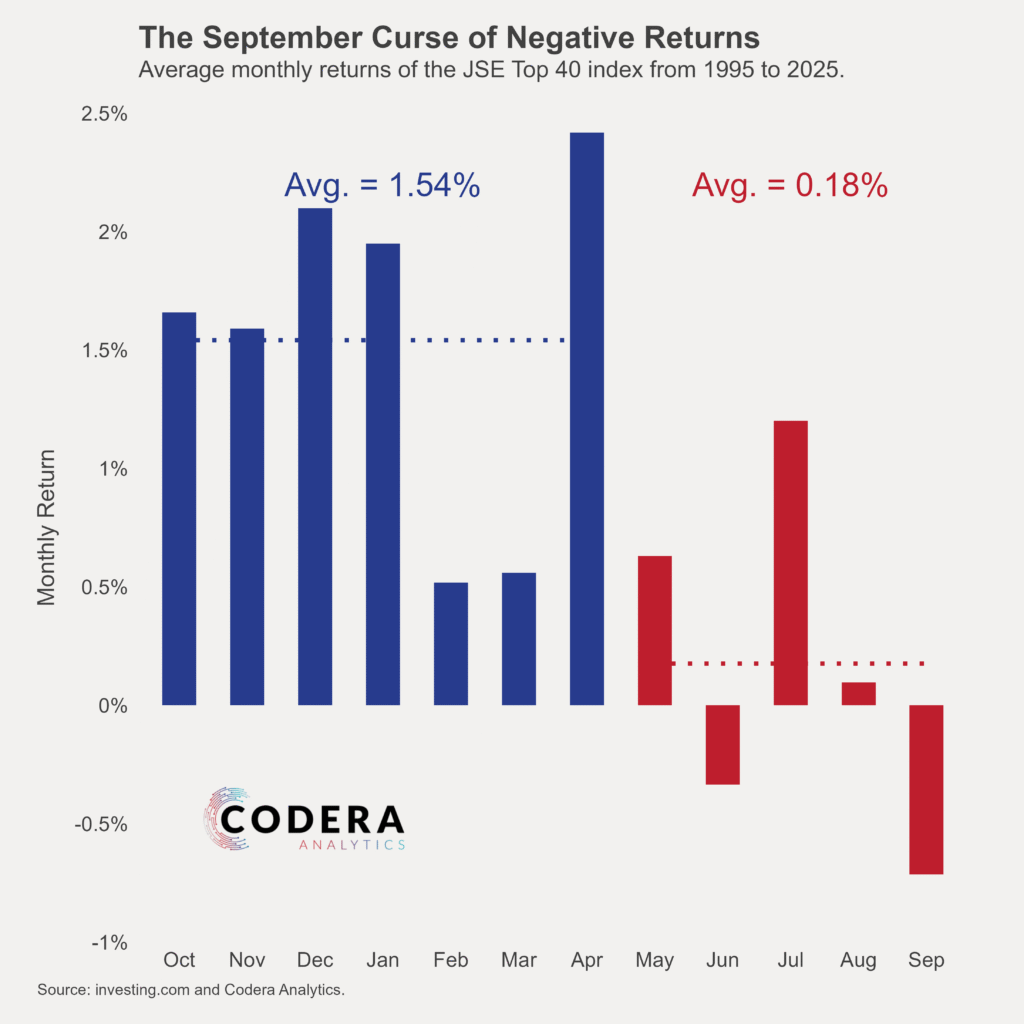

Sherwood news recently ran a chart showing monthly returns of the S&P 500 with the caption ‘Sell in May and go away?’ speculating whether it is summer holidays that see traders hit the sell button before heading off to the beach for the rest of summer. Today’s post by Oliver Guest shows that the same seasonal spike has been common for the Top 40 stocks on the JSE, as well as a similar September curse (at least on average). Average monthly returns between October and April have been a lot higher than between May to September. As has been the case for the S&P, September has tended see negative returns on the JSE, so strap in!

One possible explanation could be tax effects related to tax year-end (generally February/March for full year results, or July/August for half year) optimization behaviour.